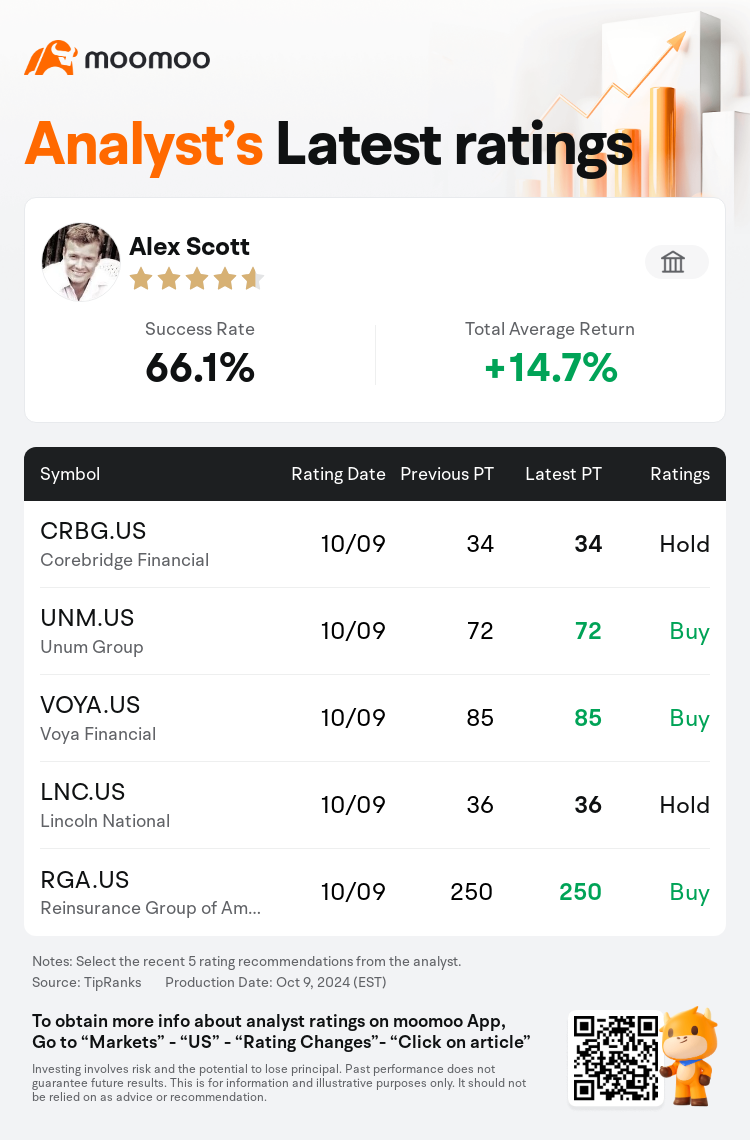

Barclays analyst Alex Scott maintains $Corebridge Financial (CRBG.US)$ with a hold rating, and maintains the target price at $34.

According to TipRanks data, the analyst has a success rate of 66.1% and a total average return of 14.7% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Corebridge Financial (CRBG.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Corebridge Financial (CRBG.US)$'s main analysts recently are as follows:

The outlook appears robust for both life and property and casualty insurance sectors. In the life insurance domain, there are 'offsetting currents' due to the positive influence of the equity markets counterbalanced by reductions in interest rates. It is anticipated that catastrophe-related losses will be somewhat above the norm, influenced by a series of events including three significant storms in the U.S. For property and casualty insurers, it's expected that underlying margins will continue to be strong, and that updates in pricing will be received positively, even with property insurance where concerns have been raised regarding a slowdown in pricing growth.

