This Is What Whales Are Betting On Caterpillar

This Is What Whales Are Betting On Caterpillar

Deep-pocketed investors have adopted a bullish approach towards Caterpillar (NYSE:CAT), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CAT usually suggests something big is about to happen.

有钱的投资者采取了看好卡特彼勒(纽交所:CAT)的方法,这是市场参与者不应忽视的。我们在Benzinga跟踪公共期权记录时发现了这一重大举动。这些投资者的身份仍然未知,但CAT的这种重大举动通常意味着即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 37 extraordinary options activities for Caterpillar. This level of activity is out of the ordinary.

我们从今天的观察中获得了这些信息,当Benzinga的期权扫描器突出显示了37起卡特彼勒的非凡期权活动。这种活动水平是非同寻常的。

The general mood among these heavyweight investors is divided, with 37% leaning bullish and 37% bearish. Among these notable options, 18 are puts, totaling $2,032,141, and 19 are calls, amounting to $3,075,855.

这些重量级投资者中普遍的情绪分歧,37%看好,37%看淡。在这些显著的期权中,有18个看跌,总额为2,032,141美元,19个看涨,总额为3,075,855美元。

Expected Price Movements

预期价格波动

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $290.0 to $470.0 for Caterpillar over the last 3 months.

考虑到这些合约的成交量和未平仓合约量,看起来大户一直将对卡特彼勒的价格区间定位在290.0美元至470.0美元之间,过去3个月。

Volume & Open Interest Trends

成交量和未平仓量趋势

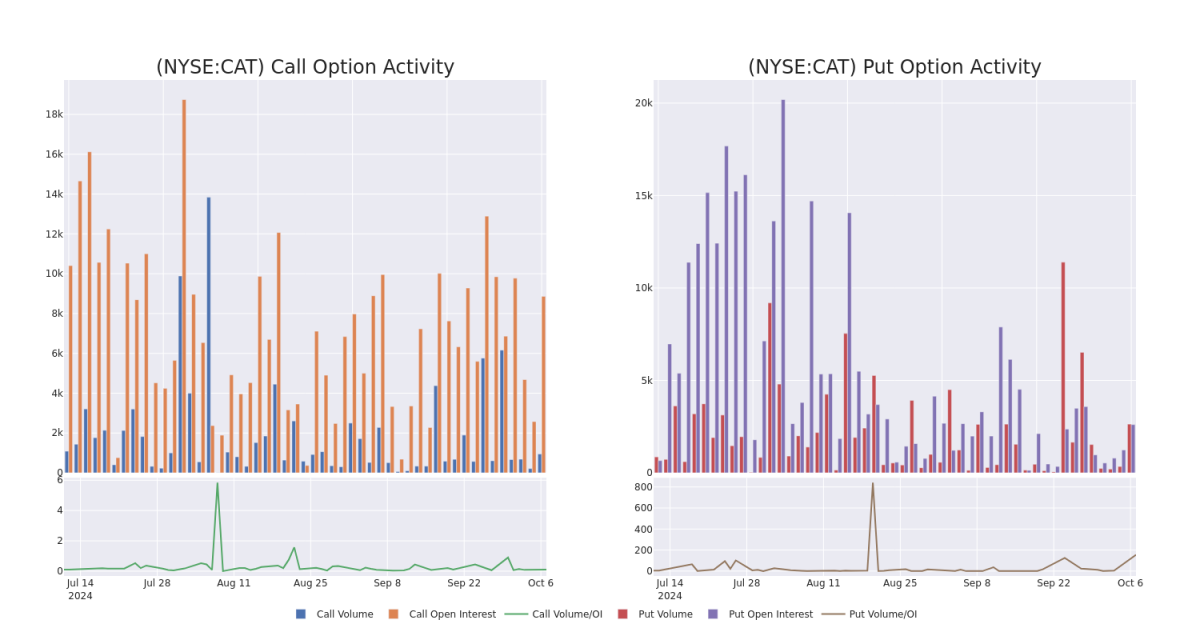

In today's trading context, the average open interest for options of Caterpillar stands at 729.62, with a total volume reaching 8,469.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Caterpillar, situated within the strike price corridor from $290.0 to $470.0, throughout the last 30 days.

