Baidu's Options Frenzy: What You Need to Know

Baidu's Options Frenzy: What You Need to Know

Deep-pocketed investors have adopted a bullish approach towards Baidu (NASDAQ:BIDU), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in BIDU usually suggests something big is about to happen.

深口袋投资者对百度(纳斯达克:买盘)采取了看好的态度,这是市场参与者不应忽视的。本财经媒体对Benzinga的公开期权记录的追踪揭示了今天这一重大举措。这些投资者的身份仍然是未知的,但是在买盘中发生如此重大的变动通常意味着即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 30 extraordinary options activities for Baidu. This level of activity is out of the ordinary.

我们从观察到的信息中获取了这个信息,当Benzinga的期权扫描仪突显出百度30个非凡期权活动时。这种活动水平是不寻常的。

The general mood among these heavyweight investors is divided, with 43% leaning bullish and 33% bearish. Among these notable options, 13 are puts, totaling $635,882, and 17 are calls, amounting to $1,256,485.

这些大手笔投资者中的整体情绪存在分歧,43%倾向看涨,33%倾向看淡。在这些备受关注的期权中,有13个看跌,金额总计为$635,882,有17个看涨,金额总计为$1,256,485。

Expected Price Movements

预期价格波动

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $140.0 for Baidu, spanning the last three months.

经过评估交易量和未平仓合约后,很明显主要市场推动者的焦点是百度的股价在$50.0和$140.0之间的价格区间,跨越了过去三个月。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

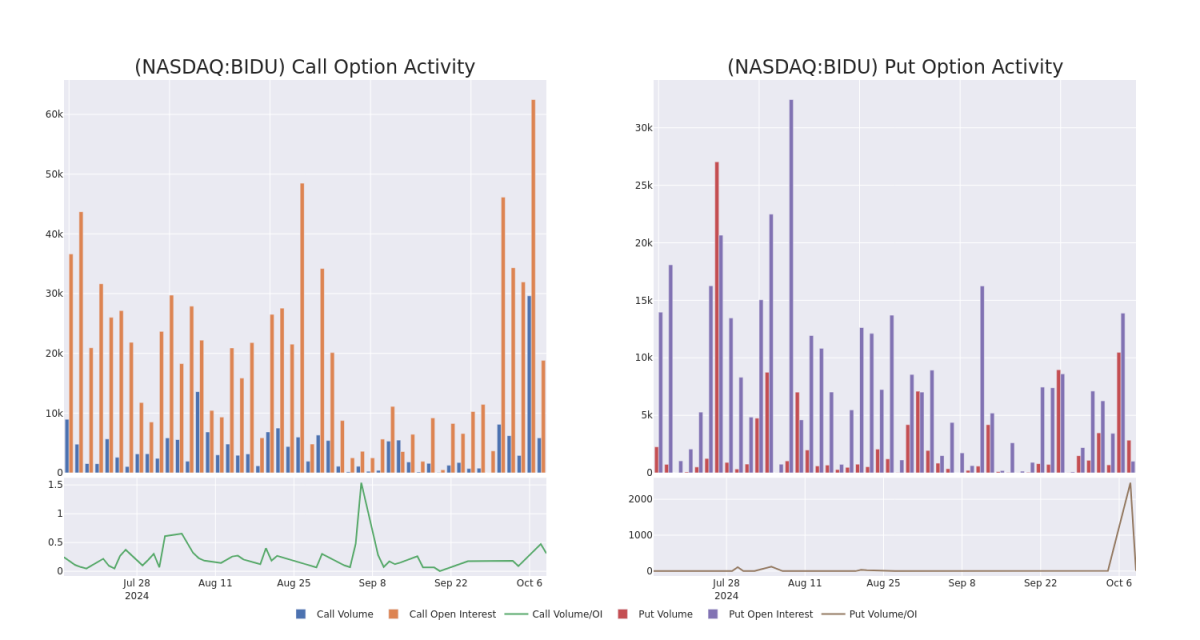

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Baidu's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Baidu's significant trades, within a strike price range of $50.0 to $140.0, over the past month.

