BofA Securities analyst Grace Carter maintains $The Baldwin Insurance Group (BWIN.US)$ with a buy rating, and sets the target price at $59.

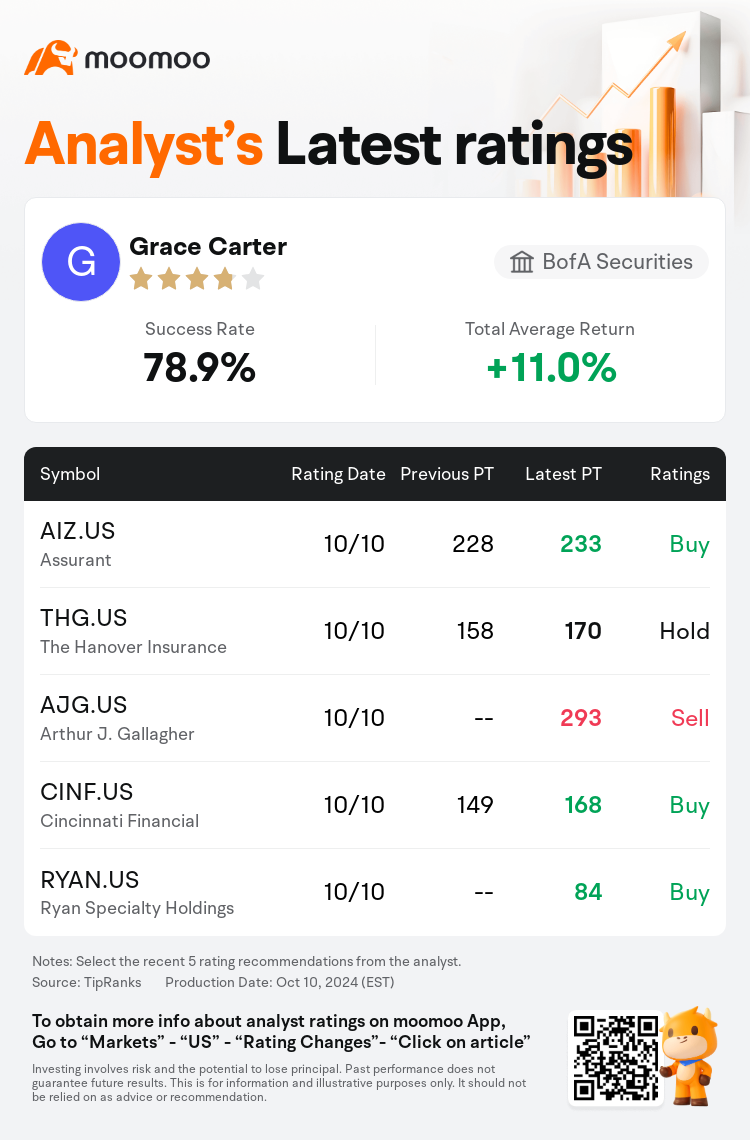

According to TipRanks data, the analyst has a success rate of 78.9% and a total average return of 11.0% over the past year.

Furthermore, according to the comprehensive report, the opinions of $The Baldwin Insurance Group (BWIN.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $The Baldwin Insurance Group (BWIN.US)$'s main analysts recently are as follows:

Insurance brokers maintain a generally optimistic outlook for 2024 organic growth prospects. Large-cap broker organic growth is anticipated to stay above average in the third quarter. Nonetheless, it's projected that the sector's underlying growth will decelerate to align with long-term averages in the years 2025 to 2026. Changes in expectations for the group are informed by occurrences during the quarter and the overall market's P/E multiple expansion.

The fundamental outlook for the property and casualty sector is positive looking into the third-quarter reports. However, optimistic expectations, bullish sentiment, and current valuations moderate the perspective on the stocks. Key advantages include continued firm pricing and a defensive risk profile within the group. Nevertheless, the expectations for margins at underwriters and sales growth at brokers appear to be on the higher side.

