Block's Options Frenzy: What You Need to Know

Block's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bearish stance on Block.

拥有大量资金的鲸鱼对Block采取了明显的看淡立场。

Looking at options history for Block (NYSE:SQ) we detected 12 trades.

查看Block(纽交所:SQ)的期权历史,我们发现了12笔交易。

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 41% with bearish.

如果考虑每笔交易的具体细节,可以准确地说,投资者中有33%打算看好,41%打算看淡。

From the overall spotted trades, 6 are puts, for a total amount of $241,874 and 6, calls, for a total amount of $262,790.

从所有被发现的交易中,有6笔看跌,总金额为$241,874,还有6笔看涨,总金额为$262,790。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $77.5 for Block, spanning the last three months.

经评估交易量和未平仓合约后,很明显主要市场动向集中在Block价格区间为$50.0至$77.5之间,跨越了过去三个月。

Insights into Volume & Open Interest

成交量和持仓量分析

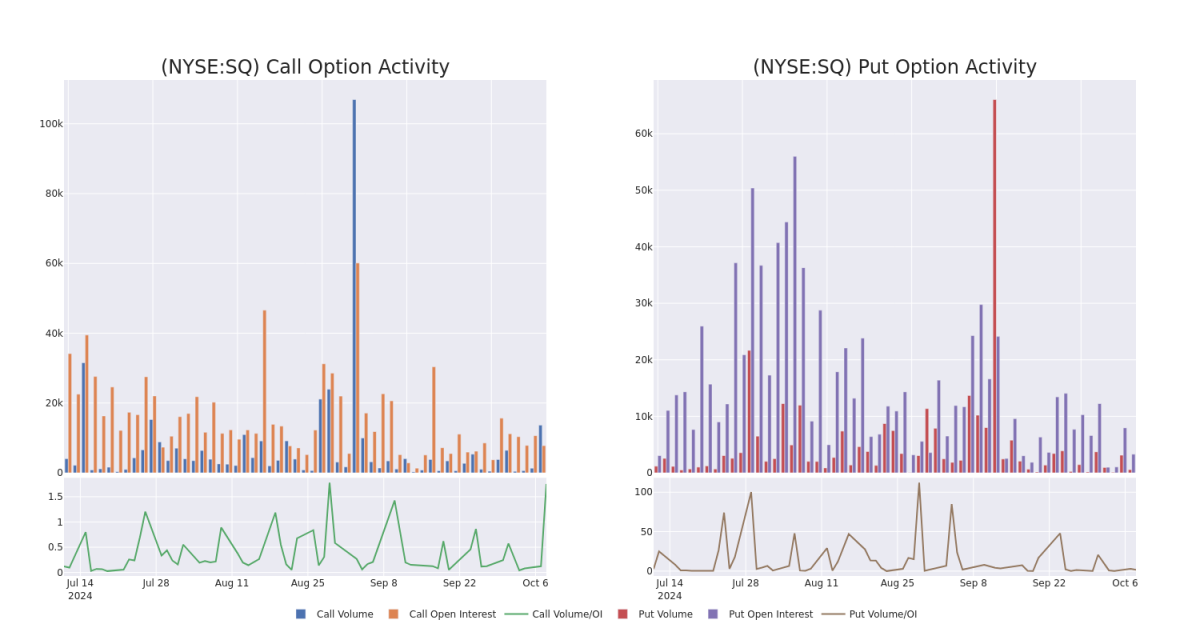

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Block's options for a given strike price.

这些数据可以帮助您追踪Block期权在某个行使价格的流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Block's whale activity within a strike price range from $50.0 to $77.5 in the last 30 days.

下面,我们可以观察在过去30天内,涉及从$50.0到$77.5区间内所有Block的大宗交易的看涨期权和看跌期权的成交量和未平仓量的变化。

Block Option Activity Analysis: Last 30 Days

Block期权活动分析:最近30天

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | CALL | TRADE | BULLISH | 06/20/25 | $16.15 | $16.0 | $16.12 | $60.00 | $80.6K | 1.3K | 53 |

| SQ | PUT | SWEEP | BEARISH | 11/15/24 | $10.25 | $10.0 | $10.25 | $75.00 | $54.3K | 142 | 0 |

| SQ | PUT | TRADE | NEUTRAL | 11/08/24 | $3.4 | $3.3 | $3.35 | $65.00 | $51.5K | 126 | 156 |

| SQ | PUT | TRADE | BEARISH | 11/15/24 | $5.5 | $5.45 | $5.5 | $67.50 | $49.5K | 1.8K | 90 |

| SQ | CALL | SWEEP | BEARISH | 11/15/24 | $4.25 | $4.15 | $4.15 | $70.00 | $44.4K | 1.2K | 592 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | 看涨 | 交易 | 看好 | 06/20/25 | $16.15 | $16.0 | $16.12 | $60.00 | $80.6K | 1.3K | 53 |

| SQ | 看跌 | SWEEP | 看淡 | 11/15/24 | $10.25 | $10.0 | $10.25 | $75.00 | $54.3K | 142 | 0 |

| SQ | 看跌 | 交易 | 中立 | 11/08/24 | $3.4 | $3.3 | $3.35 | $65.00 | $51.5K | 126 | 156 |

| SQ | 看跌 | 交易 | 看淡 | 11/15/24 | $5.5 | $5.45 | $5.5 | $67.50 | $49.5K | 1.8K | 90 |

| SQ | 看涨 | SWEEP | 看淡 | 11/15/24 | $4.25 | $4.15 | $4.15 | 70.00美元 | $44.4千美元 | 1.2K | 592 |

About Block

关于Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square's payment volume was a little over $200 million.

成立于2009年,Block为商家提供支付服务及相关服务。该公司还推出了Cash App,一个人对人的支付网络。2023年,Square的支付量略超过2亿美元。

In light of the recent options history for Block, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于Block的最新期权历史,现在应将焦点集中在公司本身。我们的目标是探索其当前表现。

Present Market Standing of Block

Block现有市场地位

- Trading volume stands at 2,794,690, with SQ's price up by 3.53%, positioned at $68.03.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 23 days.

- 交易量为2,794,690,SQ的价格上涨3.53%,为$68.03。

- RSI指标显示该股票可能接近超买。

- 预计23天后公布收益报告。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期权异动模块可以提前发现潜在的市场热点。了解大笔的资金在您喜欢的股票上的仓位变动。点击这里获取访问权限。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Block options trades with real-time alerts from Benzinga Pro.

期权交易存在较高的风险和潜在回报。精明的交易者通过不断学习,调整策略,监视多种因子和密切关注市场行情来管理这些风险。通过Benzinga Pro的实时警报了解最新的Block期权交易情况。

From the overall spotted trades, 6 are puts, for a total amount of $241,874 and 6, calls, for a total amount of $262,790.

From the overall spotted trades, 6 are puts, for a total amount of $241,874 and 6, calls, for a total amount of $262,790.