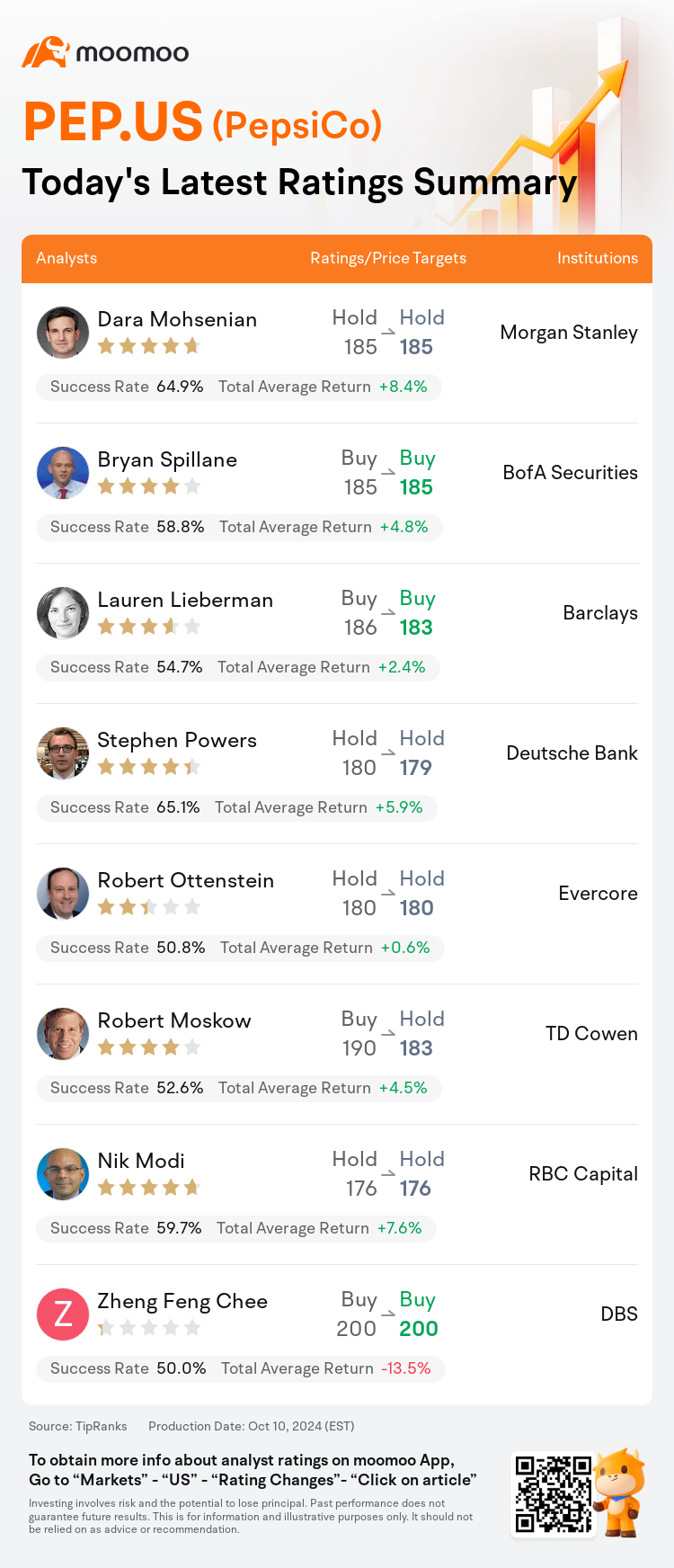

On Oct 10, major Wall Street analysts update their ratings for $PepsiCo (PEP.US)$, with price targets ranging from $176 to $200.

Morgan Stanley analyst Dara Mohsenian maintains with a hold rating, and maintains the target price at $185.

BofA Securities analyst Bryan Spillane maintains with a buy rating, and maintains the target price at $185.

Barclays analyst Lauren Lieberman maintains with a buy rating, and adjusts the target price from $186 to $183.

Barclays analyst Lauren Lieberman maintains with a buy rating, and adjusts the target price from $186 to $183.

Deutsche Bank analyst Stephen Powers maintains with a hold rating, and adjusts the target price from $180 to $179.

Evercore analyst Robert Ottenstein maintains with a hold rating, and maintains the target price at $180.

Furthermore, according to the comprehensive report, the opinions of $PepsiCo (PEP.US)$'s main analysts recently are as follows:

The overarching perspective on PepsiCo remains firmly positive, with expectations still set for a 7% earnings growth by 2024, alongside a profit performance next year that may modestly trail the anticipated trajectory.

Exiting Q3, PepsiCo appears to be set up to conclude fiscal 2024 with near-term earnings 'firmly intact,' though the sales momentum is now more subdued than earlier anticipated. It is suggested that the 'bad news' appears to be accounted for and the stock may offer a 'free option' if U.S. consumption data responds positively to further demand-stimulating efforts from the company throughout the remainder of fiscal 2024.

Following PepsiCo's Q3 report, there was an update to the company's model. The stock's post-report performance exceeded expectations, driven by the company's confirmation of its earnings growth guidance and a reversal of previous market skepticism.

The perspective on PepsiCo as a leading consumer packaged goods company remains intact, yet there is a belief that the 'aggressive pricing' strategy in its three largest U.S. categories may have pushed the value proposition too far, potentially impacting the company's short-term pricing leverage. Consequently, expectations for PepsiCo's organic growth have been moderated to 1.9% for fiscal 2024 and 3% for fiscal 2025, which falls short of the company's projected growth rate of 4%-6%.

