Super Micro Computer Stock Volatile On 100K GPU Shipments: Can AI Hype Keep It Up?

Super Micro Computer Stock Volatile On 100K GPU Shipments: Can AI Hype Keep It Up?

Super Micro Computer Inc. (NASDAQ:SMCI) has been riding the AI wave for some time, and its latest announcement sent the stock soaring again.

超微电脑公司(纳斯达克:SMCI)已经一段时间以来一直在搭乘人工智能的浪潮,最新公告再次推动股价飙升。

Shares jumped 15% after the company revealed it's shipping over 100,000 GPUs per quarter, a figure that could translate into billions of dollars in potential revenue, with GPUs being the core hardware behind AI development and deployment.

股价在公司披露每季度发货超过10万个gpu后上涨了15%,这一数字可能转化为数十亿美元的潜在营业收入,由于gpu是人工智能开发和部署背后的核心硬件。

But while the stock got a short-term boost, questions about its sustainability loom large. It soon receded and was down by about 7% by 1:30 PM ET.

但是,虽然股票获得了短期提振,但对其可持续性的质疑越来越大。到下午1:30时,股价迅速回落了约7%。

AI Infrastructure Powers Stock Surge

人工智能基础设施推动股价飙升

Super Micro has been a major player in supplying AI infrastructure, and the latest GPU shipment announcement highlights its role in powering some of the biggest AI data centers. The company's new liquid cooling technology also caught Wall Street's attention, as it promises to reduce costs and optimize hardware for data centers that run constantly.

超微一直是供应人工智能基础设施的重要角色,最新的gpu发货公告凸显了其在为一些最大的人工智能数据中心提供动力的作用。公司的新型液冷技术也吸引了华尔街的注意,因为它承诺降低成本并优化为不断运行的数据中心运行的硬件。

But there's a wrinkle: Super Micro has been dealing with investigations, including a Department of Justice probe following short-seller allegations of accounting issues.

但问题也随之而来:超微一直在处理调查,包括一项由卖空者指控会计问题的司法部调查。

Read Also: Super Micro Down 60% Since Joining S&P 500, Barclays Drops Bull Stance On 'Customer Erosion And Weak AI Server Margins'

阅读更多:自加入标普500指数以来,超微股价下跌60%,巴克莱银行调低了对其“客户流失和人工智能服务器利润率弱化”的看好态度

Headwinds Persist Despite Rally

尽管出现了反弹,但阻力仍然存在

Even with this impressive GPU announcement, Super Micro is battling broader headwinds.

尽管有着这一令人印象深刻的gpu芯片-云计算发布,超微电脑仍在应对更广泛的逆风。

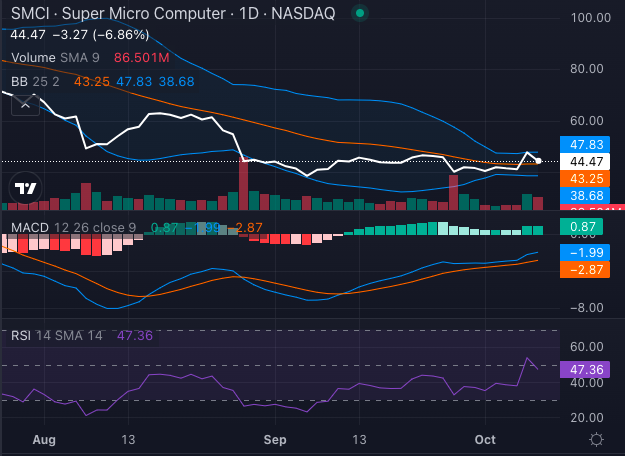

Despite the recent rally, the stock remains down over 50% since peaking in March, and technical indicators suggest the path ahead could be rocky.

尽管最近股价出现反弹,自三月份达到高点以来股价下跌超过50%,技术因子表明未来可能充满挑战。

Chart created using Benzinga Pro

使用Benzinga Pro创建的图表

Currently trading at $44.44, the stock is below both its 50-day and 200-day simple moving averages ($50.23 and $70.92, respectively), which are typically bearish signals.

目前股价为44.44美元,低于其50日和200日简单移动平均线(分别为50.23美元和70.92美元),这通常是消极信号。

Read Also: What's Going On With Super Micro Computer Stock?

超微电脑的股票发生了什么事?

Bullish Signs, But Uncertainties Remain

积极因素存在,但仍存在不确定性。

Still, the stock price sits above its eight-day and 20-day SMAs, signaling near-term bullish potential.

然而,股价仍高于其8日和20日简单移动平均线,表明短期内存在看好潜力。

Chart created using Benzinga Pro

使用Benzinga Pro创建的图表

The MACD, however, remains negative, and while the RSI at 47.36 isn't in overbought territory, it suggests that investor enthusiasm could face hurdles.

MACD仍然为负数,而RSI为47.36,尽管不处于超买区域,但表明投资者的热情可能会面临障碍。

The AI demand boom has propelled Super Micro, but with ongoing legal and financial uncertainties, the real question is whether this surge can last.

人工智能需求激增推动了超微电脑的增长,但随着持续的法律和财政不确定性,真正的问题是这种激增能否持续。

For now, it seems like investors are still very much along for the ride.

目前看来,投资者仍然对这段旅程充满期待。

- Stocks Fall As Oil Prices Spike, 10-Year Yields Top 4%; Energy Sector Outperforms: What's Driving Markets Monday?

- 随着油价飙升,10年期收益率超过4%,股市下跌;能源板块表现优异:是什么推动了周一的市场?

Image: Shutterstock

图片:shutterstock

Super Micro has been a major player in supplying AI infrastructure, and the latest GPU shipment announcement highlights its role in powering some of the biggest AI data centers. The company's new liquid cooling technology also caught Wall Street's attention, as it promises to reduce costs and optimize hardware for data centers that run constantly.

Super Micro has been a major player in supplying AI infrastructure, and the latest GPU shipment announcement highlights its role in powering some of the biggest AI data centers. The company's new liquid cooling technology also caught Wall Street's attention, as it promises to reduce costs and optimize hardware for data centers that run constantly.