检查成交量和未平仓合约可以为股票研究提供关键见解。这些信息对于评估百度在某些行权价格的期权的流动性和兴趣水平至关重要。以下是我们对过去一个月内百度重要交易的看涨和看跌的成交量和未平仓合约趋势的快照。

Baidu Option Activity Analysis: Last 30 Days

百度期权活动分析:过去30天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BIDU | CALL | TRADE | BULLISH | 01/17/25 | $11.5 | $11.3 | $11.5 | $100.00 | $230.0K | 3.1K | 220 |

| BIDU | CALL | SWEEP | NEUTRAL | 12/20/24 | $3.65 | $3.6 | $3.65 | $120.00 | $136.9K | 3.2K | 1.3K |

| BIDU | CALL | SWEEP | BEARISH | 12/20/24 | $3.65 | $3.6 | $3.65 | $120.00 | $107.6K | 3.2K | 1.0K |

| BIDU | CALL | SWEEP | BULLISH | 11/01/24 | $4.7 | $4.7 | $4.7 | $105.00 | $103.8K | 2.0K | 1.5K |

| BIDU | CALL | SWEEP | BEARISH | 12/20/24 | $4.0 | $3.7 | $3.7 | $120.00 | $85.8K | 3.2K | 308 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BIDU | 看涨 | 交易 | 看好 | 01/17/25 | $11.5 | $11.3 | $11.5 | $100.00。 | $230.0K | 3.1K | 220 |

| BIDU | 看涨 | SWEEP | 中立 | 12/20/24 | $3.65 | $3.6 | $3.65 | $120.00 | $136.9千美元 | 3.2K | 1.3K |

| BIDU | 看涨 | SWEEP | 看淡 | 12/20/24 | $3.65 | $3.6 | $3.65 | $120.00 | $107.6K | 3.2K | 1.0K |

| BIDU | 看涨 | SWEEP | 看好 | 11/01/24 | $4.7 | $4.7 | $4.7 | $105.00 | $103.8千美元 | 2.0K | 1.5K |

| BIDU | 看涨 | SWEEP | 看淡 | 12/20/24 | $4.0 | $3.7 | $3.7 | $120.00 | $85.8K | 3.2K | 308 |

About Baidu

关于百度

Baidu is the largest internet search engine in China with over 50% share of the search engine market in 2024 per web analytics firm, Statcounter. The firm generated 72% of core revenue from online marketing services from its search engine in 2023. Outside its search engine, Baidu is a technology-driven company and its other major growth initiatives are artificial intelligence cloud, video streaming services, voice recognition technology, and autonomous driving.

百度是中国最大的互联网搜索引擎,在2024年的搜索引擎市场份额超过50%,根据网络分析公司Statcounter的数据。该公司在2023年从其搜索引擎的在线营销服务中产生了72%的核心收入。除了搜索引擎以外,百度还是一家以技术为驱动的公司,其其他主要增长动力是人工智能云、视频流媒体服务、语音识别技术和自动驾驶。

After a thorough review of the options trading surrounding Baidu, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

经过对百度周边期权交易的彻底审查,我们将转而更详细地审视该公司。这包括对其当前市场地位和表现的评估。

Current Position of Baidu

百度的当前位置

- With a trading volume of 532,182, the price of BIDU is down by -3.35%, reaching $102.46.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 41 days from now.

- 成交量为532,182,BIDU的价格下跌了-3.35%,达到102.46美元。

- 当前RSI值表明该股票可能接近超买状态。

- 下一个财报将于41天后发布。

Professional Analyst Ratings for Baidu

百度的专业分析师评级

1 market experts have recently issued ratings for this stock, with a consensus target price of $100.0.

有1位市场专家最近为该股发出了评级,一致目标价为100.0美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Reflecting concerns, an analyst from HSBC lowers its rating to Hold with a new price target of $100.

Benzinga Edge的飞凡期权板块在市场发生之前发现潜在的市场活跃者。查看大资金在您最喜爱的股票上的持仓。 点击这里进行访问。* 反映了关切,汇丰银行的分析师将评级下调至持有,并制定了100美元的新目标价。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Baidu options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在回报。精明的交易员通过不断学习,调整策略,监控多个因子,并密切关注市场动向来管理这些风险。通过Benzinga Pro的实时警报随时了解最新的百度期权交易。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $140.0 for Baidu, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $140.0 for Baidu, spanning the last three months.