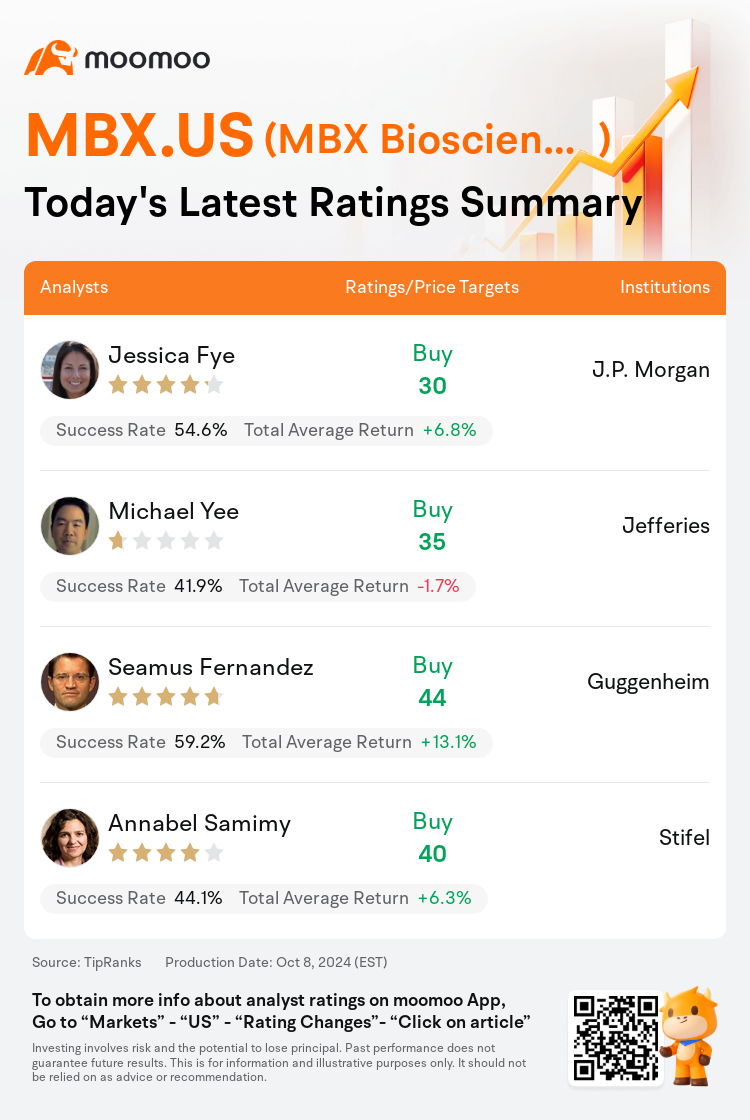

On Oct 08, major Wall Street analysts update their ratings for $MBX Biosciences (MBX.US)$, with price targets ranging from $30 to $44.

J.P. Morgan analyst Jessica Fye initiates coverage with a buy rating, and sets the target price at $30.

Jefferies analyst Michael Yee initiates coverage with a buy rating, and sets the target price at $35.

Guggenheim analyst Seamus Fernandez initiates coverage with a buy rating, and sets the target price at $44.

Guggenheim analyst Seamus Fernandez initiates coverage with a buy rating, and sets the target price at $44.

Stifel analyst Annabel Samimy initiates coverage with a buy rating, and sets the target price at $40.

Furthermore, according to the comprehensive report, the opinions of $MBX Biosciences (MBX.US)$'s main analysts recently are as follows:

MBX Biosciences is focused on creating peptide therapies aimed at targets within the endocrine/metabolic sector, utilizing its unique Precision platform to potentially enhance drug profiles. The company's primary candidate, MBX 2109, is considered a significant initial endeavor to address chronic hypoparathyroidism, with a Phase II trial currently in progress and anticipated top-line results in the third quarter of 2025. It is believed that the company's stock offers a compelling opportunity prior to a series of important milestones and events poised to potentially validate and increase the value of MBX's drug pipeline over the upcoming year.

MBX Biosciences is deemed to have a strong potential for success with MBX-2109 in Phase II for parathyroid hormone treatment. The company's robust scientific peptide platform is recognized for its ability to extend the duration of therapy and enhance efficacy for peptides targeting PTH and obesity. Additionally, the current valuation of the company's shares is viewed as attractive.

MBX Biosciences is recognized for its 'robust and productive' technology platform focused on precision endocrine peptides aimed at rare endocrine and metabolic disorders, which present significant market opportunities. The company has enhanced pharmaceutical attributes to ensure optimal therapeutic application, including maintaining peptide integrity, minimizing variability, prolonging action duration, and crucially, lessening the frequency of injections.

The initiation of coverage on MBX Biosciences comes with a positive outlook based on the potential presented by the company's development of longer-acting peptides aimed at clinically de-risked targets within endocrine and broader metabolic diseases. Key to this perspective is the company's lead compound, MBX 2109, which is a unique once-weekly peptide designed for a significant market opportunity in post-bariatric hypoglycemia.

Here are the latest investment ratings and price targets for $MBX Biosciences (MBX.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月8日,多家华尔街大行更新了$MBX Biosciences (MBX.US)$的评级,目标价介于30美元至44美元。

摩根大通分析师Jessica Fye首予买入评级,目标价30美元。

富瑞集团分析师Michael Yee首予买入评级,目标价35美元。

Guggenheim分析师Seamus Fernandez首予买入评级,目标价44美元。

Guggenheim分析师Seamus Fernandez首予买入评级,目标价44美元。

斯迪富分析师Annabel Samimy首予买入评级,目标价40美元。

此外,综合报道,$MBX Biosciences (MBX.US)$近期主要分析师观点如下:

MBX Biosciences专注于创建针对内分泌/代谢板块内靶点的肽治疗方案,利用其独特的Precision平台,可能增强药物概况。公司的主要候选药MBX 2109被视为解决慢性甲状旁腺功能减退症的重要初步努力,目前正进行第二期临床试验,预计2025年第三季度公布首要结果。人们认为公司股票在一系列重要里程碑和事件之前提供了引人注目的机会,有望验证和增加MBX药品管线价值。

MBX Biosciences被认为在甲状旁腺激素治疗的2期临床试验中具有强大的成功潜力,MBX-2109备受瞩目。公司强大的科学肽平台以延长治疗时间和增强针对PTH和肥胖的肽的疗效而闻名。此外,公司股票目前的估值被视为具有吸引力。

MBX Biosciences以其专注于罕见内分泌和代谢疾病领域的精密内分泌肽技术平台而闻名,这为公司提供了重要的市场机遇。公司具有增强的药物特性,以确保最佳治疗应用,包括保持肽的完整性,减少变化性,延长作用时间,关键地减少注射频率。

对MBX Biosciences的覆盖启动带来积极的前景,基于公司开发致力于内分泌和更广泛代谢疾病中长效肽的潜力。这一观点的关键在于公司的主导compound MBX 2109,这是一种独特的每周一次的肽,专为针对术后肥胖性低血糖症的重要市场机会而设计。

以下为今日4位分析师对$MBX Biosciences (MBX.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Guggenheim分析师Seamus Fernandez首予买入评级,目标价44美元。

Guggenheim分析师Seamus Fernandez首予买入评级,目标价44美元。

Guggenheim analyst Seamus Fernandez initiates coverage with a buy rating, and sets the target price at $44.

Guggenheim analyst Seamus Fernandez initiates coverage with a buy rating, and sets the target price at $44.