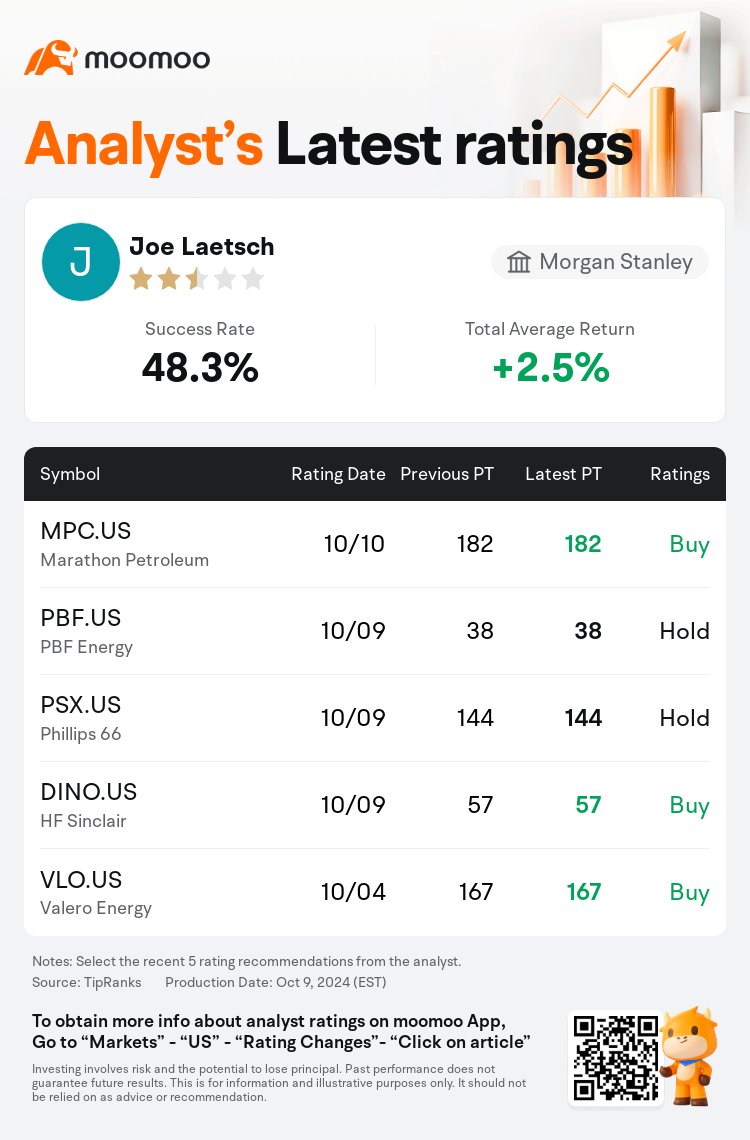

Morgan Stanley analyst Joe Laetsch maintains $PBF Energy (PBF.US)$ with a hold rating, and maintains the target price at $38.

According to TipRanks data, the analyst has a success rate of 48.3% and a total average return of 2.5% over the past year.

Furthermore, according to the comprehensive report, the opinions of $PBF Energy (PBF.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $PBF Energy (PBF.US)$'s main analysts recently are as follows:

Analysts anticipate that PBF Energy may not meet expected levels of free cash flow and earnings for Q3, despite advancements in operating efficiency. Given the company's significant exposure to the challenging macro refining climate, especially on the West Coast, a considerable shortfall for Q3 is predicted.

The analyst suggests that the challenges for PBF Energy have reached their nadir, with indications of diesel demand recovery, and factors such as lower prices and payrolls potentially bolstering gasoline demand. Additionally, refined product inventories are reported to be below the usual levels. It's expected that increasing OPEC+ output in the coming years will benefit coastal refiners by expanding crude differentials. The analyst also notes that refining capacity expansions in the Western Hemisphere are anticipated to be constrained, as planned shutdowns in 2025 are likely to counterbalance the capacity added from recent startups and biofuel expansions.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

摩根士丹利分析师Joe Laetsch维持$PBF Energy (PBF.US)$持有评级,维持目标价38美元。

根据TipRanks数据显示,该分析师近一年总胜率为48.3%,总平均回报率为2.5%。

此外,综合报道,$PBF Energy (PBF.US)$近期主要分析师观点如下:

此外,综合报道,$PBF Energy (PBF.US)$近期主要分析师观点如下:

分析师预计,尽管运营效率有所提高,但PBF Energy可能无法达到第三季度的预期自由现金流和收益水平。鉴于该公司在严峻的宏观炼油环境中面临大量风险,尤其是在西海岸,预计第三季度将出现相当大的短缺。

这位分析师认为,PBF Energy面临的挑战已达到最低点,有迹象表明柴油需求有所恢复,价格和就业人数下降等因素有可能提振汽油需求。此外,据报道,成品库存低于通常水平。预计未来几年欧佩克+产量的增加将通过扩大原油差异使沿海炼油商受益。该分析师还指出,预计西半球的炼油产能扩张将受到限制,因为计划于2025年停产可能会抵消近期初创企业和生物燃料扩张所增加的产能。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$PBF Energy (PBF.US)$近期主要分析师观点如下:

此外,综合报道,$PBF Energy (PBF.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of