Walt Disney Unusual Options Activity

Walt Disney Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Walt Disney.

有大量资金的投资者对华特迪士尼采取了显著的看好态度。

Looking at options history for Walt Disney (NYSE:DIS) we detected 15 trades.

根据迪士尼(NYSE:DIS)期权历史数据,我们检测到有15笔交易。

If we consider the specifics of each trade, it is accurate to state that 46% of the investors opened trades with bullish expectations and 46% with bearish.

如果我们考虑每个交易的细节,准确地说,46%的投资者怀着看涨期待开了仓位,46%的投资者怀着看跌期待开了仓位。

From the overall spotted trades, 4 are puts, for a total amount of $403,422 and 11, calls, for a total amount of $531,075.

在所有被发现的交易中,有4笔看跌,总金额为403,422美元,有11笔看涨,总金额为531,075美元。

What's The Price Target?

目标价是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $80.0 and $110.0 for Walt Disney, spanning the last three months.

在评估交易成交量和未平仓合约量后,显而易见市场主要关注迪士尼股票价格在80.0美元和110.0美元之间的价格区间,跨越过去三个月。

Insights into Volume & Open Interest

成交量和持仓量分析

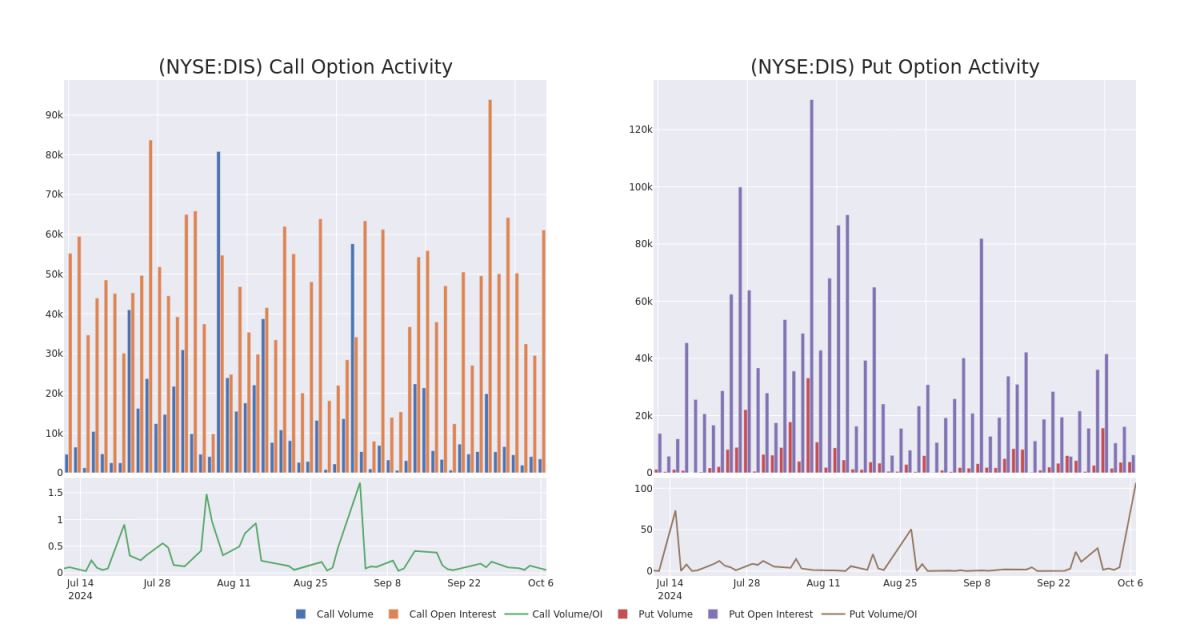

In today's trading context, the average open interest for options of Walt Disney stands at 5183.77, with a total volume reaching 7,325.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Walt Disney, situated within the strike price corridor from $80.0 to $110.0, throughout the last 30 days.

