Behind the Scenes of JD.com's Latest Options Trends

Behind the Scenes of JD.com's Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bullish stance on JD.com.

富裕的鲸鱼们在京东上采取了明显看好的态度。

Looking at options history for JD.com (NASDAQ:JD) we detected 49 trades.

查看京东(纳斯达克:JD)的期权历史,我们检测到49笔交易。

If we consider the specifics of each trade, it is accurate to state that 46% of the investors opened trades with bullish expectations and 38% with bearish.

如果我们考虑每笔交易的具体情况,那么说46%的投资者持多头期望,38%持空头期望是准确的。

From the overall spotted trades, 10 are puts, for a total amount of $600,987 and 39, calls, for a total amount of $2,921,501.

从所有已发现的交易中,有10笔看跌,总金额为$600,987;有39笔看涨,总金额为$2,921,501。

Expected Price Movements

预期价格波动

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $70.0 for JD.com, spanning the last three months.

在评估交易量和未平仓合约后,明显看出主要市场推动者将重点放在京东的价格区间在$20.0和$70.0之间,涵盖过去三个月。

Volume & Open Interest Trends

成交量和未平仓量趋势

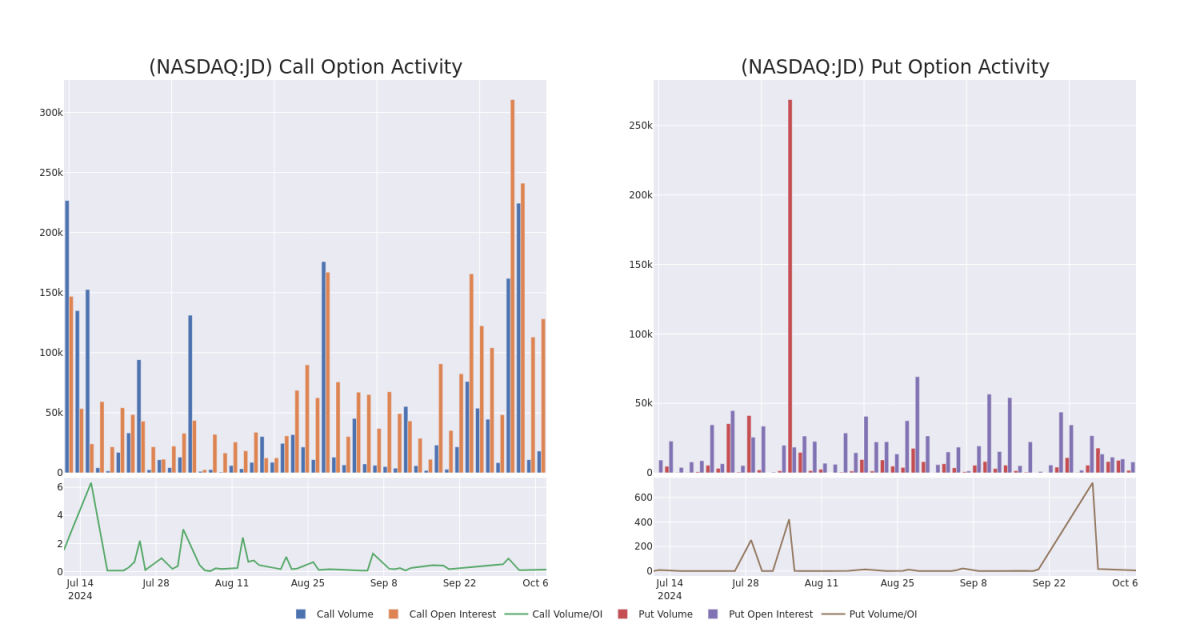

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for JD.com's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across JD.com's significant trades, within a strike price range of $20.0 to $70.0, over the past month.

