The Total Return for Jabil (NYSE:JBL) Investors Has Risen Faster Than Earnings Growth Over the Last Five Years

The Total Return for Jabil (NYSE:JBL) Investors Has Risen Faster Than Earnings Growth Over the Last Five Years

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance, the price of Jabil Inc. (NYSE:JBL) stock is up an impressive 244% over the last five years. It's also up 16% in about a month. We note that Jabil reported its financial results recently; luckily, you can catch up on the latest revenue and profit numbers in our company report.

当您购买公司股票时,请记住可能会失败,从而损失资金。但是当您选择一家业绩真正蓬勃发展的公司时,您可能会获得超过100%的回报。例如,捷普科技(NYSE:JBL)股票的价格在过去五年中大涨了244%。一个月内上涨了16%。我们注意到捷普科技最近公布了财务业绩;幸运的是,您可以在我们的公司报告中了解最新的营业收入和利润数字。

While the stock has fallen 5.3% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

虽然本周该股下跌了5.3%,但值得关注的是长期,看看股票的历史回报是否受到基本面的驱动。

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

引用本杰明·格雷厄姆的话:短期内市场是一个投票机,但长期来看它是一个称重机。评估公司周边环境的情绪变化的一种有缺陷但合理的方法是将每股收益(EPS)与股价进行比较。

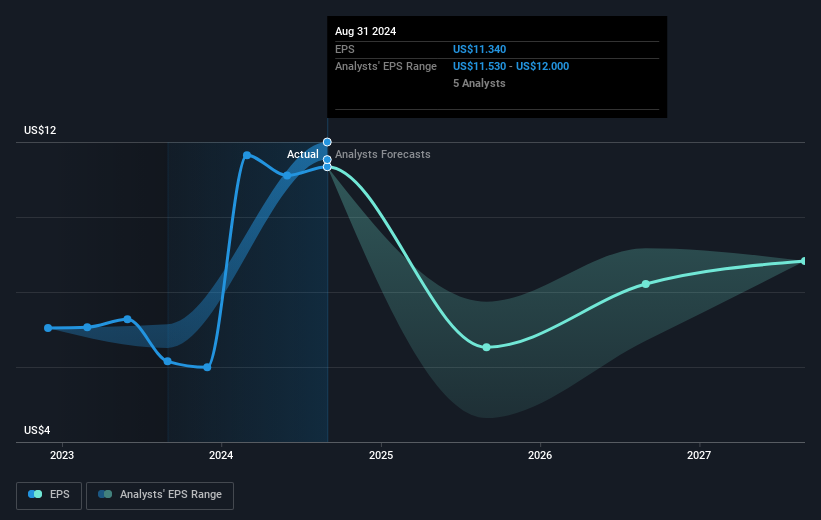

During five years of share price growth, Jabil achieved compound earnings per share (EPS) growth of 46% per year. This EPS growth is higher than the 28% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days. The reasonably low P/E ratio of 9.80 also suggests market apprehension.

在五年的股价增长中,捷普科技实现了每年46%的每股收益(EPS)复合增长。这种EPS增长高于股价的平均年增长率28%。因此,市场对这支股票的热情似乎不高。相对较低的市盈率为9.80也表明市场担忧。

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

下图显示了EPS随时间的变化情况(如果您单击该图像,则可以查看更多详细信息)。

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

我们很高兴地宣布,该公司的CEO获得的薪酬比同样规模的公司的大多数CEO获得的薪酬更加适度。但是,在购买或出售股票之前,我们始终建议仔细审查公司历史增长趋势,这些历史增长趋势可以在这里获得。真正重要的问题是这家公司未来能否增长收益。

What About Dividends?

那么分红怎么样呢?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Jabil, it has a TSR of 254% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

重要的是考虑股票的总股东回报,以及股价回报。 TSR包括任何剥离或折价的资本增资价值,以及基于股息再投资的任何股息。 可以说TSR为支付股息的股票提供了更完整的图片。就捷普科技而言,过去5年其TSR为254%。 这超过了我们之前提到的股价回报。 这在很大程度上是其股息支付的结果!

A Different Perspective

不同的观点

While the broader market gained around 35% in the last year, Jabil shareholders lost 6.8% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 29%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Jabil better, we need to consider many other factors. For instance, we've identified 3 warning signs for Jabil (1 is a bit unpleasant) that you should be aware of.

尽管更广泛的市场在过去一年中获得了约35%的涨幅,但捷普科技的股东却损失了6.8%(即使包括股息在内)。 即使好股票的股价有时会下跌,但我们希望在产业基本指标显示改善之前,不要过分感兴趣。 长期投资者不会那么沮丧,因为他们在过去五年中每年都会获得29%的收益。 如果基本数据继续表明长期可持续增长,那么目前的抛售可能是一个值得考虑的机会。 沿着更长期来跟踪股价表现总是很有趣。 但要更好地了解捷普科技,我们需要考虑许多其他因素。 例如,我们已经发现了3个对捷普科技的警告信号(其中1个有点不愉快),希望您注意。

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

如果您愿意查看另一家公司(具有潜在的更好财务状况),请不要错过这个免费的公司列表,证明它们可以增长收益。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

请注意,本文所引述的市场回报反映了目前在美国交易所上市的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

During five years of share price growth, Jabil achieved compound earnings per share (EPS) growth of 46% per year. This EPS growth is higher than the 28% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days. The reasonably low P/E ratio of 9.80 also suggests market apprehension.

During five years of share price growth, Jabil achieved compound earnings per share (EPS) growth of 46% per year. This EPS growth is higher than the 28% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days. The reasonably low P/E ratio of 9.80 also suggests market apprehension.