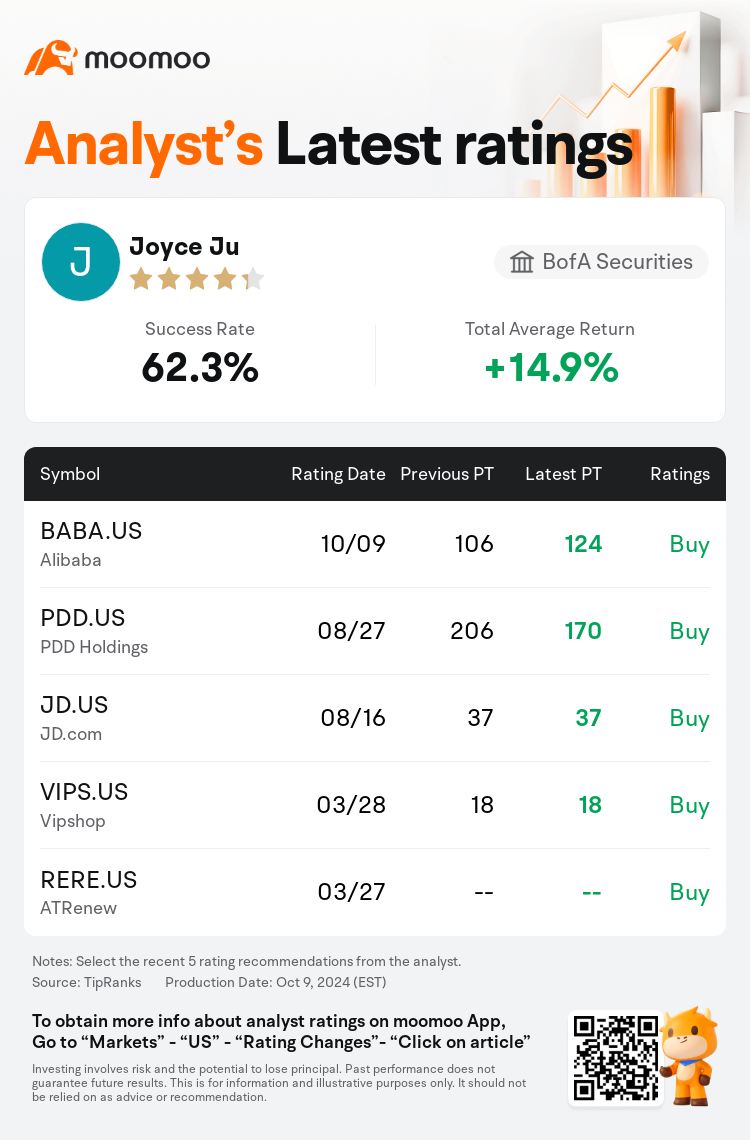

BofA Securities analyst Joyce Ju maintains $Alibaba (BABA.US)$ with a buy rating, and adjusts the target price from $106 to $124.

According to TipRanks data, the analyst has a success rate of 62.3% and a total average return of 14.9% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Alibaba (BABA.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Alibaba (BABA.US)$'s main analysts recently are as follows:

Expectations are set for Alibaba to unveil its fiscal Q2 results in the upcoming early to mid-November period, with predictions indicating a 6% year-over-year increase in total revenue. It's anticipated that core Taobao Tmall revenue will remain relatively unchanged compared to the previous year. Projections suggest a modest 1.8% year-over-year rise in China marketplaces' customer management revenue, predicated on a mid-single digit percentage expansion in gross merchandise value (GMV) coupled with a slight decrease in the blended take rate.

A conservative stance is being maintained on Alibaba due to subdued consumer spending and ongoing reinvestments that are expected to continue impacting earnings. It's anticipated that Alibaba's Gross Merchandise Value will show an increase of 4%-5% year over year, compared to the higher single digits seen in the previous quarter. There's also an expectation of a quicker growth in customer management revenue, around 2%-3%, which is an improvement from the 0.6% growth in the prior quarter, potentially driven by software service fees.

It is anticipated that Alibaba's fiscal second-quarter performance at key divisions such as Taobao and Tmall Group may be impacted by a challenging consumption climate. Nonetheless, it is advised that investors look past these results in anticipation of potential positive developments in subsequent quarters. When comparing current valuation metrics, such as forward PE multiples, among the 'big 3' in China's e-commerce sector (which includes Alibaba, PDD Holdings, and JD.com), it is believed that Alibaba presents the most compelling investment opportunity.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美银证券分析师Joyce Ju维持$阿里巴巴 (BABA.US)$买入评级,并将目标价从106美元上调至124美元。

根据TipRanks数据显示,该分析师近一年总胜率为62.3%,总平均回报率为14.9%。

此外,综合报道,$阿里巴巴 (BABA.US)$近期主要分析师观点如下:

此外,综合报道,$阿里巴巴 (BABA.US)$近期主要分析师观点如下:

预计阿里巴巴将在即将到来的11月初至中旬公布其第二财季业绩,预计总收入将同比增长6%。预计淘宝天猫的核心收入与去年相比将保持相对不变。预测显示,中国市场的客户管理收入同比略有增长1.8%,前提是商品总值(GMV)的中等个位数百分比增长,加上混合收取率略有下降。

由于消费者支出疲软和持续的再投资预计将继续影响收益,阿里巴巴一直保持保守立场。预计阿里巴巴的商品总值将同比增长4%-5%,而上一季度的个位数较高。还有人预计,客户管理收入将更快地增长,约为2%-3%,较上一季度的0.6%有所改善,这可能是由软件服务费推动的。

预计阿里巴巴第二财季在淘宝和天猫集团等关键部门的业绩可能会受到充满挑战的消费环境的影响。尽管如此,建议投资者忽略这些业绩,以期在接下来的几个季度中可能出现积极的进展。在比较中国电子商务行业 “三巨头”(包括阿里巴巴、PDD Holdings和京东)中当前的估值指标,例如远期市盈倍数时,可以认为阿里巴巴提供了最具吸引力的投资机会。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$阿里巴巴 (BABA.US)$近期主要分析师观点如下:

此外,综合报道,$阿里巴巴 (BABA.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of