A Closer Look at Caterpillar's Options Market Dynamics

A Closer Look at Caterpillar's Options Market Dynamics

Financial giants have made a conspicuous bearish move on Caterpillar. Our analysis of options history for Caterpillar (NYSE:CAT) revealed 23 unusual trades.

金融巨头在卡特彼勒股票上有明显的看淡动作。我们对卡特彼勒(纽交所:CAT)期权历史进行了分析,发现了23笔飞凡交易。

Delving into the details, we found 13% of traders were bullish, while 60% showed bearish tendencies. Out of all the trades we spotted, 13 were puts, with a value of $533,750, and 10 were calls, valued at $468,305.

深入细节后,我们发现13%的交易者看好,而60%表现出看淡倾向。在我们发现的所有交易中,有13笔看跌期权,价值为533,750美元,还有10笔看涨期权,价值468,305美元。

What's The Price Target?

目标价是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $350.0 to $440.0 for Caterpillar over the recent three months.

根据交易活动,显然显著的投资者在过去三个月中瞄准卡特彼勒股票的价格区间为350.0美元到440.0美元。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

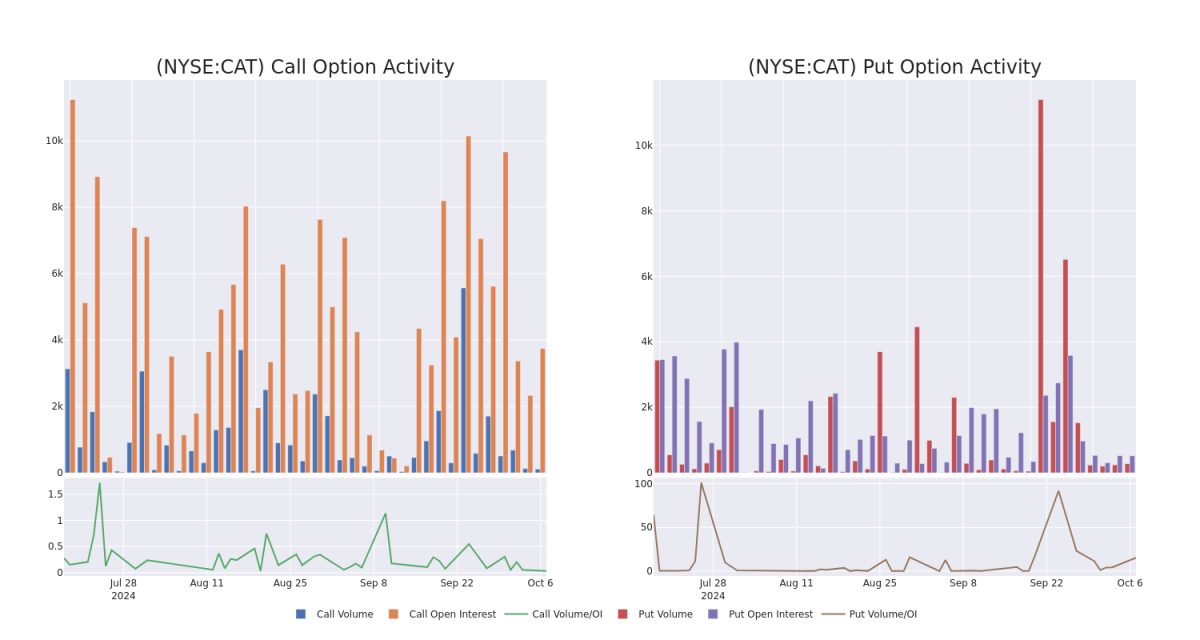

In today's trading context, the average open interest for options of Caterpillar stands at 284.0, with a total volume reaching 379.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Caterpillar, situated within the strike price corridor from $350.0 to $440.0, throughout the last 30 days.

