Market Whales and Their Recent Bets on Procter & Gamble Options

Market Whales and Their Recent Bets on Procter & Gamble Options

Financial giants have made a conspicuous bearish move on Procter & Gamble. Our analysis of options history for Procter & Gamble (NYSE:PG) revealed 8 unusual trades.

金融巨头在普葛收购上采取了明显的看淡举动。我们对普葛(纽交所:PG)的期权历史进行分析,发现有8笔异常交易。

Delving into the details, we found 37% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $64,067, and 6 were calls, valued at $265,953.

深入细节,我们发现37%的交易者看好,而62%表现出看淡倾向。在我们发现的所有交易中,有2笔看跌交易,价值为$64,067,有6笔看涨交易,价值为$265,953。

Predicted Price Range

预测价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $150.0 and $175.0 for Procter & Gamble, spanning the last three months.

在评估了成交量和持仓量之后,显而易见,主要的市场搅局者都把焦点放在普葛的股价区间在$150.0和$175.0之间,涵盖了过去三个月的时间。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

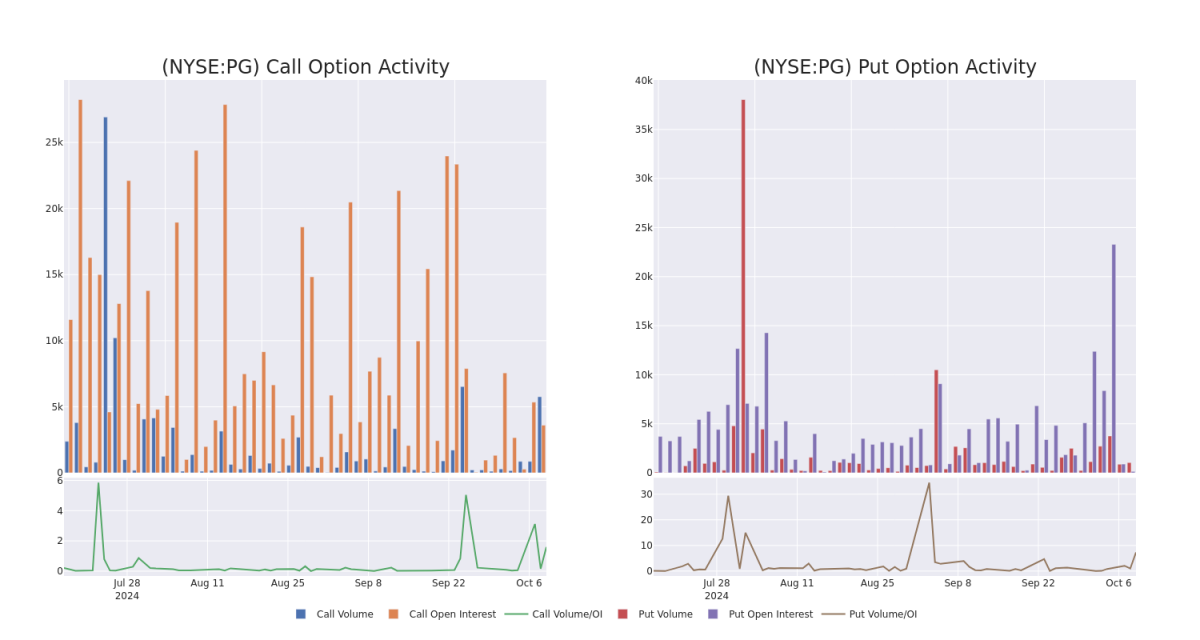

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Procter & Gamble's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Procter & Gamble's significant trades, within a strike price range of $150.0 to $175.0, over the past month.

