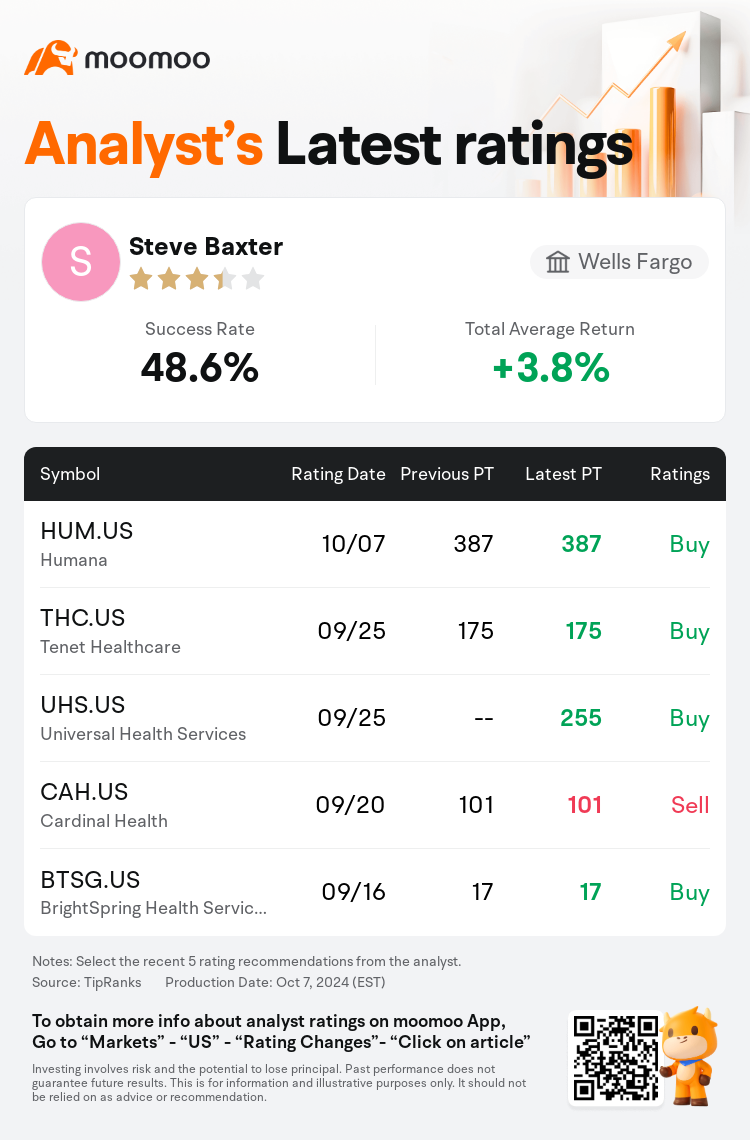

Wells Fargo analyst Steve Baxter maintains $Humana (HUM.US)$ with a buy rating, and maintains the target price at $387.

According to TipRanks data, the analyst has a success rate of 48.6% and a total average return of 3.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Humana (HUM.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Humana (HUM.US)$'s main analysts recently are as follows:

The performance of Humana is anticipated to hinge on the outcome of their appeal with CMS regarding the recent decline in the 2025 Star ratings for payment year 2026. It is considered 'unlikely' that a resolution will be reached by the beginning of open enrollment, according to an analyst.

For 2025, Humana's coverage for members under bonus-qualified plans is anticipated to decrease significantly to 25% from 94% the previous year. The preliminary star results were below investors' expectations and present a notable risk to the company's financial performance in 2026.

The overall recovery narrative for Humana has grown increasingly complex, despite the inherent flexibility in Medicare Advantage plans to adjust pricing annually and the potential for improved star ratings. Without effective star appeal efforts, the timeline for the company to return to normalized margins could extend beyond 2027.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

富国集团分析师Steve Baxter维持$哈门那 (HUM.US)$买入评级,维持目标价387美元。

根据TipRanks数据显示,该分析师近一年总胜率为48.6%,总平均回报率为3.8%。

此外,综合报道,$哈门那 (HUM.US)$近期主要分析师观点如下:

此外,综合报道,$哈门那 (HUM.US)$近期主要分析师观点如下:

预计Humana的表现将取决于他们就最近2026付款年度的2025年星级评级下降向CMS提出上诉的结果。一位分析师表示,在开始开放注册之前,人们认为 “不太可能” 达成解决方案。

到2025年,Humana对符合奖金条件的计划的会员的承保范围预计将从去年的94%大幅下降至25%。初步的明星业绩低于投资者的预期,对公司2026年的财务表现构成了显著风险。

尽管Medicare Advantage计划具有每年调整定价的固有灵活性,而且星级评级有可能提高,但Humana的整体复苏叙述却变得越来越复杂。如果不采取有效的明星吸引措施,公司恢复正常利润率的时间表可能会延续到2027年以后。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$哈门那 (HUM.US)$近期主要分析师观点如下:

此外,综合报道,$哈门那 (HUM.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of