在今天的交易环境中,卡特彼勒期权的平均持仓量为284.0,总成交量达到379.00。附图描述了过去30天内卡特彼勒高价交易的看涨和看跌期权成交量及持仓量的变化情况,这些交易都处于350.0美元到440.0美元的行权价走廊中。

Caterpillar 30-Day Option Volume & Interest Snapshot

卡特彼勒30天期权成交量和未平仓合约瞬间

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAT | CALL | TRADE | BEARISH | 11/15/24 | $45.45 | $44.7 | $44.7 | $360.00 | $102.8K | 1.0K | 42 |

| CAT | CALL | SWEEP | BEARISH | 11/01/24 | $42.6 | $39.35 | $39.35 | $360.00 | $78.7K | 362 | 0 |

| CAT | PUT | TRADE | NEUTRAL | 06/20/25 | $34.6 | $33.55 | $34.14 | $400.00 | $68.2K | 4 | 20 |

| CAT | CALL | TRADE | NEUTRAL | 11/15/24 | $43.65 | $42.65 | $43.07 | $360.00 | $64.6K | 1.0K | 19 |

| CAT | PUT | SWEEP | BEARISH | 12/20/24 | $26.95 | $25.6 | $26.57 | $410.00 | $53.7K | 163 | 60 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 卡特彼勒 | 看涨 | 交易 | 看淡 | 11/15/24 | 45.45美元 | $44.7 | $44.7 | $360.00 | $102.8K | 1.0K | 42 |

| 卡特彼勒 | 看涨 | SWEEP | 看淡 | 11/01/24 | 42.6美元 | $39.35 | $39.35 | $360.00 | $78.7K | 362 | 0 |

| 卡特彼勒 | 看跌 | 交易 | 中立 | 06/20/25 | 34.6 | $33.55 | $34.14 | $400.00 | $68.2K | 4 | 20 |

| 卡特彼勒 | 看涨 | 交易 | 中立 | 11/15/24 | $43.65 | $42.65 | $43.07 | $360.00 | $64.6K | 1.0K | 19 |

| 卡特彼勒 | 看跌 | SWEEP | 看淡 | 12/20/24 | $26.95 | $25.6 | $26.57 | $410.00 | $53.7K | 163 | 60 |

About Caterpillar

关于卡特彼勒

Caterpillar is the top manufacturer of heavy equipment, power solutions, and locomotives. It is currently the world's largest manufacturer of heavy equipment. The company is divided into four reportable segments: construction industries, resource industries, energy and transportation, and Cat Financial. Its products are available through a dealer network that covers the globe with about 2,700 branches maintained by 160 dealers. Cat Financial provides retail financing for machinery and engines to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Caterpillar product sales.

卡特彼勒是重型设备、动力解决方案和机车的顶级制造商。它是目前世界上最大的重型设备制造商。该公司分为四个报告分部:施工行业、资源行业、能源和运输、和猫金融。公司的产品通过遍布全球的经销商网络销售,由160个经销商维护着大约2700个分支机构。猫金融为客户提供机械和发动机的零售融资,除了为经销商提供批发融资,这增加了卡特彼勒产品销售的可能性。

After a thorough review of the options trading surrounding Caterpillar, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

经过对卡特彼勒周围期权交易的深入审查,我们转而更详细地研究该公司。这包括评估其当前的市场地位和表现。

Caterpillar's Current Market Status

卡特彼勒的当前市场状况

- Trading volume stands at 474,985, with CAT's price up by 0.49%, positioned at $399.03.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 22 days.

- 成交量为474,985,CAT的价格上涨了0.49%,位于399.03美元。

- RSI指示股票可能已超买。

- 预计在22天内公布收益报告。

What Analysts Are Saying About Caterpillar

分析师对卡特彼勒的评价

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $434.0.

过去30天内,共有1位专业分析师对这支股票发表了评论,设定了434.0美元的平均目标价。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from B of A Securities persists with their Buy rating on Caterpillar, maintaining a target price of $434.

20年期期权交易专业人士揭示了他的一行图表技术,显示了何时买入和卖出。跟随他的交易,每20天平均获利27%。点击此处获取权限。来自BofA证券的分析师坚持给予卡特彼勒买入评级,维持434美元的目标价。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Caterpillar with Benzinga Pro for real-time alerts.

交易期权涉及更大风险,但也提供了更高利润的潜力。精明交易员通过持续教育、战略交易调整、利用各种指标以及保持对市场动态的敏感来减轻这些风险。通过Benzinga Pro及时获取有关卡特彼勒的最新期权交易警报。

In today's trading context, the average open interest for options of Caterpillar stands at 284.0, with a total volume reaching 379.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Caterpillar, situated within the strike price corridor from $350.0 to $440.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Caterpillar stands at 284.0, with a total volume reaching 379.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Caterpillar, situated within the strike price corridor from $350.0 to $440.0, throughout the last 30 days.