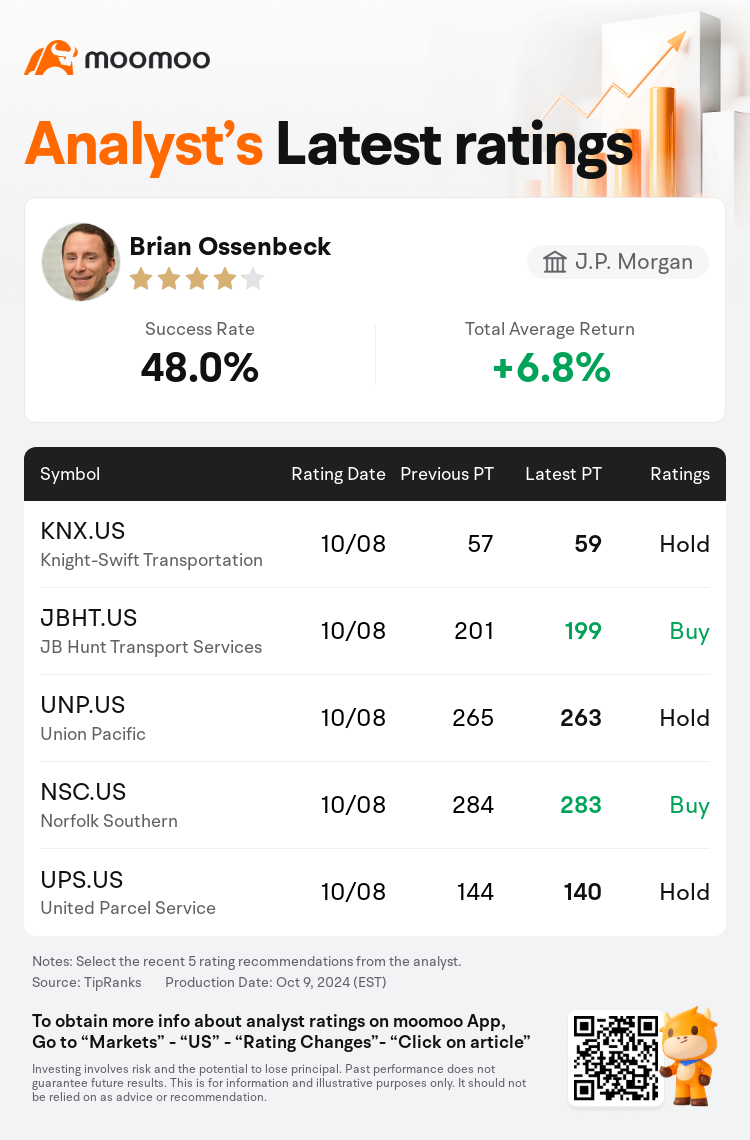

J.P. Morgan analyst Brian Ossenbeck maintains $Old Dominion Freight Line (ODFL.US)$ with a hold rating, and adjusts the target price from $189 to $191.

According to TipRanks data, the analyst has a success rate of 48.0% and a total average return of 6.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Old Dominion Freight Line (ODFL.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Old Dominion Freight Line (ODFL.US)$'s main analysts recently are as follows:

Forecasts for Q3 earnings per share for less-than-truckload shippers have been adjusted downward, affecting projections for 2025/2026 based on lower starting points. This revision primarily stems from generally soft mid-Q3 operational updates from the industry, although it's noted that a competitor has maintained robust volume intake trends, thanks to ongoing new terminal openings.

The initiation of coverage on the transportation and logistics industry reflects a broadly optimistic outlook, based on the assessment that the current cyclical downturn is nearing its end. With the anticipation of rates and margins nearing their lowest point, there is an expectation of significant earnings growth in the coming years as the market recuperates. This positive perspective is underpinned by the belief that many companies in the industry boast strong leadership and a history of prudent capital management. Transportation firms are seen as offering vital, irreplaceable services that are integral to the North American economy, which minimizes the risk of disruption or replacement. Investors are advised to position themselves to benefit from the cyclical upturn, focusing on companies that are well-placed to gain disproportionately as the conditions in the freight market improve.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

