Unpacking the Latest Options Trading Trends in Cameco

Unpacking the Latest Options Trading Trends in Cameco

Investors with a lot of money to spend have taken a bearish stance on Cameco (NYSE:CCJ).

拥有大量资金的投资者对cameco(纽交所:CCJ)持看淡态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录中发现,今天这些头寸已经出现了。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CCJ, it often means somebody knows something is about to happen.

无论这些是机构还是富裕个人,我们都不清楚。但当CCJ发生这么大的事情时,这通常意味着某人知道即将发生的事情。

Today, Benzinga's options scanner spotted 20 options trades for Cameco.

今天,Benzinga的期权扫描器发现了20笔对cameco的期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 40% bullish and 45%, bearish.

这些大宗交易商的整体情绪在40%看涨和45%看淡之间分歧。

Out of all of the options we uncovered, there was 1 put, for a total amount of $62,433, and 19, calls, for a total amount of $1,367,447.

在我们发现的所有期权中,有1笔看跌期权,金额总计62433美元,以及19笔看涨期权,金额总计1367447美元。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $13.0 and $60.0 for Cameco, spanning the last three months.

经评估交易量和未平仓合约后,很明显主要市场推动因素着眼于Cameco股价处于13.0到60.0美元之间的区间,横跨过去三个月。

Insights into Volume & Open Interest

成交量和持仓量分析

In terms of liquidity and interest, the mean open interest for Cameco options trades today is 3344.08 with a total volume of 6,096.00.

就流动性和关注度而言,Cameco期权交易的平均未平仓合约量为3344.08,总成交量为6096.00。

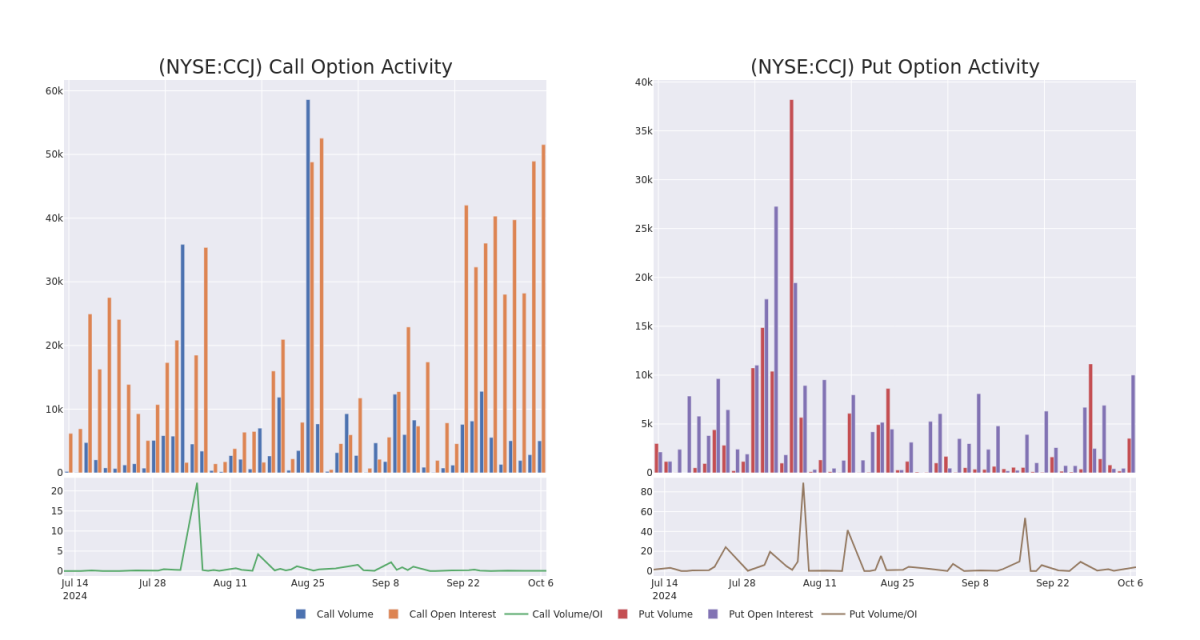

In the following chart, we are able to follow the development of volume and open interest of call and put options for Cameco's big money trades within a strike price range of $13.0 to $60.0 over the last 30 days.

