NVIDIA's Options: A Look at What the Big Money Is Thinking

NVIDIA's Options: A Look at What the Big Money Is Thinking

Financial giants have made a conspicuous bullish move on NVIDIA. Our analysis of options history for NVIDIA (NASDAQ:NVDA) revealed 362 unusual trades.

金融巨头对英伟达采取了明显的看好态势。我们对英伟达(纳斯达克:NVDA)的期权历史进行分析,发现有362笔异常交易。

Delving into the details, we found 52% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 66 were puts, with a value of $4,124,070, and 296 were calls, valued at $21,740,761.

深入细节后,我们发现52%的交易员持看好态度,而36%展现了看淡趋势。在我们发现的所有交易中,有66笔看跌交易,价值412万零70万美元,还有296笔看涨交易,价值2174万零761美元。

What's The Price Target?

目标价是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $0.5 to $160.0 for NVIDIA over the recent three months.

根据交易活动,显然重要投资者的目标是英伟达在最近三个月内的价格范围从0.5美元到160.0美元。

Insights into Volume & Open Interest

成交量和持仓量分析

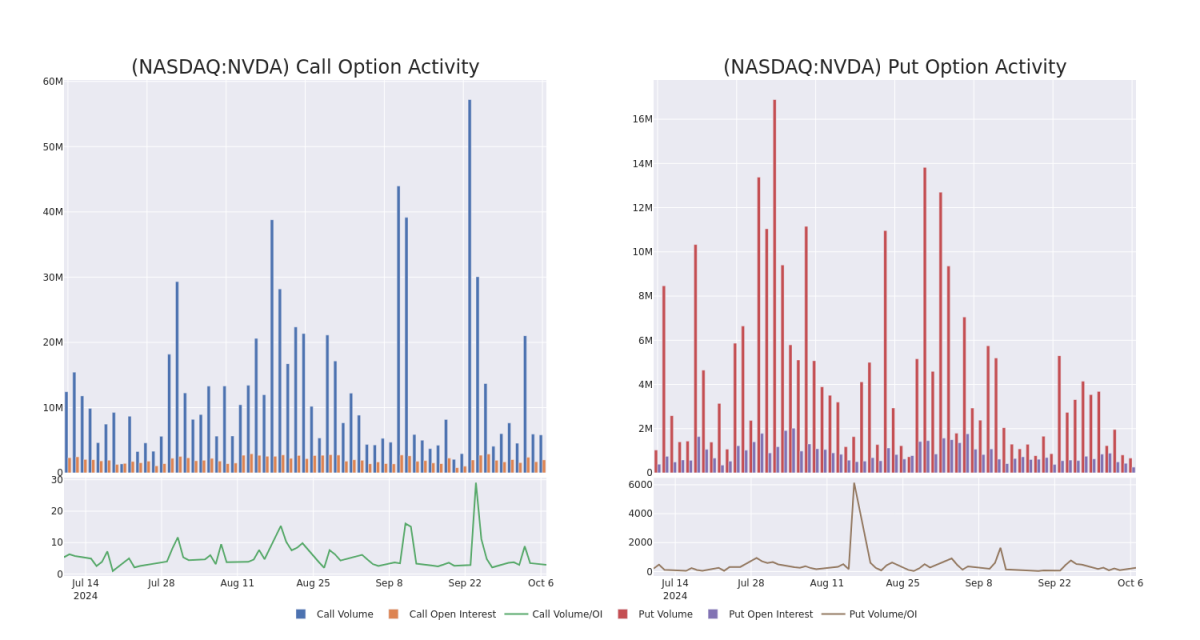

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for NVIDIA's options for a given strike price.

这些数据可以帮助您跟踪英伟达期权在特定行权价下的流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of NVIDIA's whale activity within a strike price range from $0.5 to $160.0 in the last 30 days.

