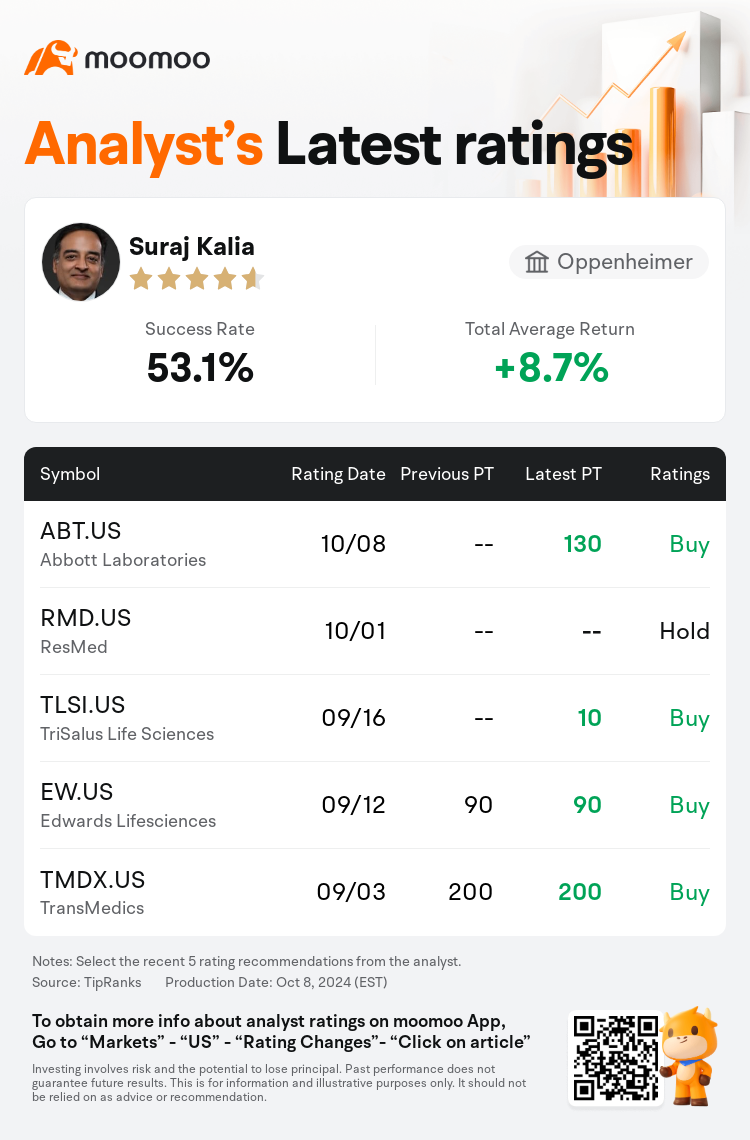

Oppenheimer analyst Suraj Kalia initiates coverage on $Abbott Laboratories (ABT.US)$ with a buy rating, and sets the target price at $130.

According to TipRanks data, the analyst has a success rate of 53.1% and a total average return of 8.7% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Abbott Laboratories (ABT.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Abbott Laboratories (ABT.US)$'s main analysts recently are as follows:

The firm's industry checks indicate that Q3 underlying utilization trends remained positive, even though the usual summer seasonality led to a sequential decrease in elective procedures. Additionally, investor sentiment towards MedTech stocks is favorable as the earnings season approaches, with the expectation that investors will likely persist in favoring successful and catalyst-driven names as the year comes to a close.

Abbott is described as a 'large-cap diversified healthcare play' with a dual character. On one hand, it boasts an enticing medical technology portfolio, accounting for 45% of its $42 billion global sales, with an annual growth rate of 11%-13%. On the other hand, the non-MedTech segments are growing at a lower rate, influenced by the ongoing litigation in the pediatric nutrition sector and diminishing COVID-19 diagnostics sales. It's suggested that as these pressures in the non-MedTech sectors lessen, Abbott's financial comparisons should improve by fiscal 2026, potentially leading to an uptick in sales growth to low-double-digits and an increase in EBIT margins.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

奥本海默控股分析师Suraj Kalia首予$雅培 (ABT.US)$买入评级,目标价130美元。

根据TipRanks数据显示,该分析师近一年总胜率为53.1%,总平均回报率为8.7%。

此外,综合报道,$雅培 (ABT.US)$近期主要分析师观点如下:

此外,综合报道,$雅培 (ABT.US)$近期主要分析师观点如下:

该公司的行业调查显示,尽管通常的夏季季节性因素导致选修程序连续减少,但第三季度的基础利用率趋势仍然乐观。此外,随着财报季的临近,投资者对医疗科技股票的情绪良好,预计随着财报季的临近,投资者可能会继续青睐成功且具有催化剂驱动力的股票。

雅培被描述为具有双重特征的 “大盘多元化医疗保健公司”。一方面,它拥有诱人的医疗技术产品组合,占其420亿美元全球销售额的45%,年增长率为11%-13%。另一方面,受儿科营养领域正在进行的诉讼和 COVID-19 诊断销售减少的影响,非医疗科技细分市场正以较低的速度增长。有人认为,随着非医疗技术领域的压力减轻,到2026财年,雅培的财务比较将有所改善,这可能会导致销售增长回升至低两位数,息税前利润率增加。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$雅培 (ABT.US)$近期主要分析师观点如下:

此外,综合报道,$雅培 (ABT.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of