The life insurance sector presents a varied outlook, with Corebridge standing out as a top selection within the space. Despite acknowledging that the industry has firm capital positions and valuations appear to be fair, analysts suggest that growth catalysts are expected to temper. Therefore, they advise that investor selectivity will be key to achieving success in the life insurance market going forward.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

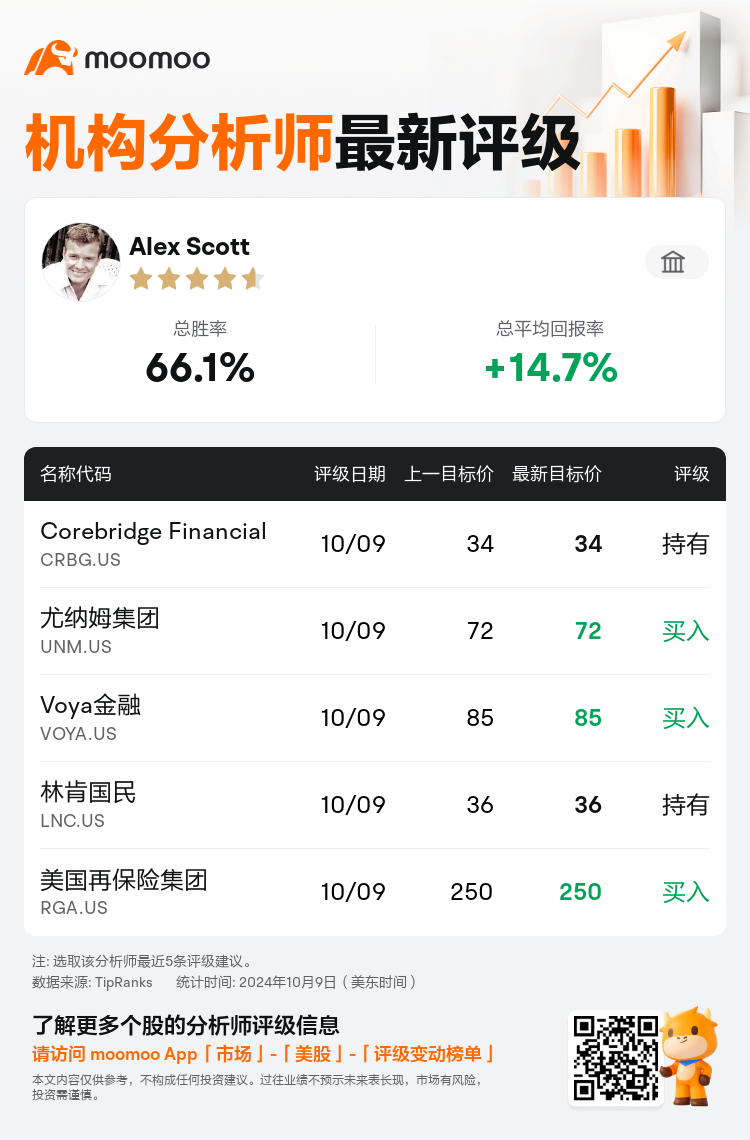

巴克莱银行分析师Alex Scott维持$Corebridge Financial (CRBG.US)$持有评级,维持目标价34美元。

根据TipRanks数据显示,该分析师近一年总胜率为66.1%,总平均回报率为14.7%。

此外,综合报道,$Corebridge Financial (CRBG.US)$近期主要分析师观点如下:

此外,综合报道,$Corebridge Financial (CRBG.US)$近期主要分析师观点如下:

人寿和财产保险以及意外伤害保险行业的前景似乎都很乐观。在人寿保险领域,由于股票市场的积极影响被利率降低所抵消,因此存在 “抵消潮流”。受包括美国三场重大风暴在内的一系列事件的影响,预计与灾难相关的损失将略高于正常水平。对于财产和意外伤害保险公司而言,预计基础利润率将继续保持强劲,定价的更新将获得积极的回报,即使财产保险业对定价增长放缓表示担忧。

人寿保险行业的前景各不相同,Corebridge是该领域的首选。尽管分析师承认该行业的资本状况稳健,估值似乎也很公平,但分析师认为,增长催化剂预计将有所缓和。因此,他们建议,投资者的选择性将是未来人寿保险市场取得成功的关键。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Corebridge Financial (CRBG.US)$近期主要分析师观点如下:

此外,综合报道,$Corebridge Financial (CRBG.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of