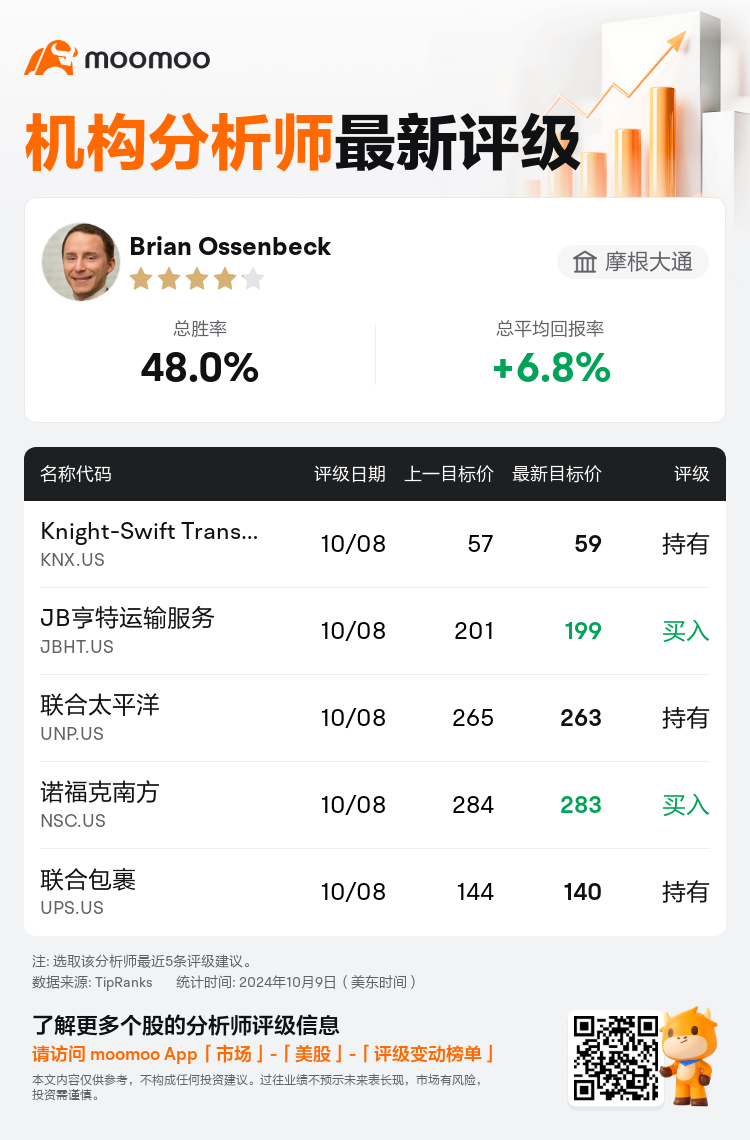

摩根大通分析师Brian Ossenbeck维持$Old Dominion Freight Line (ODFL.US)$持有评级,并将目标价从189美元上调至191美元。

根据TipRanks数据显示,该分析师近一年总胜率为48.0%,总平均回报率为6.8%。

此外,综合报道,$Old Dominion Freight Line (ODFL.US)$近期主要分析师观点如下:

此外,综合报道,$Old Dominion Freight Line (ODFL.US)$近期主要分析师观点如下:

对零担托运人第三季度每股收益的预测已向下调整,影响了基于较低起点的2025/2026年的预测。此次修订主要源于该行业第三季度中期总体上疲软的运营更新,尽管有人指出,由于新航站楼的持续开放,竞争对手一直保持强劲的吞吐量趋势。

根据对当前周期性衰退已接近尾声的评估,对运输和物流行业的报道的开始反映了普遍乐观的前景。随着利率和利润率的预期接近最低点,随着市场的复苏,预计未来几年的收益将大幅增长。这种积极的观点得到了这样的信念的支持,即该行业的许多公司都拥有强大的领导能力和审慎的资本管理历史。运输公司被视为提供至关重要的、不可替代的服务,这些服务是北美经济不可或缺的一部分,从而最大限度地降低了中断或替代的风险。建议投资者做好准备,从周期性回升中受益,重点关注那些在货运市场状况改善时有能力获得不成比例收益的公司。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Old Dominion Freight Line (ODFL.US)$近期主要分析师观点如下:

此外,综合报道,$Old Dominion Freight Line (ODFL.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of