在今天的交易背景下,迪士尼期权的平均未平仓合约达到5183.77,总成交量达到7,325.00。伴随图表详细描述了过去30天内迪士尼股票高价交易的看涨和看跌期权成交量及未平仓合约变化情况,位于80.0美元至110.0美元的行权价格走廊内。

Walt Disney Option Volume And Open Interest Over Last 30 Days

迪士尼期权的成交量和持仓量过去30天的情况

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DIS | PUT | TRADE | BEARISH | 11/08/24 | $0.7 | $0.64 | $0.68 | $86.00 | $238.0K | 33 | 3.5K |

| DIS | CALL | TRADE | BULLISH | 01/16/26 | $11.5 | $11.0 | $11.3 | $100.00 | $135.6K | 3.5K | 120 |

| DIS | PUT | SWEEP | BEARISH | 04/17/25 | $7.25 | $7.15 | $7.25 | $95.00 | $100.7K | 317 | 139 |

| DIS | CALL | TRADE | NEUTRAL | 10/18/24 | $1.43 | $1.31 | $1.36 | $95.00 | $73.1K | 11.0K | 562 |

| DIS | CALL | TRADE | BEARISH | 01/16/26 | $10.85 | $10.65 | $10.7 | $100.00 | $64.2K | 3.5K | 205 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 项目8.01 | 看跌 | 交易 | 看淡 | 11/08/24 | 0.7美元 | $0.64 | $0.68 | $86.00 | 238.0千美元 | 33 | 3.5K |

| 项目8.01 | 看涨 | 交易 | 看好 | 01/16/26 | $11.5 | $11.0 | $11.3 | $100.00。 | $135.6K | 3.5K | 120 |

| 项目8.01 | 看跌 | SWEEP | 看淡 | 04/17/25 | $7.25 | $7.15 | $7.25 | $ 95.00 | $100.7K | 317 | 139 |

| 项目8.01 | 看涨 | 交易 | 中立 | 10/18/24 | $1.43应翻译为1.43美元 | $1.31 | $1.36 | $ 95.00 | $73.1K | 11.0K | 562 |

| 项目8.01 | 看涨 | 交易 | 看淡 | 01/16/26 | $10.85 | $10.65 | $10.7 | $100.00。 | 64.2K美元 | 3.5K | 205 |

About Walt Disney

关于迪士尼

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from franchises and characters the firm has created over the course of a century. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney's own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney's theme parks and vacation destinations, and also benefits from merchandise licensing.

迪士尼分为三个全球业务板块:娱乐、体育和体验。娱乐和体验都受益于公司一世纪以来创造的特许经营权和角色。娱乐包括ABC广播网络、几个有线电视网络、迪士尼+和Hulu流媒体服务。在这个板块中,迪士尼还进行电影和电视制作和分销,将内容授权给电影院、其他内容提供商,或者越来越多地在自己的流媒体平台和电视网络内使用。体育板块包括ESPN和ESPN+流媒体服务。体验包括迪士尼的主题公园和度假胜地,还受益于商品授权。

After a thorough review of the options trading surrounding Walt Disney, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对迪士尼周边期权交易进行全面审查后,我们开始对公司进行更详细的评估。这包括对迪士尼当前市场地位和表现的评估。

Walt Disney's Current Market Status

迪士尼的当前市场状况

- With a trading volume of 2,189,917, the price of DIS is down by -1.94%, reaching $93.31.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 38 days from now.

- 成交量为2,189,917,迪士尼的价格下跌了-1.94%,达到93.31美元。

- 当前RSI值表明该股票可能接近超买状态。

- 下一份收益报告将于38天后发布。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期权异动模块可以提前发现潜在的市场热点。了解大笔的资金在您喜欢的股票上的仓位变动。点击这里获取访问权限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

From the overall spotted trades, 4 are puts, for a total amount of $403,422 and 11, calls, for a total amount of $531,075.

From the overall spotted trades, 4 are puts, for a total amount of $403,422 and 11, calls, for a total amount of $531,075.