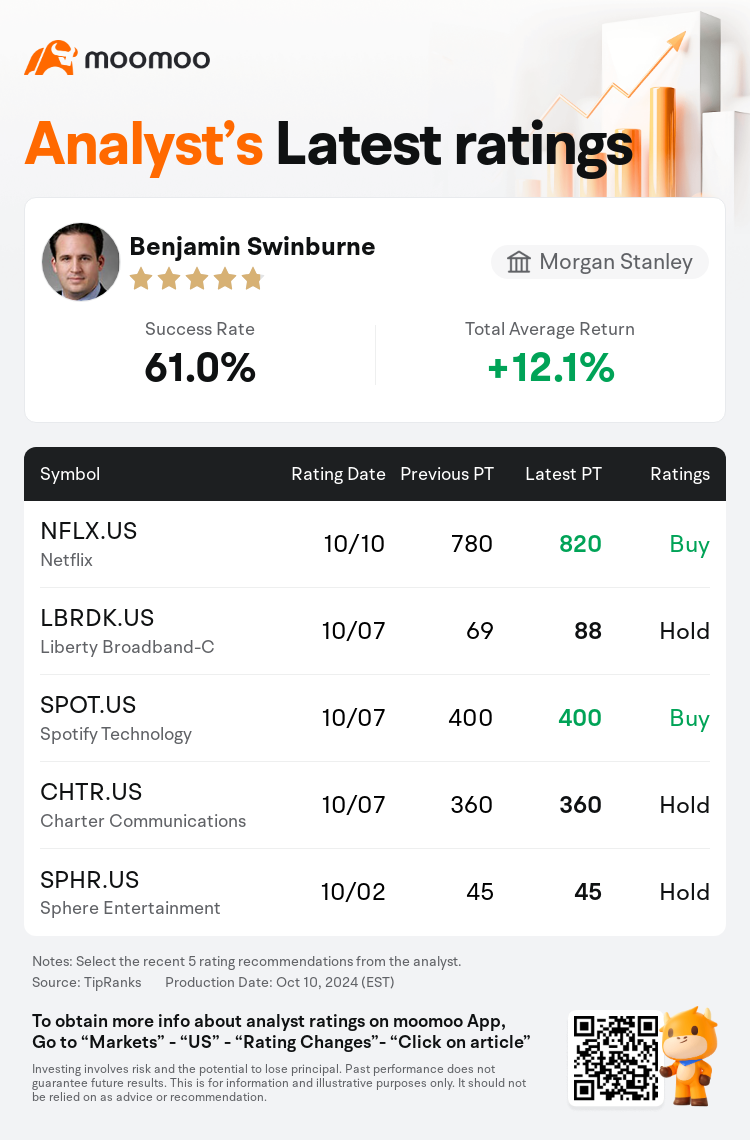

Morgan Stanley analyst Benjamin Swinburne maintains $Netflix (NFLX.US)$ with a buy rating, and adjusts the target price from $780 to $820.

According to TipRanks data, the analyst has a success rate of 61.0% and a total average return of 12.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Netflix (NFLX.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Netflix (NFLX.US)$'s main analysts recently are as follows:

The 'new normal' in Hollywood appears to benefit Netflix, with less intense competition for content and studios being more amenable to licensing. The introduction of an advertising tier is seen as a potential way to further maximize revenues, possibly expanding the total addressable market rather than just enhancing average revenue per member. Projections for Q3 net additions are estimated at 4 to 4.5 million, which may be on the lower side, with expectations of 8 to 9 million for Q4.

Netflix is viewed as a robust growth narrative with substantial potential for increased revenue, earnings, and free cash flow in the coming years. Nevertheless, there's an assessment that the stock's current valuation may not allow for further multiple expansion and might actually shrink as growth decelerates approaching 2025, owing to a diminishing temporary boost in net additions from paid sharing. It's believed that Netflix continued to experience an uptick in subscriber numbers due to paid sharing in the third quarter, though the temporary advantages of this are expected to taper off. The estimate for third-quarter net additions was raised based on these expectations.

With the stock up 13% since the second quarter results, which was bolstered by positive subscriber data from third parties, it is anticipated that Netflix will need to deliver robust results and forecasts, in addition to announcing a price hike, to maintain momentum. Previously, a hike in the Premium tier price was introduced in various regions including the U.S., U.K., and France. It is now projected that there will be an increase in the Premium tier's pricing in other regions as well, with a significant 8%-15% rise expected for the Standard plan. Since there has been no Standard price increase since January 2022, the current pricing stands at a narrow 4% premium compared to peers, significantly lower than the 53% recorded previously. Additionally, the strong viewership in the third quarter and an impressive content lineup for the fourth quarter, featuring NFL, are likely to further mitigate the risk of subscriber churn.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

摩根士丹利分析师Benjamin Swinburne维持$奈飞 (NFLX.US)$买入评级,并将目标价从780美元上调至820美元。

根据TipRanks数据显示,该分析师近一年总胜率为61.0%,总平均回报率为12.1%。

此外,综合报道,$奈飞 (NFLX.US)$近期主要分析师观点如下:

此外,综合报道,$奈飞 (NFLX.US)$近期主要分析师观点如下:

好莱坞的 “新常态” 似乎使Netflix受益,内容竞争不那么激烈,制片厂更愿意获得许可。引入广告等级被视为进一步实现收入最大化的潜在途径,这可能会扩大总体潜在市场,而不仅仅是提高每位会员的平均收入。预计第三季度净增量为4至450万,可能较低,第四季度预计为8至900万。

Netflix被视为强劲的增长故事,在未来几年具有增加收入、收益和自由现金流的巨大潜力。尽管如此,有评估认为,该股目前的估值可能不允许进一步的多次扩张,并且实际上可能会随着增长在接近2025年时减速而萎缩,这是由于付费共享带来的净增加量逐渐减少。据信,由于付费共享,Netflix的订阅人数在第三季度继续增加,尽管其临时优势预计将逐渐减弱。根据这些预期,提高了对第三季度净增量的估计。

自第二季度业绩公布以来,该股上涨了13%,这得益于第三方的积极订户数据,预计Netflix除了宣布涨价外,还需要提供强劲的业绩和预测以保持势头。此前,包括美国、英国和法国在内的各个地区都提高了高级套餐的价格。现在预计其他地区的高级套餐价格也将上涨,预计标准套餐的价格将大幅上涨8%-15%。由于自2022年1月以来标准价格没有上涨,因此与同行相比,目前的溢价仅为4%,大大低于之前的53%。此外,第三季度的强劲收视率和以NFL为主角的第四季度令人印象深刻的内容阵容可能会进一步降低订户流失的风险。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$奈飞 (NFLX.US)$近期主要分析师观点如下:

此外,综合报道,$奈飞 (NFLX.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of