Wells Fargo's Options Frenzy: What You Need to Know

Wells Fargo's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bullish stance on Wells Fargo.

有大量资金可以花的鲸鱼对富国银行采取了明显的看涨立场。

Looking at options history for Wells Fargo (NYSE:WFC) we detected 21 trades.

查看富国银行(纽约证券交易所代码:WFC)的期权历史记录,我们发现了21笔交易。

If we consider the specifics of each trade, it is accurate to state that 61% of the investors opened trades with bullish expectations and 33% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,61%的投资者以看涨的预期开启交易,33%的投资者持看跌预期。

From the overall spotted trades, 17 are puts, for a total amount of $1,337,985 and 4, calls, for a total amount of $191,597.

在已发现的全部交易中,有17笔是看跌期权,总额为1,337,985美元,4笔看涨期权,总额为191,597美元。

What's The Price Target?

目标价格是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $70.0 for Wells Fargo during the past quarter.

分析这些合约的交易量和未平仓合约,看来大型企业一直在关注富国银行在过去一个季度的价格范围从50.0美元到70.0美元不等。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

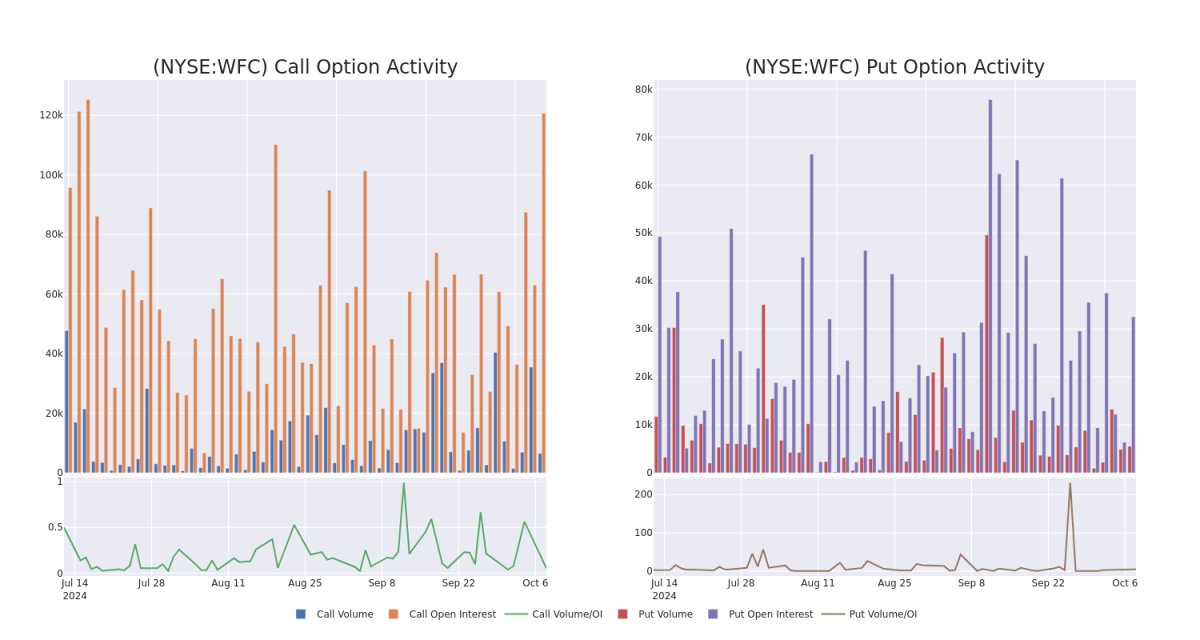

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Wells Fargo's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Wells Fargo's whale trades within a strike price range from $50.0 to $70.0 in the last 30 days.