The performance of the Baldwin Group in Q3, particularly among reinsurers, might be influenced by this week's Hurricane Milton. There is a positive outlook on the Personal segment due to improving margins and growth in policies-in-force. It is anticipated that Q3 catastrophe losses will remain below the five-year seasonal average, yet they could surpass those of the same quarter in the previous year. This might present challenges for primary insurers looking ahead.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美银证券分析师Grace Carter维持$The Baldwin Insurance Group (BWIN.US)$买入评级,目标价59美元。

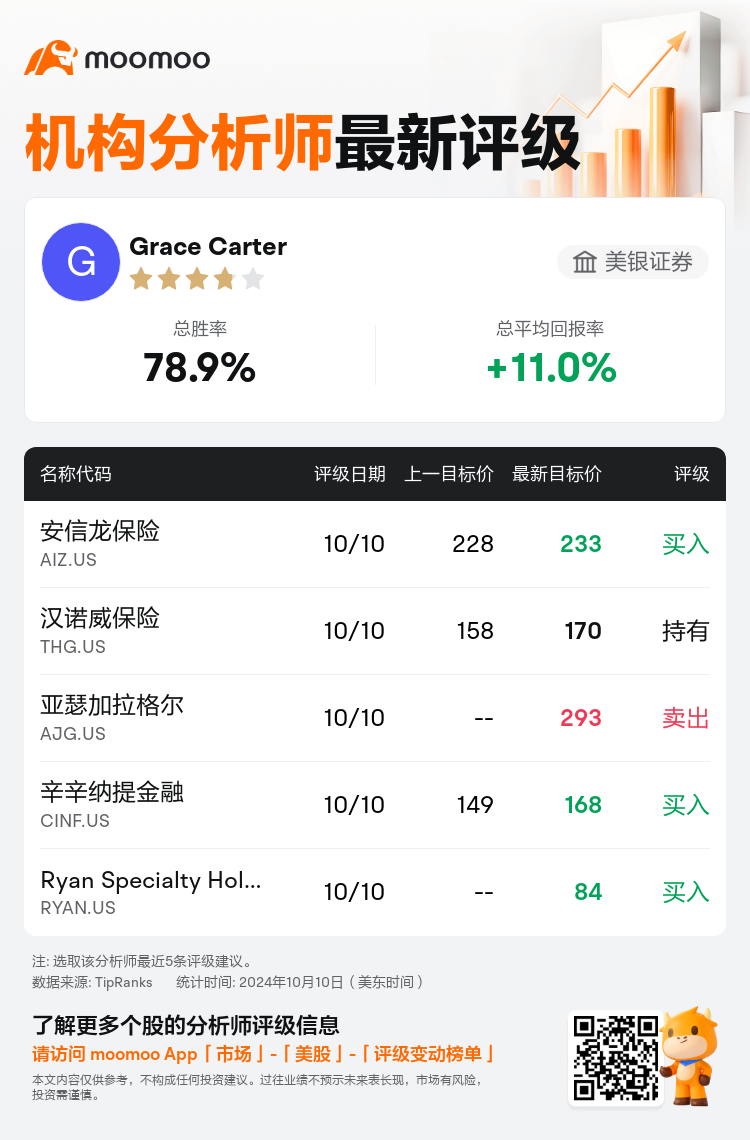

根据TipRanks数据显示,该分析师近一年总胜率为78.9%,总平均回报率为11.0%。

此外,综合报道,$The Baldwin Insurance Group (BWIN.US)$近期主要分析师观点如下:

此外,综合报道,$The Baldwin Insurance Group (BWIN.US)$近期主要分析师观点如下:

保险经纪人对2024年的有机增长前景普遍保持乐观的前景。预计第三季度大型经纪商的有机增长将保持在平均水平以上。尽管如此,预计该行业的潜在增长将在2025年至2026年期间减速,与长期平均水平保持一致。该集团预期的变化是由本季度发生的事件以及整个市场的市盈倍数扩张所致。

从第三季度报告来看,财产和意外伤害行业的基本前景乐观。但是,乐观的预期、看涨情绪和当前的估值缓和了对股票的前景。主要优势包括持续的公司定价和集团内部的防御性风险状况。尽管如此,对承销商利润率和经纪商销售增长的预期似乎更高。

宝德威集团第三季度的表现,尤其是再保险公司的表现,可能会受到本周飓风米尔顿的影响。由于利润率的提高和现行政策的增长,个人细分市场前景乐观。预计第三季度的灾难损失将保持在五年季节性平均水平以下,但可能会超过去年同期的水平。展望未来,这可能会给初级保险公司带来挑战。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$The Baldwin Insurance Group (BWIN.US)$近期主要分析师观点如下:

此外,综合报道,$The Baldwin Insurance Group (BWIN.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of