Analyzing Mastercard In Comparison To Competitors In Financial Services Industry

Analyzing Mastercard In Comparison To Competitors In Financial Services Industry

In the ever-evolving and intensely competitive business landscape, conducting a thorough company analysis is of utmost importance for investors and industry followers. In this article, we will carry out an in-depth industry comparison, assessing Mastercard (NYSE:MA) alongside its primary competitors in the Financial Services industry. By meticulously examining key financial metrics, market positioning, and growth prospects, we aim to offer valuable insights to investors and shed light on company's performance within the industry.

在不断发展和竞争激烈的商业环境中,进行彻底的公司分析对于投资者和行业追随者至关重要。在本文中,我们将进行深入的行业比较,评估万事达(纽交所:MA)与其在金融服务行业中的主要竞争对手。通过精心检查关键财务指标、市场定位和增长前景,我们旨在为投资者提供有价值的见解,并阐明公司在行业内的表现。

Mastercard Background

万事达背景

Mastercard is the second-largest payment processor in the world, having processed close to over $9 trillion in volume during 2023. Mastercard operates in over 200 countries and processes transactions in over 150 currencies.

万事达是全球第二大支付处理器,在2023年处理了超过9万亿美元的交易量。万事达在全球200多个国家和地区运营,可以处理超过150种货币的交易。

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Mastercard Inc | 38.05 | 61.96 | 17.66 | 44.44% | $4.32 | $5.35 | 11.04% |

| Visa Inc | 29.76 | 14.12 | 16.27 | 12.62% | $6.45 | $7.13 | 9.57% |

| Fiserv Inc | 32.25 | 3.79 | 5.61 | 3.14% | $2.22 | $3.12 | 7.38% |

| PayPal Holdings Inc | 19.26 | 3.93 | 2.75 | 5.46% | $1.75 | $3.61 | 8.21% |

| Fidelity National Information Services Inc | 83.79 | 2.71 | 4.92 | 1.39% | $0.8 | $0.95 | 2.68% |

| Block Inc | 62.06 | 2.14 | 1.80 | 1.02% | $0.6 | $2.23 | 11.21% |

| Global Payments Inc | 18.10 | 1.12 | 2.58 | 1.68% | $1.08 | $1.63 | 4.74% |

| Corpay Inc | 24.06 | 8.36 | 6.35 | 8.38% | $0.51 | $0.77 | 2.9% |

| Jack Henry & Associates Inc | 34.83 | 7.21 | 6 | 5.58% | $0.18 | $0.23 | 4.73% |

| WEX Inc | 36.33 | 4.84 | 3.39 | 4.32% | $0.25 | $0.41 | 8.4% |

| Shift4 Payments Inc | 55.48 | 8.73 | 2.04 | 5.7% | $0.13 | $0.23 | 29.83% |

| Euronet Worldwide Inc | 17.06 | 3.62 | 1.27 | 6.76% | $0.18 | $0.41 | 5.02% |

| The Western Union Co | 7.20 | 9.04 | 0.98 | 33.62% | $0.24 | $0.4 | -8.85% |

| StoneCo Ltd | 10.40 | 1.25 | 1.60 | 3.29% | $1.13 | $2.25 | 11.86% |

| Payoneer Global Inc | 29.65 | 4.40 | 3.30 | 4.87% | $0.06 | $0.2 | 15.86% |

| PagSeguro Digital Ltd | 7.65 | 1 | 1.53 | 3.59% | $1.83 | $-0.02 | 6.74% |

| Paymentus Holdings Inc | 80 | 5.73 | 3.77 | 2.1% | $0.02 | $0.06 | 32.55% |

| DLocal Ltd | 20 | 5.67 | 3.77 | 10.06% | $0.06 | $0.07 | 6.29% |

| Evertec Inc | 32.59 | 4.53 | 2.87 | 6.44% | $0.09 | $0.11 | 26.88% |

| Average | 33.36 | 5.12 | 3.93 | 6.67% | $0.98 | $1.32 | 10.33% |

| 公司 | 市销率P/S | 净资产收益率ROE | 息税前收入EBITDA (以十亿计) | 毛利润 (以十亿计) | 营收增长 | CrowdStrike Holdings Inc (847.84) | 营业收入增长 |