交易期权时,查看交易量和未平仓合约是一个强有力的举动。这些数据可以帮助您跟踪富国银行期权在给定行使价下的流动性和利息。下面,我们可以观察到过去30天中富国银行所有鲸鱼交易的看涨和看跌期权交易量和未平仓合约的变化,其行使价在50.0美元至70.0美元之间。

Wells Fargo Call and Put Volume: 30-Day Overview

富国银行看涨期权和看跌期权交易量:30天概述

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | PUT | SWEEP | BULLISH | 07/18/25 | $9.95 | $9.85 | $9.85 | $65.00 | $206.8K | 72 | 35 |

| WFC | PUT | SWEEP | BULLISH | 04/17/25 | $13.35 | $13.25 | $13.25 | $70.00 | $193.4K | 2 | 121 |

| WFC | PUT | SWEEP | BULLISH | 03/21/25 | $11.1 | $11.0 | $11.0 | $67.50 | $188.1K | 382 | 328 |

| WFC | PUT | SWEEP | BULLISH | 02/21/25 | $13.25 | $13.1 | $13.1 | $70.00 | $157.2K | 0 | 121 |

| WFC | PUT | SWEEP | BULLISH | 03/21/25 | $11.1 | $11.0 | $11.0 | $67.50 | $119.9K | 382 | 157 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | 放 | 扫 | 看涨 | 07/18/25 | 9.95 美元 | 9.85 美元 | 9.85 美元 | 65.00 美元 | 206.8 万美元 | 72 | 35 |

| WFC | 放 | 扫 | 看涨 | 04/17/25 | 13.35 美元 | 13.25 美元 | 13.25 美元 | 70.00 美元 | 193.4 万美元 | 2 | 121 |

| WFC | 放 | 扫 | 看涨 | 03/21/25 | 11.1 | 11.0 美元 | 11.0 美元 | 67.50 美元 | 188.1 万美元 | 382 | 328 |

| WFC | 放 | 扫 | 看涨 | 02/21/25 | 13.25 美元 | 13.1 美元 | 13.1 美元 | 70.00 美元 | 157.2 万美元 | 0 | 121 |

| WFC | 放 | 扫 | 看涨 | 03/21/25 | 11.1 | 11.0 美元 | 11.0 美元 | 67.50 美元 | 119.9 万美元 | 382 | 157 |

About Wells Fargo

关于富国银行

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company has four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management. It is almost entirely focused on the U.S.

富国银行是美国最大的银行之一,拥有约1.9万亿美元的资产负债表资产。该公司有四个主要部门:个人银行、商业银行、企业和投资银行以及财富和投资管理。它几乎完全集中在美国

Where Is Wells Fargo Standing Right Now?

富国银行现在的立场在哪里?

- With a volume of 4,180,144, the price of WFC is up 0.14% at $57.38.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 2 days.

- WFC的交易量为4,180,144美元,上涨0.14%,至57.38美元。

- RSI指标暗示标的股票可能接近超买。

- 下一份财报预计将在2天后公布。

Professional Analyst Ratings for Wells Fargo

富国银行的专业分析师评级

4 market experts have recently issued ratings for this stock, with a consensus target price of $66.25.

4位市场专家最近发布了该股的评级,共识目标价为66.25美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到不寻常的期权活动:智能货币在移动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Evercore ISI Group persists with their Outperform rating on Wells Fargo, maintaining a target price of $68. * An analyst from Morgan Stanley persists with their Overweight rating on Wells Fargo, maintaining a target price of $67. * An analyst from Wolfe Research has elevated its stance to Outperform, setting a new price target at $65. * Maintaining their stance, an analyst from Goldman Sachs continues to hold a Buy rating for Wells Fargo, targeting a price of $65.

Benzinga Edge的不寻常期权委员会在潜在的市场推动者发生之前就发现了它们。看看大笔资金对你最喜欢的股票持有哪些头寸。点击此处查看。* Evercore ISI Group的一位分析师坚持对富国银行的跑赢大盘评级,将目标价维持在68美元。* 摩根士丹利的一位分析师坚持对富国银行的增持评级,维持67美元的目标价。* 沃尔夫研究的一位分析师已将其立场上调至跑赢大盘,将新的目标股价定为65美元。* 高盛的一位分析师继续坚持自己的立场富国银行的买入评级,目标价为65美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。

From the overall spotted trades, 17 are puts, for a total amount of $1,337,985 and 4, calls, for a total amount of $191,597.

From the overall spotted trades, 17 are puts, for a total amount of $1,337,985 and 4, calls, for a total amount of $191,597.