审视成交量和持仓量可为股票研究提供关键见解。这些信息是衡量普葛的期权在特定行权价上的流动性和兴趣水平的关键。下面,我们为您呈现了过去一个月内普葛重要交易的成交量和持仓量趋势快照,涵盖了$150.0到$175.0的行权价范围。

Procter & Gamble Call and Put Volume: 30-Day Overview

宝洁公司看涨和看跌期权成交量:30天概述

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PG | CALL | SWEEP | BULLISH | 12/20/24 | $20.85 | $20.5 | $20.8 | $150.00 | $66.5K | 89 | 34 |

| PG | CALL | SWEEP | BEARISH | 10/25/24 | $0.97 | $0.96 | $0.96 | $175.00 | $65.2K | 532 | 879 |

| PG | CALL | TRADE | BEARISH | 12/20/24 | $5.45 | $5.3 | $5.35 | $170.00 | $39.0K | 2.2K | 161 |

| PG | CALL | SWEEP | BEARISH | 10/25/24 | $1.03 | $0.94 | $0.94 | $175.00 | $37.4K | 532 | 2.1K |

| PG | PUT | SWEEP | BULLISH | 04/17/25 | $2.33 | $2.32 | $2.32 | $150.00 | $36.4K | 143 | 638 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PG | 看涨 | SWEEP | 看好 | 12/20/24 | $20.85 | $20.5 | $20.8 | $150.00 | $66.5K | 89 | 34 |

| PG | 看涨 | SWEEP | 看淡 | 10/25/24 | $0.97 | 0.96美元 | 0.96美元 | $175.00 | $65.2K | 532 | 879 |

| PG | 看涨 | 交易 | 看淡 | 12/20/24 | $5.45 | $5.3 | $5.35 | $170.00 | $39.0K | 2.2K | 161 |

| PG | 看涨 | SWEEP | 看淡 | 10/25/24 | $1.03 | $0.94 | $0.94 | $175.00 | 37,400美元 | 532 | 2.1K |

| PG | 看跌 | SWEEP | 看好 | 04/17/25 | $2.33 | $2.32 | $2.32 | $150.00 | 成交量: $36.4K | 143 | 638 |

About Procter & Gamble

关于宝洁公司

Since its founding in 1837, Procter & Gamble has become one of the world's largest consumer product manufacturers, generating more than $80 billion in annual sales. It operates with a lineup of leading brands, including more than 20 that generate north of $1 billion each in annual global sales, such as Tide laundry detergent, Charmin toilet paper, Pantene shampoo, and Pampers diapers. Sales outside its home turf represent more than half of the firm's consolidated total.

自1837年创立以来,Procter&Gamble已成为世界上最大的消费品制造商之一,年销售额超过800亿美元。公司经营着一系列领先品牌,包括超过20个品牌的全球年销售额均超过10亿美元,例如Tide洗衣粉、Charmin卫生纸、Pantene洗发水和Pampers纸尿裤。公司在国外的销售额占其总销售额的一半以上。

After a thorough review of the options trading surrounding Procter & Gamble, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在全面审视宝洁(Procter & Gamble)周边期权交易之后,我们将深入研究该公司。这包括对它当前的市场地位和业绩的评估。

Current Position of Procter & Gamble

宝洁公司的当前持仓

- Currently trading with a volume of 3,925,689, the PG's price is up by 0.59%, now at $169.15.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 9 days.

- 目前交易量为3,925,689,PG的价格上涨了0.59%,目前为169.15美元。

- RSI读数表明该股票目前处于中立状态,处于超买和超卖之间。

- 预计发布收益报告还有9天。

Expert Opinions on Procter & Gamble

关于宝洁(Procter & Gamble)的专家意见

3 market experts have recently issued ratings for this stock, with a consensus target price of $174.33333333333334.

3位市场专家最近对这只股票发出了评级,一致目标价为174.33333333333334美元。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Procter & Gamble, targeting a price of $186. * Reflecting concerns, an analyst from Piper Sandler lowers its rating to Neutral with a new price target of $174.* In a cautious move, an analyst from Barclays downgraded its rating to Equal-Weight, setting a price target of $163.

20年期期权交易专家透露了他的一线图表技术,显示何时买入和卖出。复制他的交易,平均每20天获利27%。单击此处进行访问。* 派杰投资的分析师坚持维持看好评级,目标价为186美元。* 反映担忧,派杰投资的分析师将评级调降为中立,设定新的目标价174美元。* 巴克莱银行的分析师采取谨慎举措,将评级下调为中性,设定目标价163美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Procter & Gamble's options at certain strike prices. Below, we present a snapshot of the

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Procter & Gamble's options at certain strike prices. Below, we present a snapshot of the