Spotlight on Goldman Sachs Gr: Analyzing the Surge in Options Activity

Spotlight on Goldman Sachs Gr: Analyzing the Surge in Options Activity

Financial giants have made a conspicuous bullish move on Goldman Sachs Gr. Our analysis of options history for Goldman Sachs Gr (NYSE:GS) revealed 13 unusual trades.

金融巨头对高盛集团采取了明显的看好举动。我们对高盛集团(NYSE: GS)期权历史进行分析后发现了13笔异常交易。

Delving into the details, we found 69% of traders were bullish, while 23% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $219,664, and 7 were calls, valued at $304,889.

深入细节后,我们发现69%的交易者持有看涨看跌期权,而23%显示了看淡倾向。在我们发现的所有交易中,有6笔看跌交易,价值219,664美元,还有7笔看涨交易,价值304,889美元。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $460.0 and $550.0 for Goldman Sachs Gr, spanning the last three months.

经过评估交易量和未平仓合约后,很明显,主要市场参与者将高盛集团的价格范围调整在460.0美元至550.0美元之间,跨越了过去三个月。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

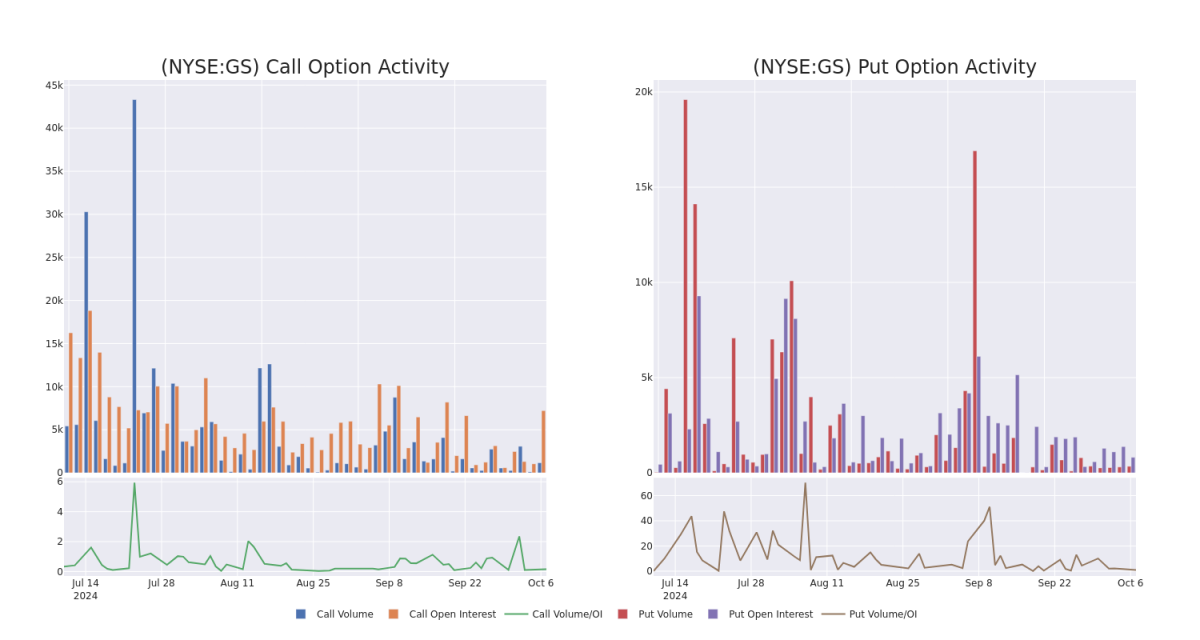

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Goldman Sachs Gr's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Goldman Sachs Gr's substantial trades, within a strike price spectrum from $460.0 to $550.0 over the preceding 30 days.