在今天的交易背景下,卡特彼勒期权的平均未平仓合约量为729.62,总成交量达到8,469.00。附带的图表描述了过去30天内,卡特彼勒高价交易的看涨和看跌期权成交量和未平仓合约量的发展情况,位于290.0美元至470.0美元的行权价走廊内。

Caterpillar 30-Day Option Volume & Interest Snapshot

卡特彼勒30天期权成交量和未平仓合约瞬间

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAT | CALL | TRADE | NEUTRAL | 01/17/25 | $37.05 | $35.05 | $36.0 | $370.00 | $1.6M | 1.0K | 451 |

| CAT | PUT | TRADE | BEARISH | 11/15/24 | $12.55 | $12.25 | $12.5 | $380.00 | $1.0M | 1.6K | 1.5K |

| CAT | CALL | TRADE | BULLISH | 11/01/24 | $32.7 | $29.85 | $32.7 | $360.00 | $588.6K | 382 | 180 |

| CAT | CALL | TRADE | NEUTRAL | 01/17/25 | $24.5 | $23.85 | $24.17 | $390.00 | $120.8K | 1.0K | 52 |

| CAT | CALL | SWEEP | BULLISH | 01/17/25 | $24.6 | $23.95 | $24.35 | $390.00 | $97.3K | 1.0K | 52 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 卡特彼勒 | 看涨 | 交易 | 中立 | 01/17/25 | $37.05 | $35.05 | $36.0 | $370.00 | $1.6M | 1.0K | 451 |

| 卡特彼勒 | 看跌 | 交易 | 看淡 | 11/15/24 | $12.55 | $12.25 | $12.5 | $380.00 | $1.0M | 1.6K | 1.5K |

| 卡特彼勒 | 看涨 | 交易 | 看好 | 11/01/24 | $32.7 | $29.85 | $32.7 | $360.00 | $588.6K | 382 | 180 |

| 卡特彼勒 | 看涨 | 交易 | 中立 | 01/17/25 | $24.5 | $23.85 | $24.17 | $390.00 | $120.8K | 1.0K | |

| 卡特彼勒 | 看涨 | SWEEP | 看好 | 01/17/25 | $24.6 | $23.95 | $24.35 | $390.00 | $97.3K | 1.0K |

About Caterpillar

关于卡特彼勒

Caterpillar is the top manufacturer of heavy equipment, power solutions, and locomotives. It is currently the world's largest manufacturer of heavy equipment. The company is divided into four reportable segments: construction industries, resource industries, energy and transportation, and Cat Financial. Its products are available through a dealer network that covers the globe with about 2,700 branches maintained by 160 dealers. Cat Financial provides retail financing for machinery and engines to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Caterpillar product sales.

卡特彼勒是重型设备、动力解决方案和机车的顶级制造商。它是目前世界上最大的重型设备制造商。该公司分为四个报告分部:施工行业、资源行业、能源和运输、和猫金融。公司的产品通过遍布全球的经销商网络销售,由160个经销商维护着大约2700个分支机构。猫金融为客户提供机械和发动机的零售融资,除了为经销商提供批发融资,这增加了卡特彼勒产品销售的可能性。

Present Market Standing of Caterpillar

卡特彼勒的当前市场地位

- With a volume of 1,775,332, the price of CAT is down -2.38% at $388.78.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 21 days.

- 成交量为1,775,332,卡特彼勒的价格下跌了-2.38%,目前为$388.78。

- RSI因子暗示底层股票可能被超买。

- 预计下次发布收益报告距今21天。

Professional Analyst Ratings for Caterpillar

卡特彼勒的专业分析师评级

1 market experts have recently issued ratings for this stock, with a consensus target price of $434.0.

1位市场专家最近对这只股票发表了评级意见,一致目标价为$434.0。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Caterpillar with a target price of $434.

Benzinga Edge的飞凡期权委员会在事件发生前发现潜在的市场推动者。看看大资金在您喜爱的股票上的持仓情况。点击这里查看.* 一位来自美国银行证券的分析师在评估中保持对卡特彼勒的买入评级,目标价为$434。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $290.0 to $470.0 for Caterpillar over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $290.0 to $470.0 for Caterpillar over the last 3 months.