|---|---|---|---|---|---|---|---|

| 万事达公司 | 38.05 | 61.96 | 17.66 | 44.44% | $4.32 | $5.35 | 11.04% |

| Visa Inc | 29.76 | 14.12 | 16.27 | 12.62% | $6.45 | $7.13 | 9.57% |

| Fiserv公司 | 32.25 | 3.79 | 5.61 | 3.14% | $2.22 | $3.12 | 7.38% |

| PayPal Holdings Inc | 19.26 | 3.93 | 2.75 | 5.46% | $1.75 | $3.61 | 8.21% |

| 繁德信息技术公司 | 83.79 | 2.71 | 4.92 | 1.39% | $0.8 | 0.95美元 | 2.68% |

| Block公司 | 62.06 | 2.14 | 1.80 | 1.02% | $0.6 | $2.23 | 11.21% |

| Global Payments公司 | 18.10 | 1.12 | 2.58 | 1.68% | $1.08 | $1.63 | 4.74% |

| Corpay公司 | 24.06 | 8.36 | 6.35 | 8.38% | $0.51 | $0.77 | 2.9% |

| 杰克·亨利和合伙人公司 | 通过分析万事达卡,我们可以推断出以下趋势: | 7.21 | 6 | 5.58% | 0.18美元 | $0.23 | 4.73% |

| wex inc | 36.33 | 4.84 | 3.39 | 4.32% | $0.25 | $0.41 | 8.4% |

| shift4 payments inc | 55.48 | 8.73 | 2.04 | 5.7% | 0.13元 | $0.23 | 29.83% |

| Euronet Worldwide Inc | 17.06 | 3.62 | 1.27 | 6.76% | 0.18美元 | $0.41 | 5.02% |

| 西联汇款公司 | 7.20 | 9.04 | 0.98 | 33.62% | 0.24美元 | $0.4 | -8.85% |

| stoneco ltd | 10.40 | 根据公司的固定费用覆盖率,利率为1.25% 至 1.75%每年,或者(b)有一个“备选主板利率”,并可减少至0.75%每年,取决于公司的固定费用覆盖率。截至2021年7月3日,公司的基于LIBOR的利率为% (对于$),公司的主板基准利率为% (对于$)。根据未取出的贷款利率,每月应支付承诺费,利率为%每年。根据与摩根大通银行(“贷款协议”)的信贷协议的条款,现金收据将被存入锁匣中,并由公司自行决定,除非处于“现金控制期”,在此期间,现金收据将用于减少贷款协议下的应付金额。现金控制期在事件违约或可用余额连续三个工作日低于$时触发,并将继续到先前的连续天数中存在任何违约事件且多余的可用余额始终大于$(这样的触发器根据公司的循环承诺进行调整)。此外,如果依据信贷协议所定义的“额外可用余额”小于$,则公司应维持最低固定费用覆盖率为1.0至1.0 (触发器根据公司的循环承诺进行调整)。截至2021年7月3日,公司的可用余额为$25,764。信贷协议要求我们在判断任何应支付股息或进行任何普通股分配时获得摩根大通银行的事先书面同意。信贷设施于2022年12月16日到期。 | 1.60 | 3.29% | $1.13 | 2.25美元 | 11.86% |

| Payoneer全球货币公司 | 29.65 | 4.40 | 仅当A类普通股票的收盘价等于或超过330.00美元时,公司才可以赎回未行使的认股权证。 | 4.87% | 0.06美元 | $0.2 | 15.86% |

| pagseguro digital有限公司 | 7.65 | 1 | 1.53 | 3.59% | $1.83 | $-0.02 | 6.74% |

| Paymentus Holdings Inc | 80 | 5.73 | 3.77 | 2.1% | $0.02 | 0.06美元 | 32.55% |

| DLocal有限公司 | 20 | 5.67 | 3.77 | 10.06% | 0.06美元 | 0.07美元 | 6.29% |

| Evertec Inc | 32.59 | 截至2021年9月30日的每股净有形账面价值 | 2.87 | 6.44% | $0.09 | $0.11 | 26.88% |

| 平均值 | 33.36 | 5.12 | 3.93 | 6.67% | $0.98 | $1.32 | 10.33% |

When conducting a detailed analysis of Mastercard, the following trends become clear:

在对万事达进行详细分析时,以下趋势变得清晰:

At 38.05, the stock's Price to Earnings ratio significantly exceeds the industry average by 1.14x, suggesting a premium valuation relative to industry peers.

