Unpacking the Latest Options Trading Trends in Texas Instruments

Unpacking the Latest Options Trading Trends in Texas Instruments

Deep-pocketed investors have adopted a bearish approach towards Texas Instruments (NASDAQ:TXN), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in TXN usually suggests something big is about to happen.

大力投资者采取了对德州仪器(纳斯达克:TXN)的看淡策略,这是市场参与者不应该忽视的。我们在Benzinga跟踪公共期权记录时发现了这一重大举动。这些投资者的身份仍然未知,但在TXN上的如此大规模的举动通常意味着大事即将发生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for Texas Instruments. This level of activity is out of the ordinary.

我们从观察中获取了这些信息,当Benzinga的期权扫描程序突出显示了德州仪器的9项非凡期权活动。这种活动水平是非同寻常的。

The general mood among these heavyweight investors is divided, with 44% leaning bullish and 55% bearish. Among these notable options, 5 are puts, totaling $337,703, and 4 are calls, amounting to $406,592.

这些大型投资者之间的一般情绪是分歧的,44%倾向于看好,55%看淡。在这些值得注意的期权中,5项为看跌,总额为$337,703,4项为看涨,总额为$406,592。

Expected Price Movements

预期价格波动

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $200.0 to $215.0 for Texas Instruments over the last 3 months.

考虑到这些合约的成交量和持仓量,看起来大鲸鱼们在过去3个月中一直在瞄准德州仪器的价格区间从$200.0到$215.0。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

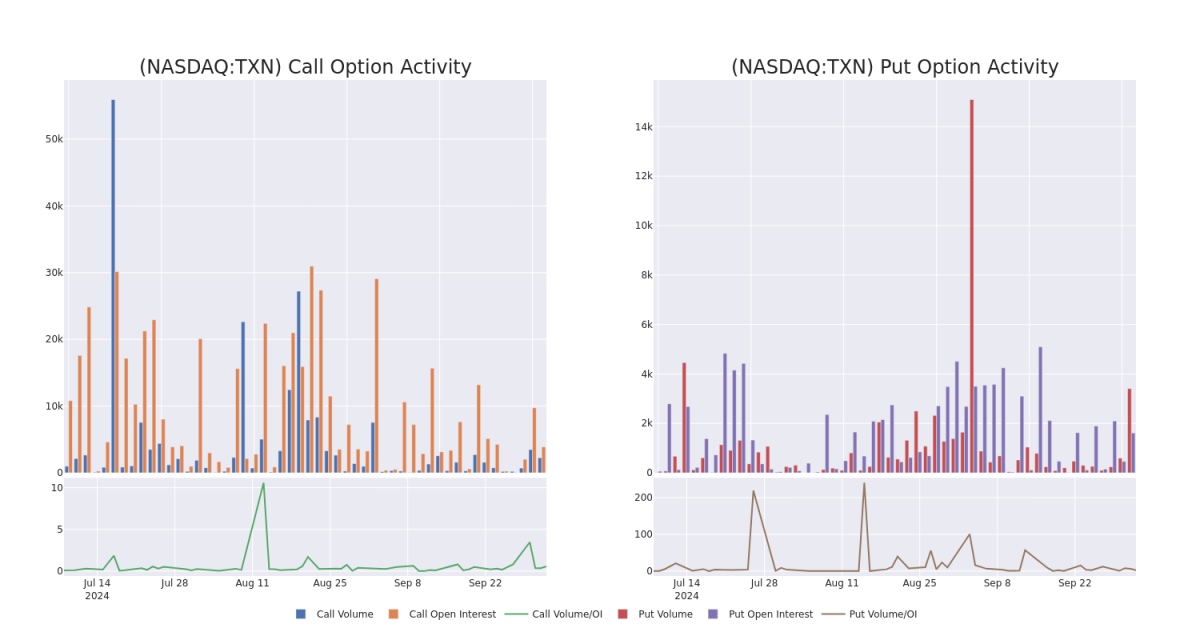

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Texas Instruments's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Texas Instruments's substantial trades, within a strike price spectrum from $200.0 to $215.0 over the preceding 30 days.