评估成交量和未平仓合约是期权交易中的战略步骤。这些指标揭示了高盛集团期权在特定行权价上的流动性和投资者兴趣。即将发布的数据将可视化显示过去30天中,与高盛集团重要交易相关的看涨看跌期权在460.0美元至550.0美元行权价范围内的成交量和未平仓合约的波动。

Goldman Sachs Gr Option Activity Analysis: Last 30 Days

高盛期权活动分析:过去30天

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GS | CALL | SWEEP | BEARISH | 10/11/24 | $3.6 | $3.55 | $3.55 | $497.50 | $77.0K | 129 | 172 |

| GS | CALL | TRADE | BULLISH | 10/18/24 | $10.7 | $10.5 | $10.7 | $500.00 | $54.5K | 2.7K | 78 |

| GS | PUT | SWEEP | BEARISH | 04/17/25 | $21.15 | $20.35 | $20.6 | $460.00 | $47.3K | 12 | 0 |

| GS | CALL | SWEEP | BULLISH | 10/18/24 | $0.62 | $0.61 | $0.61 | $550.00 | $41.9K | 4.0K | 696 |

| GS | PUT | SWEEP | BULLISH | 10/11/24 | $8.45 | $7.75 | $7.91 | $497.50 | $40.0K | 403 | 53 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 高盛公司所有板块成交量 | 看涨 | SWEEP | 看淡 | 10/11/24 | $3.6 | $3.55 | $3.55 | 08/30/24 | $77.0K | 129 | 172 |

| 高盛公司所有板块成交量 | 看涨 | 交易 | 看好 | 10/18/24 | $10.7 | $10.5 | $10.7 | $500.00 | 54.5K美元 | 2.7K | 78 |

| 高盛公司所有板块成交量 | 看跌 | SWEEP | 看淡 | 04/17/25 | $21.15 | $20.35 | 20.6美元 | $460.00 | $47.3K | 12 | 0 |

| 高盛公司所有板块成交量 | 看涨 | SWEEP | 看好 | 10/18/24 | $0.62 | $0.61 | $0.61 | $550.00 | $41.9K | 4.0K | 696 |

| 高盛公司所有板块成交量 | 看跌 | SWEEP | 看好 | 10/11/24 | 8.45美元 | $7.75 | $7.91 | 08/30/24 | $40.0千美元 | 403 | 53 |

About Goldman Sachs Gr

高盛集团简介

Goldman Sachs is a leading global investment banking and asset management firm. Approximately 20% of its revenue comes from investment banking, 45% from trading, 20% from asset management and 15% from wealth management and retail financial services. Around 60% of the company's net revenue is generated in the Americas, 15% in Asia, and 25% in Europe, the Middle East, and Africa.

高盛是一家领先的全球投资银行和资产管理公司。约20%的营业收入来自投资银行业务,45%来自交易业务,20%来自资产管理业务,15%来自财富管理和零售金融服务。公司约60%的净营收来自美洲,15%来自亚洲,25%来自欧洲、中东和非洲。

Where Is Goldman Sachs Gr Standing Right Now?

高盛集团现在处于何种地位?

- With a trading volume of 146,068, the price of GS is up by 0.69%, reaching $498.59.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 8 days from now.

- 高盛的成交量为146,068股,价格上涨0.69%,达到498.59美元。

- 当前RSI值表明该股票可能接近超买状态。

- 下一次的财报发布日期是8天后。

What Analysts Are Saying About Goldman Sachs Gr

分析师对高盛集团的看法

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $524.5.

在过去的一个月里,有2位行业分析师分享了他们对这支股票的看法,提出了平均目标价$524.5。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Oppenheimer persists with their Outperform rating on Goldman Sachs Gr, maintaining a target price of $577. * Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Goldman Sachs Gr, targeting a price of $472.

Benzinga Edge的飞凡期权板块在事件发生前发现潜在的市场变动者。看看大额资金在您喜爱的股票上持有什么仓位。 点击这里获取更多信息。* Oppenheimer的分析师坚持给予高盛评级,维持目标价为$577。* JP摩根的分析师坚持维持其持有高盛的超配评级,目标价定为$472。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Goldman Sachs Gr's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Goldman Sachs Gr's substantial trades, within a strike price spectrum from $460.0 to $550.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Goldman Sachs Gr's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Goldman Sachs Gr's substantial trades, within a strike price spectrum from $460.0 to $550.0 over the preceding 30 days.