下面我们可以观察英伟达所有看涨和看跌期权的成交量和持仓量的演变,分别涵盖了过去30天内英伟达所有大宗交易的行权价范围从0.5美元到160.0美元。

NVIDIA Option Activity Analysis: Last 30 Days

英伟达期权活动分析:最近30天

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVDA | CALL | SWEEP | NEUTRAL | 10/11/24 | $1.12 | $1.1 | $1.11 | $132.00 | $555.1K | 47.9K | 31.6K |

| NVDA | CALL | SWEEP | BEARISH | 10/11/24 | $7.6 | $7.5 | $7.56 | $121.00 | $408.0K | 9.8K | 2.3K |

| NVDA | PUT | SWEEP | BULLISH | 12/19/25 | $35.0 | $34.85 | $34.85 | $145.00 | $188.1K | 1.8K | 104 |

| NVDA | PUT | TRADE | BEARISH | 01/15/27 | $33.0 | $32.65 | $33.0 | $130.00 | $161.7K | 111 | 3 |

| NVDA | CALL | SWEEP | BEARISH | 10/18/24 | $2.42 | $2.4 | $2.41 | $132.00 | $129.9K | 20.5K | 6.4K |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVDA | 看涨 | SWEEP | 中立 | 10/11/24 | $1.12 | $1.1 | $1.11 | 132.00美元 | $555.1千 | 47.9千 | 31.6千 |

| NVDA | 看涨 | SWEEP | 看淡 | 10/11/24 | $7.6 | $7.5 | $7.56 | 121.00美元 | $408.0K | 9.8千 | 2.3K |

| NVDA | 看跌 | SWEEP | 看好 | 2025年12月19日 | $35.0 | $34.85 | $34.85 | $145.00 | 188.1千美元 | 1.8K | 104 |

| NVDA | 看跌 | 交易 | 看淡 | 01/15/27 | $33.0 | $32.65 | $33.0 | $130.00 | $161.7K | 111 | 3 |

| NVDA | 看涨 | SWEEP | 看淡 | 10/18/24 | $2.42 | $2.4 | $2.41 | 132.00美元 | 129.9千美元 | 20.5千 | 6.4千 |

About NVIDIA

关于NVIDIA

Nvidia is a leading developer of graphics processing units. Traditionally, GPUs were used to enhance the experience on computing platforms, most notably in gaming applications on PCs. GPU use cases have since emerged as important semiconductors used in artificial intelligence. Nvidia not only offers AI GPUs, but also a software platform, Cuda, used for AI model development and training. Nvidia is also expanding its data center networking solutions, helping to tie GPUs together to handle complex workloads.

英伟达是领先的图形处理器开发商。传统上,GPU 用于增强计算平台的体验,尤其是在个人电脑中的游戏应用上。GPU 的用途已经成为重要的半导体器件,用于人工智能。英伟达不仅提供人工智能 GPU,还提供用于人工智能模型开发和训练的 CUDA 软件平台。英伟达还在扩大其数据中心网络解决方案,帮助将 GPU 联合起来处理复杂的工作负载。

Following our analysis of the options activities associated with NVIDIA, we pivot to a closer look at the company's own performance.

在对英伟达的期权活动进行分析后,我们将转而更近距离地关注公司自身的表现。

NVIDIA's Current Market Status

英伟达当前市场状况

- Trading volume stands at 90,133,605, with NVDA's price up by 1.5%, positioned at $126.8.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 43 days.

- 交易量为90,133,605,NVDA的价格上涨了1.5%,达到126.8美元。

- RSI指示股票可能已超买。

- 预计会有一次收益公告,还有43天。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的专业期权交易员揭示了他的单线图技巧,可以显示何时买入和卖出。复制他的交易,每20天平均盈利27%。点击这里获取更多信息。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for NVIDIA with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供更高利润的潜力。 精明的交易者通过持续教育、战略交易调整、利用各种因子以及保持对市场动态的敏感度来降低这些风险。 使用Benzinga Pro随时获取英伟达的最新期权交易,以获取实时提醒。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.