A Closer Look at Salesforce's Options Market Dynamics

A Closer Look at Salesforce's Options Market Dynamics

Investors with a lot of money to spend have taken a bearish stance on Salesforce (NYSE:CRM).

持有大量资金的投资者看淡赛富时 (纽交所:CRM)。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CRM, it often means somebody knows something is about to happen.

无论这些投资者是机构还是富人,我们不得而知。但当CRM发生这样的大事情时,通常意味着有人知道即将发生什么。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 8 uncommon options trades for Salesforce.

今天,Benzinga的期权扫描器发现了8笔赛富时的不寻常期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 25% bullish and 50%, bearish.

这些大额交易者的总体情绪分为25%看好和50%看淡。

Out of all of the special options we uncovered, 2 are puts, for a total amount of $61,226, and 6 are calls, for a total amount of $306,449.

在所有我们发现的特殊期权中,有2个看跌期权,总金额为$61,226,有6个看涨期权,总金额为$306,449。

What's The Price Target?

目标价是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $250.0 to $340.0 for Salesforce over the last 3 months.

考虑到这些合同的成交量和未平仓合约,过去3个月来,鲸鱼一直在瞄准Salesforce的价格区间,范围从$250.0到$340.0。

Insights into Volume & Open Interest

成交量和持仓量分析

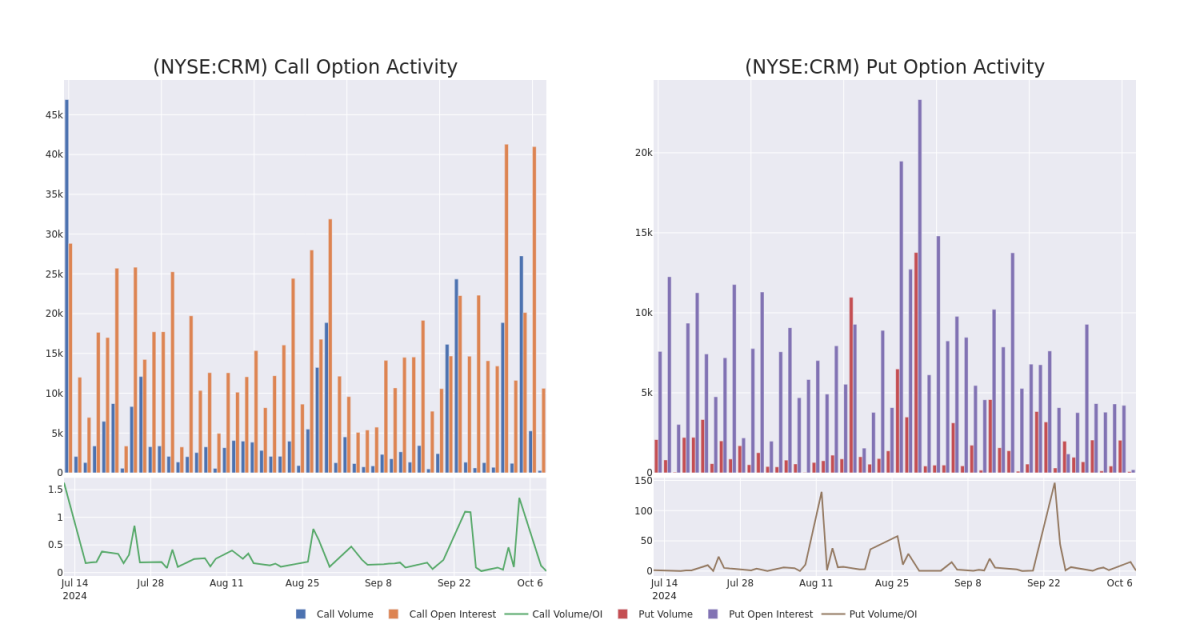

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Salesforce's options for a given strike price.

这些数据可以帮助您跟踪给定执行价格下Salesforce期权的流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Salesforce's whale activity within a strike price range from $250.0 to $340.0 in the last 30 days.

