Celsius Holdings Unusual Options Activity

Celsius Holdings Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Celsius Holdings.

拥有大量资金的鲸鱼已明显看好Celsius Holdings。

Looking at options history for Celsius Holdings (NASDAQ:CELH) we detected 23 trades.

查看Celsius Holdings(纳斯达克:CELH)的期权历史,我们检测到23笔交易。

If we consider the specifics of each trade, it is accurate to state that 52% of the investors opened trades with bullish expectations and 34% with bearish.

如果我们考虑每笔交易的具体细节,可以准确地说,52%的投资者持有看好期望,34%持有看淡期望。

From the overall spotted trades, 11 are puts, for a total amount of $729,151 and 12, calls, for a total amount of $559,641.

从整体交易中发现,有11笔看跌期权,总额为$729,151,还有12笔看涨期权,总额为$559,641。

Expected Price Movements

预期价格波动

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $15.0 to $70.0 for Celsius Holdings over the recent three months.

根据交易活动,重要的投资者似乎瞄准了Celsius Holdings在最近三个月内的价格区间,范围从$15.0到$70.0。

Volume & Open Interest Trends

成交量和未平仓量趋势

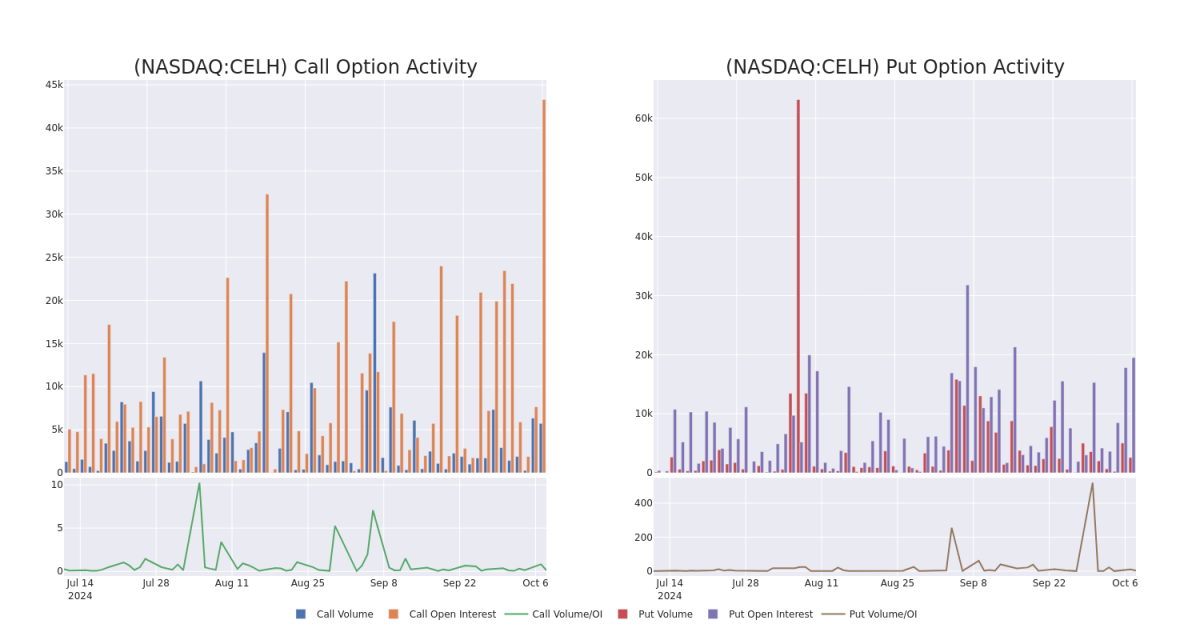

In today's trading context, the average open interest for options of Celsius Holdings stands at 3304.68, with a total volume reaching 8,322.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Celsius Holdings, situated within the strike price corridor from $15.0 to $70.0, throughout the last 30 days.

在今天的交易背景下,Celsius Holdings期权的平均未平仓量为3304.68,总成交量达到8322.00。随附的图表描述了Celsius Holdings高价交易的看涨和看跌期权成交量和未平仓量的发展情况,这些交易位于$15.0至$70.0的行权价格走廊内,在过去30天内。

