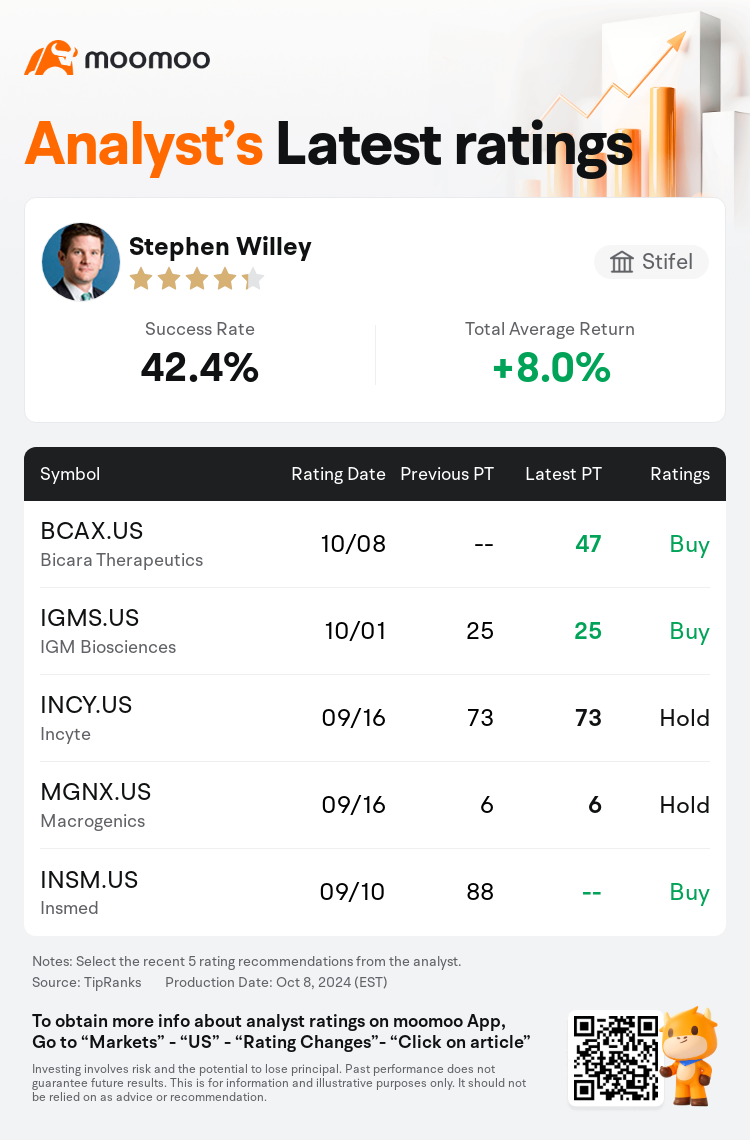

Stifel analyst Stephen Willey initiates coverage on $Bicara Therapeutics (BCAX.US)$ with a buy rating, and sets the target price at $47.

According to TipRanks data, the analyst has a success rate of 42.4% and a total average return of 8.0% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Bicara Therapeutics (BCAX.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Bicara Therapeutics (BCAX.US)$'s main analysts recently are as follows:

Early clinical results for ficerafusp alfa suggest a significant potential improvement over existing treatments for recurrent/metastatic head and neck cancer. Valuation support is provided by the company's main competitor as anticipation builds for the key data release expected in 2027.

Initial data from a Phase 1b dose-expansion trial that assesses the efficacy of a combination therapy for first-line metastatic squamous cell carcinoma of the head and neck shows the potential for top-tier clinical results. It is suggested that the current market valuation may not fully account for the unique value derived from the clear potential of the therapy to become a standard treatment in a solid tumor market worth several billions.

The treatment landscape for head and neck cancer, which has historically received little attention, is poised for transformation with the introduction of next-generation epidermal growth factor receptor bispecifics. These advancements are expected to redefine the standard of care. With its leading depth and durability in the first-line treatment, ficerafusp alfa positions Bicara Therapeutics advantageously as it commences its pivotal program. The market for first-line head and neck squamous cell carcinoma presents a significant opportunity, potentially worth $5B-$10B. Ficerafusp alfa is considered to have a very high probability of successful development.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

斯迪富分析师Stephen Willey首予$Bicara Therapeutics (BCAX.US)$买入评级,目标价47美元。

根据TipRanks数据显示,该分析师近一年总胜率为42.4%,总平均回报率为8.0%。

此外,综合报道,$Bicara Therapeutics (BCAX.US)$近期主要分析师观点如下:

此外,综合报道,$Bicara Therapeutics (BCAX.US)$近期主要分析师观点如下:

ficerafusp alfa的早期临床结果表明,与复发/转移性头颈癌的现有治疗相比,有显著的潜在改善。随着对预计于2027年发布的关键数据的预期增强,该公司的主要竞争对手提供了估值支持。

一项评估头颈部一线转移性鳞状细胞癌联合疗法疗效的10期剂量扩展试验的初步数据显示,有可能取得一流的临床结果。有人认为,当前的市场估值可能无法完全考虑到该疗法显然有可能成为价值数十亿美元的实体瘤市场的标准疗法所产生的独特价值。

头颈癌历来很少受到关注,随着下一代表皮生长因子受体双特异性的推出,其治疗格局有望发生转变。这些进步有望重新定义护理标准。凭借其领先的一线治疗深度和耐久性,ficerafusp alfa在启动其关键计划时使Bicara Therapeutics处于有利地位。一线头颈部鳞状细胞癌的市场提供了重要机会,可能价值50亿至100亿美元。Ficerafusp alfa被认为具有很高的成功开发可能性。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Bicara Therapeutics (BCAX.US)$近期主要分析师观点如下:

此外,综合报道,$Bicara Therapeutics (BCAX.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of