A Closer Look at Amazon.com's Options Market Dynamics

A Closer Look at Amazon.com's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bullish stance on Amazon.com.

拥有大量资金的鲸鱼们对亚马逊.com采取了明显的看好态度。

Looking at options history for Amazon.com (NASDAQ:AMZN) we detected 25 trades.

查看亚马逊(纳斯达克:AMZN)的期权历史,我们发现了25笔交易。

If we consider the specifics of each trade, it is accurate to state that 48% of the investors opened trades with bullish expectations and 40% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,48%的投资者持有看好预期开仓,40%持有看跌。

From the overall spotted trades, 6 are puts, for a total amount of $215,418 and 19, calls, for a total amount of $2,041,296.

从所有被发现的交易中,有6份看跌期权,总金额为215,418美元,以及19份看涨期权,总金额为2,041,296美元。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $167.5 to $200.0 for Amazon.com over the recent three months.

根据交易活动,显然大量投资者的目标价位区间是亚马逊(纳斯达克:AMZN)在最近三个月内的价格区间,从167.5美元到200.0美元。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

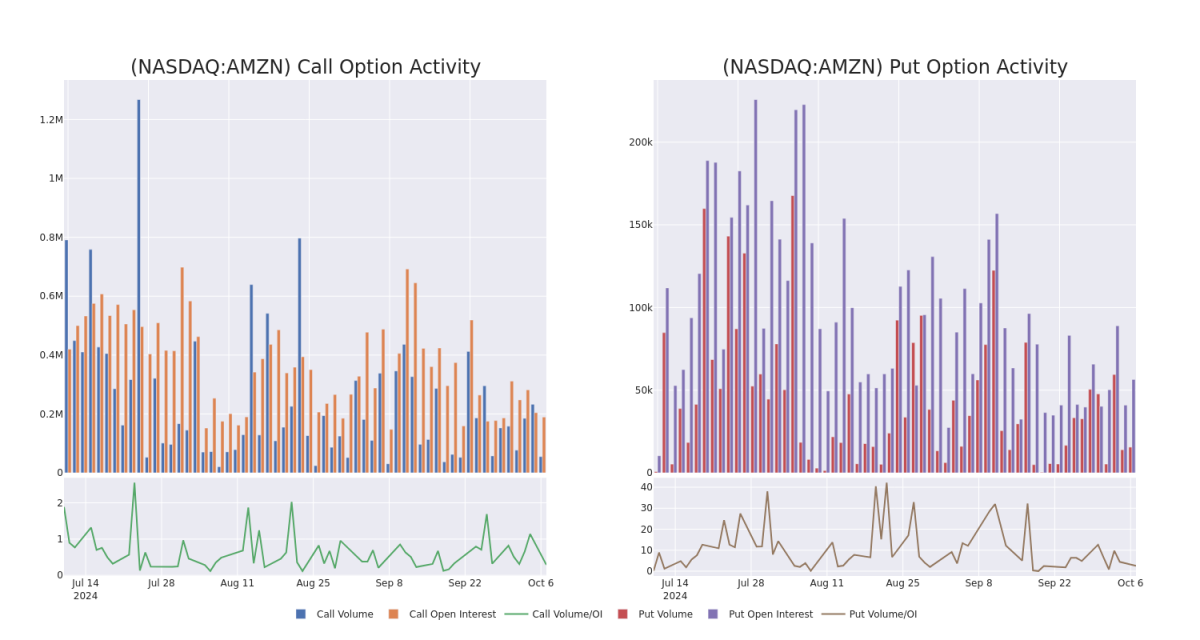

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Amazon.com's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Amazon.com's whale trades within a strike price range from $167.5 to $200.0 in the last 30 days.

在交易期权时,观察成交量和未平仓合约量是一个强有力的策略。这些数据可以帮助您跟踪亚马逊(纳斯达克:AMZN)特定执行价的期权的流动性和兴趣。下面,我们可以观察最近30天内,亚马逊(纳斯达克:AMZN)在执行价区间从167.5美元到200.0美元的所有看涨和看跌期权成交量和未平仓合约量的变化。