检查成交量和未平仓合约为股票研究提供了重要见解。这些信息是评估京东在某些执行价格的期权的流动性和兴趣水平的关键。以下是过去一个月中,针对京东的重要交易在$20.0到$70.0执行价格区间内的看涨和看跌期权成交量和未平仓合约趋势的快照。

JD.com Call and Put Volume: 30-Day Overview

京东 看涨 和 看跌 成交量:30天概览

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JD | CALL | TRADE | NEUTRAL | 11/15/24 | $3.9 | $3.8 | $3.85 | $44.00 | $673.7K | 566 | 1.8K |

| JD | CALL | SWEEP | BULLISH | 10/11/24 | $1.01 | $0.9 | $1.0 | $45.00 | $295.2K | 4.4K | 3.6K |

| JD | CALL | SWEEP | BEARISH | 01/16/26 | $6.55 | $5.5 | $5.55 | $60.00 | $162.6K | 5.1K | 386 |

| JD | CALL | SWEEP | BEARISH | 03/21/25 | $6.1 | $6.0 | $6.0 | $46.00 | $144.6K | 1.2K | 47 |

| JD | PUT | SWEEP | BULLISH | 03/21/25 | $4.75 | $4.7 | $4.7 | $42.00 | $141.4K | 130 | 101 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 京东 | 看涨 | 交易 | 中立 | 11/15/24 | $3.9 | $3.8 | $3.85 | $44.00 | $673.7千美元 | 566 | 1.8K |

| 京东 | 看涨 | SWEEP | 看好 | 10/11/24 | $1.01 | $0.9 | $1.0 | $45.00 | $295.2K | 4.4K | 3.6千 |

| 京东 | 看涨 | SWEEP | 看淡 | 01/16/26 | $ 6.55 | $5.5 | $5.55 | $60.00 | 162.6千美元 | 5.1K | 386 |

| 京东 | 看涨 | SWEEP | 看淡 | 03/21/25 | 6.1美元 | $6.0 | $6.0 | $46.00 | $144.6K | 1.2K | 47 |

| 京东 | 看跌 | SWEEP | 看好 | 03/21/25 | $4.75 | $4.7 | $4.7 | 根据TipRanks.com数据,Gruber是一位5星分析师,平均回报率为14.5%,成功率为60.5%。Gruber主要研究北美板块的股票,重点关注Solaris Oilfield Infrastructure、Oceaneering International和Atlas Energy Solutions等股票。 | $141.4千 | Dated: September 3, 2024 | 101 |

About JD.com

关于京东

JD.com is a leading e-commerce platform with its 2022 China GMV being similar to Pinduoduo (GMV not reported), on our estimate, but still lower than Alibaba. it offers a wide selection of authentic products with speedy and reliable delivery. The company has built its own nationwide fulfilment infrastructure and last-mile delivery network, staffed by its own employees, which supports both its online direct sales, its online marketplace and omnichannel businesses.

京东是一家领先的电子商务平台,其2022年中国的成交量与拼多多相似(成交量没有报告),根据我们的估计,但仍低于阿里巴巴。该平台提供广泛的正品产品选择,配送迅速可靠。该公司已经建立了自己的全国履约基础设施和末端交付网络,由自己的员工管理,支持其在线直营业务、在线市场以及全渠道业务。

After a thorough review of the options trading surrounding JD.com, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对京东周围的期权交易进行彻底审查后,我们转而更详细地审查该公司。这包括对其当前市场状态和业绩的评估。

JD.com's Current Market Status

京东当前的市场状况

- Trading volume stands at 16,442,379, with JD's price down by -5.95%, positioned at $44.28.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 36 days.

- 交易量为16,442,379,京东的股价下跌了-5.95%,定位在$44.28。

- RSI指示股票可能已超买。

- 预计在 36 天内发布收益公告。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期权异动模块可以提前发现潜在的市场热点。了解大笔的资金在您喜欢的股票上的仓位变动。点击这里获取访问权限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

From the overall spotted trades, 10 are puts, for a total amount of $600,987 and 39, calls, for a total amount of $2,921,501.

From the overall spotted trades, 10 are puts, for a total amount of $600,987 and 39, calls, for a total amount of $2,921,501.