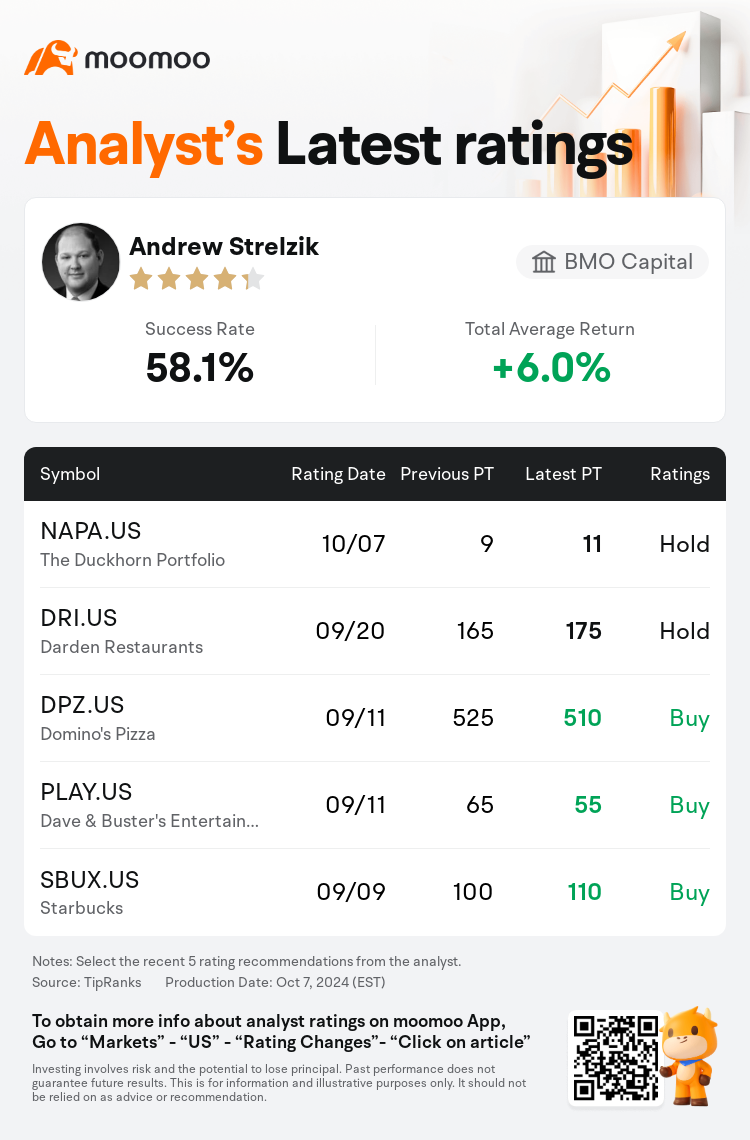

BMO Capital analyst Andrew Strelzik maintains $The Duckhorn Portfolio (NAPA.US)$ with a hold rating, and adjusts the target price from $9 to $11.

According to TipRanks data, the analyst has a success rate of 58.1% and a total average return of 6.0% over the past year.

Furthermore, according to the comprehensive report, the opinions of $The Duckhorn Portfolio (NAPA.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $The Duckhorn Portfolio (NAPA.US)$'s main analysts recently are as follows:

The proposed transaction with Butterfly Equity is viewed as likely to conclude, particularly since Duckhorn Portfolio's two principal shareholders have consented to endorse the deal. The 'go-shop' period is perceived more as a gesture of good faith towards minority shareholders rather than a substantive shopping period. The valuation is considered consistent with the proposed transaction price per share.

Anticipation of Duckhorn Portfolio's fiscal Q4 report has led to a slight adjustment in fiscal 2025 estimates, taking into account the possible impacts on pricing and product mix due to increased promotions and a deceleration in trends for Sonoma-Cutrer within monitored channels.