下面,我们可以观察在过去30天里,销售强手活动中所有赛富时的看涨和看跌期权的成交量和未平仓合约的演变,相应地,罢工价格范围为$250.0至$340.0。

Salesforce 30-Day Option Volume & Interest Snapshot

Salesforce 30天期权成交量和持仓量摘要

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | CALL | SWEEP | BULLISH | 09/19/25 | $20.2 | $19.3 | $20.05 | $340.00 | $98.2K | 159 | 77 |

| CRM | CALL | TRADE | NEUTRAL | 10/18/24 | $12.7 | $12.15 | $12.39 | $280.00 | $61.9K | 4.2K | 52 |

| CRM | CALL | TRADE | BEARISH | 11/01/24 | $43.45 | $41.55 | $42.1 | $250.00 | $42.1K | 39 | 10 |

| CRM | CALL | TRADE | BULLISH | 09/19/25 | $20.25 | $19.35 | $20.05 | $340.00 | $40.1K | 159 | 117 |

| CRM | PUT | TRADE | BEARISH | 11/08/24 | $6.35 | $5.95 | $6.35 | $285.00 | $34.9K | 122 | 66 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | 看涨 | SWEEP | 看好 | 09/19/25 | $20.2 | $19.3 | 20.05美元 | $340.00 | 98.2K美元 | 159 | 77 |

| CRM | 看涨 | 交易 | 中立 | 10/18/24 | $12.7 | $12.15 | $12.39 | $280.00 | $61.9K | 4.2千 | |

| CRM | 看涨 | 交易 | 看淡 | 11/01/24 | $43.45 | $41.55 | $42.1 | $250.00 | $42.1K | 39 | 10 |

| CRM | 看涨 | 交易 | 看好 | 09/19/25 | $20.25 | $19.35 | 20.05美元 | $340.00 | $40.1K | 159 | 117 |

| CRM | 看跌 | 交易 | 看淡 | 11/08/24 | $ 6.35 | $5.95 | $ 6.35 | $285.00 | ¥34.9K | 122 | 66 |

About Salesforce

关于赛富时

Salesforce provides enterprise cloud computing solutions. The company offers customer relationship management technology that brings companies and customers together. Its Customer 360 platform helps the group to deliver a single source of truth, connecting customer data across systems, apps, and devices to help companies sell, service, market, and conduct commerce. It also offers Service Cloud for customer support, Marketing Cloud for digital marketing campaigns, Commerce Cloud as an e-commerce engine, the Salesforce Platform, which allows enterprises to build applications, and other solutions, such as MuleSoft for data integration.

赛富时提供企业级云计算解决方案。该公司提供客户关系管理技术,将公司和客户联系在一起。其客户360平台帮助集团提供单一的数据来源,连接客户数据跨系统、应用和设备,帮助公司销售、服务、市场和开展商业。它还为客户支持提供服务云,为数字营销活动提供营销云,作为电子商务引擎的商业云,提供赛富时平台,以允许企业构建应用程序和其他解决方案,例如用于数据集成的MuleSoft。

Where Is Salesforce Standing Right Now?

赛富时目前处于什么位置?

- With a volume of 514,628, the price of CRM is down -1.09% at $288.39.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 49 days.

- CRm的成交量为514,628,价格下跌-1.09%,报288.39美元。

- RSI因子暗示底层股票可能被超买。

- 下一次盈利预计在49天内发布。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期权异动模块可以提前发现潜在的市场热点。了解大笔的资金在您喜欢的股票上的仓位变动。点击这里获取访问权限。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Salesforce with Benzinga Pro for real-time alerts.

交易期权涉及更大风险,但也有更高利润的潜力。精明的交易员通过持续的教育、战略交易调整、利用各种指标,并保持对市场动态的敏锐感来降低这些风险。通过使用Benzinga Pro及时获得关于Salesforce的最新期权交易,以获取实时提醒。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CRM, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CRM, it often means somebody knows something is about to happen.