It could be trading at a premium in relation to its book value, as indicated by its Price to Book ratio of 61.96 which exceeds the industry average by 12.1x.

With a relatively high Price to Sales ratio of 17.66, which is 4.49x the industry average, the stock might be considered overvalued based on sales performance.

The Return on Equity (ROE) of 44.44% is 37.77% above the industry average, highlighting efficient use of equity to generate profits.

With higher Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $4.32 Billion, which is 4.41x above the industry average, the company demonstrates stronger profitability and robust cash flow generation.

The gross profit of $5.35 Billion is 4.05x above that of its industry, highlighting stronger profitability and higher earnings from its core operations.

With a revenue growth of 11.04%, which surpasses the industry average of 10.33%, the company is demonstrating robust sales expansion and gaining market share.

在38.05的价格下,该股票的市盈率明显超过行业平均水平1.14倍,表明相对于行业同行来说估值较高。

根据其61.96的市净率显示,它可能在相对于账面价值上交易溢价,超过行业平均水平12.1倍。

市销率高达17.66,是行业平均水平的4.49倍,基于营业收入表现,该股可能被认为是被高估的。

44.44%的roe高出行业平均水平37.77%,突显出有效利用权益以创造利润。

凭借高达43.2亿美元的税息折旧及摊销前利润(EBITDA),比行业平均水平高出4.41倍,该公司展现出更强的盈利能力和稳健的现金流生成能力。

53.5亿美元的毛利润是其行业的4.05倍,突显了更强的盈利能力和来自核心业务的更高收入。

With a revenue growth of 11.04%, which surpasses the industry average of 10.33%, the company is demonstrating robust sales expansion and gaining market share.

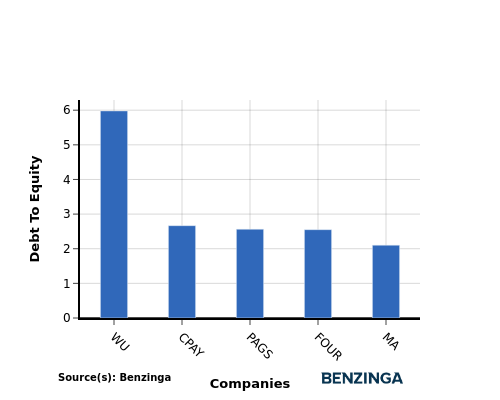

Debt To Equity Ratio

债务权益比率

The debt-to-equity (D/E) ratio gauges the extent to which a company has financed its operations through debt relative to equity.

负债与股本比率衡量了公司通过债务相对于股本来筹资运营的程度。

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

在行业比较中考虑债务权益比率可以简明地评估公司的财务状况和风险特征,有助于投资者做出明智的决策。

When evaluating Mastercard alongside its top 4 peers in terms of the Debt-to-Equity ratio, the following insights arise:

在评估万事达与其前4名同行的负债-权益比时,可以得出以下见解:

In terms of the debt-to-equity ratio, Mastercard has a lower level of debt compared to its top 4 peers, indicating a stronger financial position.

This implies that the company relies less on debt financing and has a more favorable balance between debt and equity with a lower debt-to-equity ratio of 2.1.

就负债与权益比率而言,万事达的债务水平较其前4位同行更低,表明其财务状况更强。

这意味着该公司更少依赖债务融资,并且在债务与权益之间有更有利的平衡,债务资产比为2.1。

Key Takeaways

要点

For Mastercard, the PE, PB, and PS ratios are all high compared to its peers in the Financial Services industry, indicating potential overvaluation. On the other hand, Mastercard's high ROE, EBITDA, gross profit, and revenue growth suggest strong operational performance and growth prospects relative to industry competitors. This combination of high valuation multiples and strong financial metrics positions Mastercard as a standout player in the sector.

对于万事达卡来说,市盈率、市净率和市销率都高于金融服务行业同行,表明潜在的过度估值。另一方面,万事达卡高ROE、EBITDA、毛利润和营业收入增长暗示相对于行业竞争对手,其业务运营性能和增长前景强劲。这种高估值倍数和强劲财务指标的结合将万事达卡定位为该板块的杰出角色。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自动化内容引擎生成并由编辑审查。

At

At