在下图中,我们可以追踪Cameco大额交易的看涨和看跌期权的成交量和未平仓合约发展情况,涵盖了过去30天内的13.0到60.0美元的执行价格范围。

Cameco Call and Put Volume: 30-Day Overview

Cameco看涨和看跌期权成交量:30天总览

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCJ | CALL | TRADE | BEARISH | 01/17/25 | $3.6 | $3.5 | $3.5 | $55.00 | $350.0K | 17.5K | 1.2K |

| CCJ | CALL | TRADE | BEARISH | 01/17/25 | $38.6 | $38.0 | $38.0 | $13.00 | $220.4K | 288 | 121 |

| CCJ | CALL | SWEEP | BULLISH | 09/19/25 | $11.75 | $11.6 | $11.75 | $47.00 | $110.4K | 61 | 94 |

| CCJ | CALL | SWEEP | BEARISH | 10/18/24 | $4.4 | $4.3 | $4.3 | $47.00 | $86.0K | 14.4K | 33 |

| CCJ | PUT | SWEEP | BULLISH | 10/11/24 | $8.4 | $7.9 | $7.9 | $59.00 | $62.4K | 0 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 铀 | 看涨 | 交易 | 看淡 | 01/17/25 | $3.6 | $3.5 | $3.5 | $55.00 | $350.0K | 17.5K | 1.2K |

| 铀 | 看涨 | 交易 | 看淡 | 01/17/25 | $38.6 | $38.0 | $38.0 | $13.00 | $220.4K | 288 | 121 |

| 铀 | 看涨 | SWEEP | 看好 | 09/19/25 | 11.75美元 | $11.6 | 11.75美元 | $47.00 | $110.4K | 61 | 94 |

| 铀 | 看涨 | SWEEP | 看淡 | 10/18/24 | $4.4 | $4.3 | $4.3 | $47.00 | $86.0K | 14.4K | 33 |

| 铀 | 看跌 | SWEEP | 看好 | 10/11/24 | $8.4 | $7.9 | $7.9 | $59.00 | $62.4千美元 | 0 | 0 |

About Cameco

关于Cameco Cameco是全球最大的铀燃料供应商之一,为发展无污染世界所需的铀燃料贡献力量。我们的竞争地位基于我们对世界最大的高品质储量和低成本经营的控制所有权,以及对核燃料循环的整个投资,包括对西屋电气公司和全球激光浓缩的所有权。全球实用程序公司依靠Cameco为世界各地提供全球性的核燃料解决方案,以生成安全、可靠、无碳的核能。我们的股票在多伦多和纽约证券交易所上市。我们的总部位于加拿大萨斯喀彻温省的萨斯卡通市。

Cameco Corp is a provider of uranium needed to generate clean, reliable baseload electricity around the globe. one of those uranium producers. Cameco has three reportable segments, uranium, fuel services and Westinghouse. It derives maximum revenue from Uranium Segment. It has some projects namely; Millennium, Yeelirrie, Kintyre and Exploration. The company operates in Canada, Kazakhstan, Germany, Australia and United States.

Cameco公司是一家提供铀的供应商,以在全球范围内产生清洁可靠的基础电力为使命,是铀生产商之一。 Cameco拥有三个可报告部门,分别是铀、燃料服务和Westinghouse。它从铀部门获得最大营业收入。其一些项目包括;Millennium、Yeelirrie、Kintyre和勘探。该公司在加拿大、哈萨克斯坦、德国、澳大利亚和美国开展业务。

Following our analysis of the options activities associated with Cameco, we pivot to a closer look at the company's own performance.

在对与Cameco相关的期权活动进行分析之后,我们转而更近距离地观察该公司的表现。

Present Market Standing of Cameco

Cameco目前的市场地位

- Trading volume stands at 2,127,504, with CCJ's price down by -0.88%, positioned at $50.97.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 30 days.

- 交易量为2,127,504,CCJ的价格下跌了-0.88%,定位于$50.97。

- RSI指示股票可能已超买。

- 预计30天内公布收益公告。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的专业期权交易员揭示了他的单线图技巧,可以显示何时买入和卖出。复制他的交易,每20天平均盈利27%。点击这里获取更多信息。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CCJ, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CCJ, it often means somebody knows something is about to happen.