Amazon.com Option Volume And Open Interest Over Last 30 Days

亚马逊公司期权成交量和未平仓合约过去30天内的情况

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMZN | CALL | SWEEP | BULLISH | 12/18/26 | $34.95 | $34.2 | $35.0 | $200.00 | $1.0M | 3.8K | 6 |

| AMZN | CALL | SWEEP | NEUTRAL | 01/17/25 | $6.1 | $6.0 | $6.05 | $200.00 | $151.2K | 46.4K | 2.1K |

| AMZN | CALL | SWEEP | BULLISH | 10/11/24 | $2.65 | $2.62 | $2.65 | $182.50 | $133.2K | 3.4K | 1.0K |

| AMZN | CALL | SWEEP | BEARISH | 12/20/24 | $10.05 | $9.95 | $10.0 | $185.00 | $106.0K | 6.0K | 364 |

| AMZN | CALL | SWEEP | BEARISH | 11/15/24 | $8.05 | $8.0 | $8.0 | $185.00 | $81.6K | 26.6K | 1.4K |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMZN | 看涨 | SWEEP | 看好 | 12/18/26 | $34.95 | 34.2美元 | $35.0 | 。 | $1.0M | 3.8K | 6 |

| AMZN | 看涨 | SWEEP | 中立 | 01/17/25 | 6.1美元 | $6.0 | $6.05 | 。 | $151.2K | 46.4K | 2.1K |

| AMZN | 看涨 | SWEEP | 看好 | 10/11/24 | $2.65 | $2.62 | $2.65 | $182.50 | $133.2K | 3.4千 | 1.0K |

| AMZN | 看涨 | SWEEP | 看淡 | 12/20/24 | $10.05 | $9.95 | $10.0 | $185.00 | $106.0K | 6.0K | 364 |

| AMZN | 看涨 | SWEEP | 看淡 | 11/15/24 | $8.05 | $8.0 | $8.0 | $185.00 | $81.6K | 26.6K | 1.4千 |

About Amazon.com

关于亚马逊.com

Amazon is the leading online retailer and marketplace for third party sellers. Retail related revenue represents approximately 75% of total, followed by Amazon Web Services' cloud computing, storage, database, and other offerings (15%), advertising services (5% to 10%), and other the remainder. International segments constitute 25% to 30% of Amazon's non-AWS sales, led by Germany, the United Kingdom, and Japan.

亚马逊是领先的在线零售商和第三方卖家市场。与零售相关的营业收入约占总收入的75%,其次是亚马逊Web Services的云计算、存储、数据库和其他服务(15%)、广告服务(5%至10%)以及其他收入。国际业务占亚马逊非AWS销售的25%至30%,主要在德国、英国和日本。

Following our analysis of the options activities associated with Amazon.com, we pivot to a closer look at the company's own performance.

在对亚马逊的期权交易活动进行分析后,我们将转向更深入地关注该公司的业绩。

Present Market Standing of Amazon.com

亚马逊公司的现行市场地位

- Currently trading with a volume of 16,835,876, the AMZN's price is down by -2.62%, now at $181.62.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 17 days.

- 目前成交量为16,835,876,亚马逊股价下跌了-2.62%,目前为181.62美元。

- RSI读数表明该股目前可能接近超买水平。

- 预计收益发布还有17天。

Expert Opinions on Amazon.com

亚马逊的专家意见

5 market experts have recently issued ratings for this stock, with a consensus target price of $229.0.

5位市场专家最近对这只股票发表了评级意见,达成了$229.0的共识目标价。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $230. * In a cautious move, an analyst from Morgan Stanley downgraded its rating to Overweight, setting a price target of $210. * An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $230. * Maintaining their stance, an analyst from Truist Securities continues to hold a Buy rating for Amazon.com, targeting a price of $265. * Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $210.

20年期期权交易专家揭秘他的一行图表技术,展示何时买入和卖出。跟随他的交易,平均每20天获利27%。点击这里进行访问。* Cantor Fitzgerald的分析师将其行动评级下调为增持,目标价为$230。* 作为谨慎举措,摩根士丹利的分析师将其评级降级为增持,设定价格目标为$210。* Cantor Fitzgerald的分析师已将其评级下调至增持,调整价格目标至$230。* 保持立场,Truist Securities的分析师继续维持亚马逊的买入评级,目标价为$265。* Needham的分析师因担忧将其评级下调为买入,并制定新的价格目标为$210。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

From the overall spotted trades, 6 are puts, for a total amount of $215,418 and 19, calls, for a total amount of $2,041,296.

From the overall spotted trades, 6 are puts, for a total amount of $215,418 and 19, calls, for a total amount of $2,041,296.