评估成交量和持仓量是期权交易中的一项战略步骤。这些指标揭示了投资者对指定行权价的德州仪器期权的流动性和兴趣。即将公布的数据为过去30天内与德州仪器的实质交易相关联的看涨和看跌期权的成交量和持仓量波动可视化,这些交易落在从$200.0到$215.0的行权价范围内。

Texas Instruments Call and Put Volume: 30-Day Overview

德州仪器看跌期权和看涨期权成交量:30天概览

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN | CALL | SWEEP | BULLISH | 10/11/24 | $2.65 | $2.64 | $2.65 | $205.00 | $198.8K | 1.3K | 614 |

| TXN | PUT | SWEEP | BEARISH | 03/21/25 | $18.95 | $18.6 | $18.95 | $210.00 | $117.4K | 184 | 123 |

| TXN | CALL | SWEEP | BULLISH | 11/15/24 | $11.7 | $11.65 | $11.7 | $200.00 | $117.0K | 909 | 0 |

| TXN | PUT | SWEEP | BEARISH | 03/21/25 | $18.95 | $18.65 | $18.95 | $210.00 | $115.5K | 184 | 61 |

| TXN | CALL | SWEEP | BULLISH | 11/08/24 | $3.85 | $3.8 | $3.85 | $215.00 | $47.3K | 5 | 138 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN | 看涨 | SWEEP | 看好 | 10/11/24 | $2.65 | 2.64美元 | $2.65 | $205.00 | $198.8K | 1.3K | 614 |

| TXN | 看跌 | SWEEP | 看淡 | 03/21/25 | $18.95 | 18.6美元 | $18.95 | 目标股价为$210.00。 | $117.4K | 184 | 123 |

| TXN | 看涨 | SWEEP | 看好 | 11/15/24 | $11.7 | $11.65 | $11.7 | 。 | $117.0K | 909 | 0 |

| TXN | 看跌 | SWEEP | 看淡 | 03/21/25 | $18.95 | $18.65 | $18.95 | 目标股价为$210.00。 | 115.5千美元 | 184 | 61 |

| TXN | 看涨 | SWEEP | 看好 | 11/08/24 | $3.85 | $3.8 | $3.85 | 215.00美元 | $47.3K | 5 | 138 |

About Texas Instruments

关于德州仪器

Dallas-based Texas Instruments generates over 95% of its revenue from semiconductors and the remainder from its well-known calculators. Texas Instruments is the world's largest maker of analog chips, which are used to process real-world signals such as sound and power. Texas Instruments also has a leading market share position in processors and microcontrollers used in a wide variety of electronics applications.

总部位于达拉斯的德州仪器有超过95%的营业收入来自半导体,剩下的来自其著名的计算器。德州仪器是世界上最大的模拟芯片制造商,用于处理实时信号(如声音和电源)。德州仪器还在处理器和微控制器方面拥有领先的市场份额,用于各种电子应用。

Having examined the options trading patterns of Texas Instruments, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在审查德州仪器的期权交易模式后,我们的关注现在直接转向公司。这个转变使我们能够深入研究其当前的市场地位和表现。

Present Market Standing of Texas Instruments

德州仪器现有市场地位

- With a trading volume of 1,854,754, the price of TXN is up by 2.15%, reaching $206.0.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 18 days from now.

- 德州仪器的交易量为 1,854,754,价格上涨 2.15%,达到 206.0 美元。

- 当前RSI值表明该股票可能接近超买状态。

- 下一个财报将于18天后发布。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期权异动模块可以提前发现潜在的市场热点。了解大笔的资金在您喜欢的股票上的仓位变动。点击这里获取访问权限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $200.0 to $215.0 for Texas Instruments over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $200.0 to $215.0 for Texas Instruments over the last 3 months.