The acquisition of Duckhorn Portfolio by a private equity company for approximately $1.95 billion, or $11.10 per share, is highlighted, which includes a 45-day 'go-shop' period, though the probability of a competing offer emerging is considered low. The timing of the deal is noted as unexpected, especially after the closure of the Sonoma-Cutrer acquisition and the anticipation of enhanced consumer spending in the medium term.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

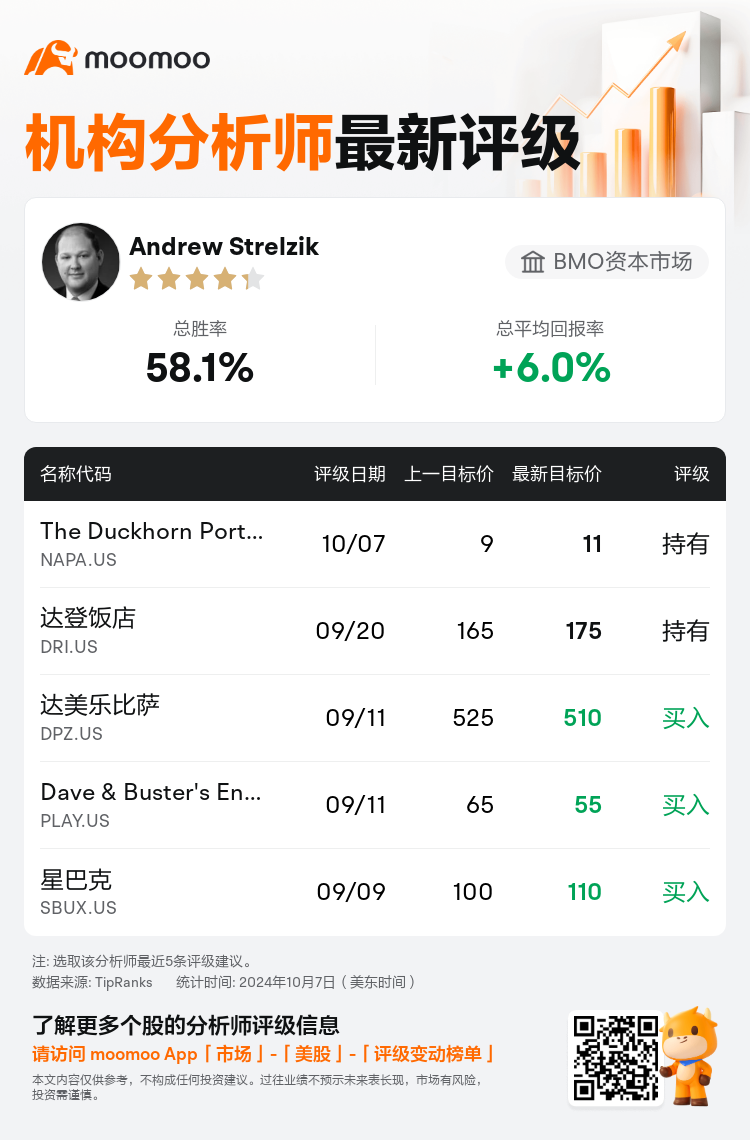

BMO资本市场分析师Andrew Strelzik维持$The Duckhorn Portfolio (NAPA.US)$持有评级,并将目标价从9美元上调至11美元。

根据TipRanks数据显示,该分析师近一年总胜率为58.1%,总平均回报率为6.0%。

此外,综合报道,$The Duckhorn Portfolio (NAPA.US)$近期主要分析师观点如下:

此外,综合报道,$The Duckhorn Portfolio (NAPA.US)$近期主要分析师观点如下:

与Butterfly Equity的拟议交易被认为有可能结束,特别是因为Duckhorn Portfolio的两位主要股东已同意支持该交易。“上市” 期更多地被视为对少数股东的诚意表现,而不是实质性的购物期。估值被认为与拟议的每股交易价格一致。

对Duckhorn Portfolio第四财季报告的预期导致2025财年的估计略有调整,其中考虑到促销活动增加以及Sonoma-Cutrer在监控渠道内的趋势减速可能对定价和产品组合产生的影响。

重点介绍了一家私募股权公司以约19.5亿美元,合每股11.10美元的价格收购Duckhorn Portfolio,其中包括45天的 “上市” 期,尽管出现竞争性报价的可能性被认为很低。该交易的时机被认为是出乎意料的,尤其是在完成对Sonoma-Cutrer的收购以及预计中期消费者支出将增加之后。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$The Duckhorn Portfolio (NAPA.US)$近期主要分析师观点如下:

此外,综合报道,$The Duckhorn Portfolio (NAPA.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of