Decoding Oracle's Options Activity: What's the Big Picture?

Decoding Oracle's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bullish move on Oracle. Our analysis of options history for Oracle (NYSE:ORCL) revealed 31 unusual trades.

金融巨头在甲骨文展现出明显的看好动作。我们对甲骨文(纽交所:ORCL)期权历史的分析显示,有31笔飞凡交易。

Delving into the details, we found 54% of traders were bullish, while 32% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $496,018, and 26 were calls, valued at $2,152,301.

深入细节,我们发现54%的交易员看涨,而32%显示看淡倾向。在所有我们发现的交易中,有5笔看跌交易,价值$496,018,有26笔看涨交易,价值$2,152,301。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $105.0 to $240.0 for Oracle over the last 3 months.

考虑到这些合约的成交量和持仓量,看起来大户们在过去3个月一直在把甲骨文的价格区间定在$105.0至$240.0。

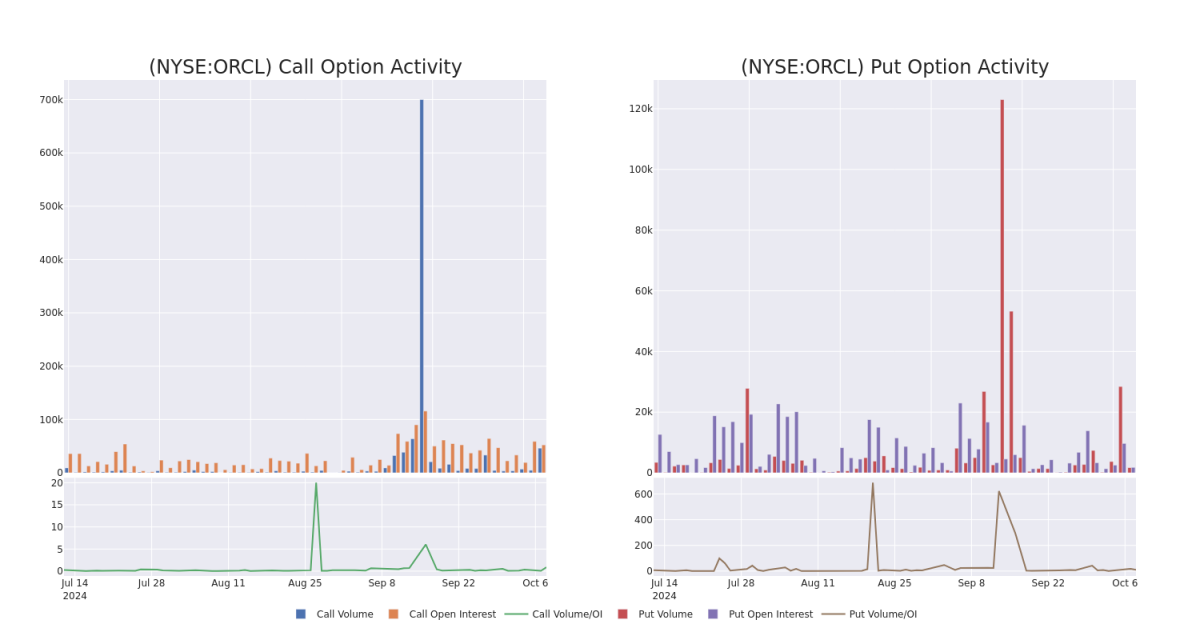

Volume & Open Interest Trends

成交量和未平仓量趋势

In terms of liquidity and interest, the mean open interest for Oracle options trades today is 2580.0 with a total volume of 47,926.00.

就流动性和兴趣而言,今天甲骨文期权交易的平均持仓量为2580.0,总成交量为47,926.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Oracle's big money trades within a strike price range of $105.0 to $240.0 over the last 30 days.

在下面的图表中,我们能够追踪甲骨文的大额交易中看涨和看跌期权的成交量和持仓量的发展,涵盖了最近30天内$105.0至$240.0的行权价区间。

Oracle Option Activity Analysis: Last 30 Days

甲骨文期权活动分析:过去30天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | CALL | SWEEP | BULLISH | 12/20/24 | $7.5 | $7.45 | $7.5 | $180.00 | $375.0K | 6.7K | 862 |

| ORCL | CALL | TRADE | BEARISH | 10/18/24 | $2.98 | $2.94 | $2.94 | $172.50 | $362.2K | 2.0K | 5.4K |

| ORCL | PUT | TRADE | BEARISH | 01/17/25 | $6.9 | $6.8 | $6.9 | $165.00 | $345.0K | 807 | 517 |

| ORCL | CALL | TRADE | BULLISH | 10/18/24 | $3.05 | $2.92 | $3.05 | $172.50 | $152.1K | 2.0K | 6.6K |

| ORCL | CALL | TRADE | BULLISH | 01/16/26 | $19.75 | $19.6 | $19.75 | $190.00 | $98.7K | 289 | 51 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | 看涨 | SWEEP | 看好 | 12/20/24 | $7.5 | $7.45 | $7.5 | 180.00美元 | $375.0K | 6.7千 | 862 |

| ORCL | 看涨 | 交易 | 看淡 | 10/18/24 | $2.98 | 2.94美元 | 2.94美元 | $172.50 | 362.2千美元 | 2.0K | 5,400 |

| ORCL | 看跌 | 交易 | 看淡 | 01/17/25 | $6.9 | $6.8 | $6.9 | 165.00美元 | 345.0千美元 | 807 | 517 |

| ORCL | 看涨 | 交易 | 看好 | 10/18/24 | $3.05 | $2.92 | $3.05 | $172.50 | $152.1K | 2.0K | 6,600份 |

| ORCL | 看涨 | 交易 | 看好 | 01/16/26 | $19.75 | $19.6 | $19.75 | $190.00 | $98.7K | 289 | 51 |

About Oracle

关于Oracle

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has 430,000 customers in 175 countries, supported by its base of 136,000 employees.

Oracle向全球企业提供数据库技术和企业资源规划(ERP)软件。Oracle成立于1977年,是第一个商用SQL数据库管理系统的创始人。如今,Oracle在175个国家拥有430,000个客户,由136,000名员工支持。

Following our analysis of the options activities associated with Oracle, we pivot to a closer look at the company's own performance.

在对Oracle的期权活动进行分析之后,我们将转向更密切关注公司的表现。

Oracle's Current Market Status

Oracle当前的市场状况

- With a trading volume of 3,778,763, the price of ORCL is up by 1.84%, reaching $173.09.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 62 days from now.

- 交易量为3,778,763,ORCL的价格上涨了1.84%,达到173.09美元。

- 当前RSI值表明股票可能已经超买。

- 下一个盈利报告将在62天后发布。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期权异动模块可以提前发现潜在的市场热点。了解大笔的资金在您喜欢的股票上的仓位变动。点击这里获取访问权限。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Oracle with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供更高利润的潜力。精明的交易员通过持续教育、战略性交易调整、利用各种因子以及保持对市场动态的敏感来降低这些风险。通过Benzinga Pro及时了解Oracle的最新期权交易,获取实时警报。

In terms of liquidity and interest, the mean open interest for Oracle options trades today is 2580.0 with a total volume of 47,926.00.

In terms of liquidity and interest, the mean open interest for Oracle options trades today is 2580.0 with a total volume of 47,926.00.