Celsius Holdings Option Activity Analysis: Last 30 Days

Celsius Holdings期权活动分析:最近30天

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CELH | PUT | SWEEP | BULLISH | 01/16/26 | $15.7 | $15.4 | $15.4 | $40.00 | $385.0K | 2.3K | 250 |

| CELH | CALL | SWEEP | BEARISH | 11/15/24 | $2.71 | $2.64 | $2.64 | $30.00 | $114.3K | 1.8K | 1.6K |

| CELH | CALL | SWEEP | BEARISH | 01/16/26 | $9.05 | $8.8 | $8.8 | $30.00 | $88.0K | 930 | 167 |

| CELH | PUT | TRADE | BULLISH | 04/17/25 | $9.5 | $9.35 | $9.4 | $35.00 | $62.0K | 722 | 66 |

| CELH | CALL | SWEEP | BULLISH | 03/21/25 | $9.4 | $9.3 | $9.4 | $22.50 | $49.8K | 17 | 54 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| celsius holdings | 看跌 | SWEEP | 看好 | 01/16/26 | 15.7 | $15.4 | $15.4 | $40.00 | $385.0K | 2.3K | 250 |

| celsius holdings | 看涨 | SWEEP | 看淡 | 11/15/24 | $2.71 | 2.64美元 | 2.64美元 | $30.00 | $114.3K | 1.8K | 1.6K |

| celsius holdings | 看涨 | SWEEP | 看淡 | 01/16/26 | $9.05 | $ 8.8 | $ 8.8 | $30.00 | $88.0千美元 | 930 | 167 |

| celsius holdings | 看跌 | 交易 | 看好 | 04/17/25 | $9.5 | $9.35 | 9.4美元 | 35.00美元 | $62.0K | 722 | 66 |

| celsius holdings | 看涨 | SWEEP | 看好 | 03/21/25 | 9.4美元 | $9.3 | 9.4美元 | $22.50 | $49.8K | 17 | 54 |

About Celsius Holdings

关于Celsius Holdings

Celsius Holdings plays in the energy drink subsegment of the global nonalcoholic beverage market, with 96% of revenue concentrated in North America. Celsius' products contain natural ingredients and a metabolism-enhancing formulation, appealing to fitness and active lifestyle enthusiasts. The firm's portfolio includes its namesake Celsius Originals beverages (including those that are naturally caffeinated with stevia), Celsius Essentials line (containing aminos), and Celsius On-the-Go powder packets. Celsius dedicates its efforts to branding and innovation, while it utilizes third parties for the manufacturing, packaging, and distribution of its products. In 2022, Celsius forged a 20-year distribution agreement with PepsiCo, which holds an 8.5% stake in the business.

Celsius Holdings是全球非酒精饮料市场中能量饮料子领域的企业,96%的营收集中于北美。Celsius的产品含天然成分和代谢增强配方,吸引健身和积极生活方式的爱好者。该公司的产品组合包括其同名的Celsius Originals饮料(包括天然咖啡因饮料,含有甜菜碱),Celsius Essentials系列(含氨基酸)和Celsius On-the-Go粉末包。Celsius致力于品牌和创新,同时利用第三方公司来制造,包装和分销其产品。 2022年,Celsius与百事可乐签署了一项为期20年的分销协议,百事可乐占Celsius的8.5%股份。

Following our analysis of the options activities associated with Celsius Holdings, we pivot to a closer look at the company's own performance.

在分析了与Celsius Holdings相关的期权交易活动后,我们将转向更详细地了解该公司的业绩表现。

Present Market Standing of Celsius Holdings

Celsius Holdings现市场立场

- Currently trading with a volume of 6,364,055, the CELH's price is down by -0.45%, now at $28.69.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 28 days.

- 目前交易量为6,364,055,celsius holdings的价格下跌了-0.45%,目前为$28.69。

- RSI读数表明该股票目前可能接近超卖状态。

- 预期财报发布在28天后。

Expert Opinions on Celsius Holdings

Celsius Holdings的专家意见

In the last month, 2 experts released ratings on this stock with an average target price of $45.0.

在过去一个月中,有2位专家对这只股票发布了评级,平均目标价为$45.0。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Celsius Holdings, targeting a price of $47. * Maintaining their stance, an analyst from Roth MKM continues to hold a Buy rating for Celsius Holdings, targeting a price of $43.

20年期权交易老手透露了他的一行图表技术,显示何时买入和卖出。复制他的交易,平均每20天有27%的利润。 点击这里获取更多信息。* 派杰投资的分析师继续维持对celsius holdings的超配评级,目标价为$47。* 罗斯MKm的分析师继续维持对celsius holdings的买入评级,目标价为$43。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Celsius Holdings options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在收益。精明的交易者通过不断学习、调整策略、监控多个因子,并密切关注市场动向来管理这些风险。通过Benzinga Pro的实时警报及时了解最新的Celsius Holdings期权交易。

From the overall spotted trades, 11 are puts, for a total amount of $729,151 and 12, calls, for a total amount of $559,641.

From the overall spotted trades, 11 are puts, for a total amount of $729,151 and 12, calls, for a total amount of $559,641.