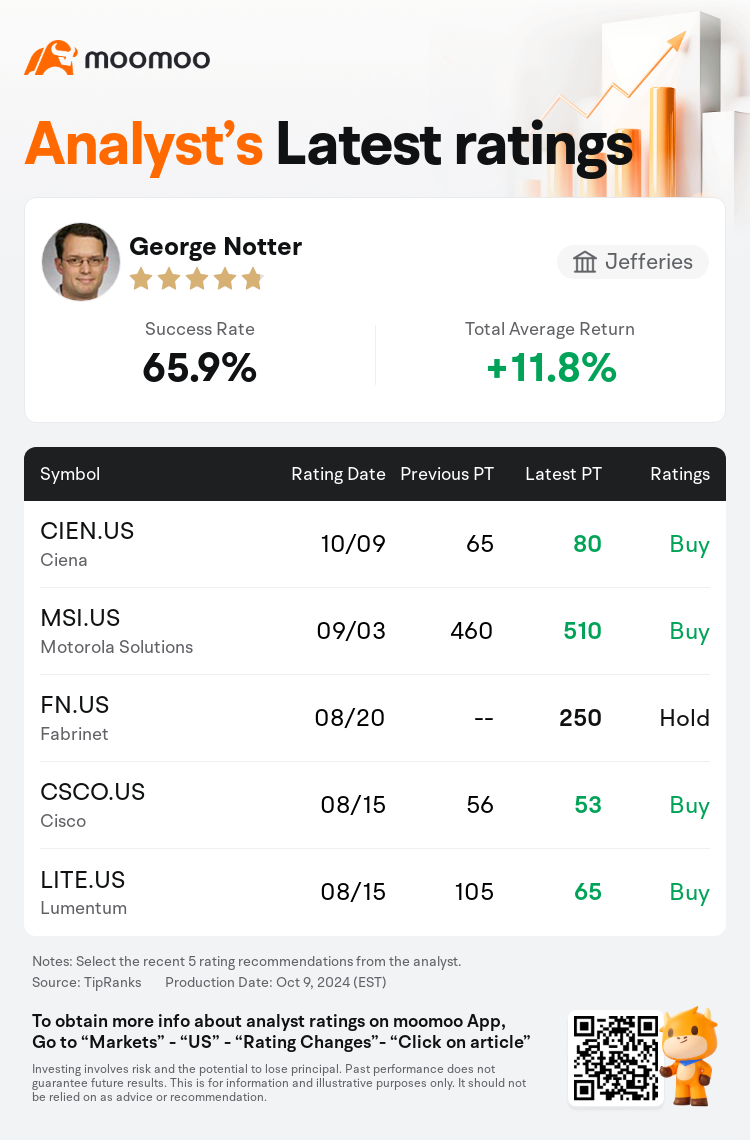

Jefferies analyst George Notter maintains $Ciena (CIEN.US)$ with a buy rating, and adjusts the target price from $65 to $80.

According to TipRanks data, the analyst has a success rate of 65.9% and a total average return of 11.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Ciena (CIEN.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Ciena (CIEN.US)$'s main analysts recently are as follows:

Ciena's recent AI/data center webcast highlighted the positive aspects of the bullish perspective, specifically the role of AI in expediting data growth and the integration of coherent technology within data centers. The company is perceived to have significant growth prospects, especially in intra and around data center operations, which could surpass expectations if data growth rates reach or exceed 25%-30%.

Following a webcast that highlighted Ciena's growing prospects and strategic plans for expansion in AI/data center markets, a discussion session yielded further insights. It is perceived that Ciena stands to benefit from the revival of telecom service provider markets and is also seen as a long-term beneficiary of the growth in DCI/internal data center interconnects.

The firm suggests that Ciena's prospects with artificial intelligence are considered to be more of a long-term potential rather than an immediate growth driver. The recent surge in optimism is believed to be already reflected in current projections, and the firm prefers to look for a more favorable risk/reward scenario before proceeding with the shares.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

富瑞集团分析师George Notter维持$Ciena (CIEN.US)$买入评级,并将目标价从65美元上调至80美元。

根据TipRanks数据显示,该分析师近一年总胜率为65.9%,总平均回报率为11.8%。

此外,综合报道,$Ciena (CIEN.US)$近期主要分析师观点如下:

此外,综合报道,$Ciena (CIEN.US)$近期主要分析师观点如下:

Ciena最近的人工智能/数据中心网络直播强调了看涨前景的积极方面,特别是人工智能在加速数据增长和数据中心内整合一致技术方面的作用。该公司被认为具有可观的增长前景,尤其是在数据中心内部和周边运营方面,如果数据增长率达到或超过25%-30%,则可能超出预期。

在网络直播强调了Ciena在人工智能/数据中心市场扩张的不断增长的前景和战略计划之后,讨论会得出了进一步的见解。人们认为,Ciena将受益于电信服务提供商市场的复苏,也被视为DCI/内部数据中心互连增长的长期受益者。

该公司表示,Ciena在人工智能方面的前景被认为更具长期潜力,而不是直接的增长动力。据信,最近的乐观情绪激增已经反映在当前的预测中,该公司倾向于在股票交易之前寻找更有利的风险/回报情景。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Ciena (CIEN.US)$近期主要分析师观点如下:

此外,综合报道,$Ciena (CIEN.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of