Here are the latest investment ratings and price targets for $PepsiCo (PEP.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

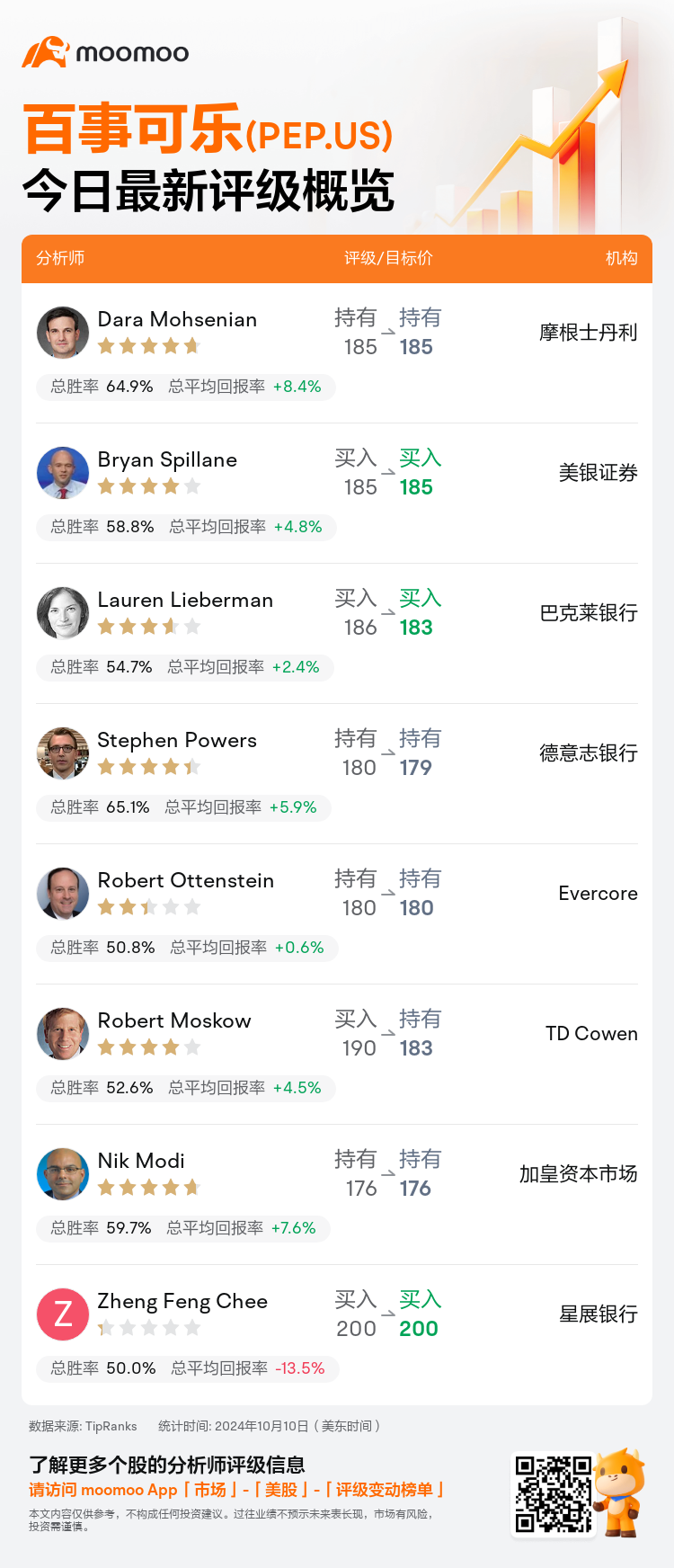

美东时间10月10日,多家华尔街大行更新了$百事可乐 (PEP.US)$的评级,目标价介于176美元至200美元。

摩根士丹利分析师Dara Mohsenian维持持有评级,维持目标价185美元。

美银证券分析师Bryan Spillane维持买入评级,维持目标价185美元。

巴克莱银行分析师Lauren Lieberman维持买入评级,并将目标价从186美元下调至183美元。

巴克莱银行分析师Lauren Lieberman维持买入评级,并将目标价从186美元下调至183美元。

德意志银行分析师Stephen Powers维持持有评级,并将目标价从180美元下调至179美元。

Evercore分析师Robert Ottenstein维持持有评级,维持目标价180美元。

此外,综合报道,$百事可乐 (PEP.US)$近期主要分析师观点如下:

百事可乐的总体观点仍然非常积极,预计到2024年仍将保持7%的盈利增长,明年的利润表现可能会略低于预期轨迹。

进入第三季度,百事可乐似乎已准备好在2024财年结束时实现近期盈利'牢固完整',尽管销售势头现在比之前预期的更为疲软。有人建议,'坏消息'似乎已经被考虑在内,如果美国消费数据对公司在2024财年剩余时间内的进一步需求刺激措施做出积极回应,则该股票可能提供一个'免费选择权'。

在百事可乐发布第三季度报告后,公司的模型进行了更新。股票报告后的表现超出了预期,这是由于公司确认了其盈利增长指引以及对之前市场怀疑的扭转。

对百事可乐作为领先的包装消费品公司的观点仍然完整,然而有人认为其在三个最大的美国类别中进行的'激进定价'策略可能已经推动价值主张过分,可能影响公司的短期定价杠杆。因此,对于百事可乐的有机增长预期已经被调整为2024财年为1.9%,2025财年为3%,这低于公司预期的增长率4%-6%。

以下为今日8位分析师对$百事可乐 (PEP.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

巴克莱银行分析师Lauren Lieberman维持买入评级,并将目标价从186美元下调至183美元。

巴克莱银行分析师Lauren Lieberman维持买入评级,并将目标价从186美元下调至183美元。

Barclays analyst Lauren Lieberman maintains with a buy rating, and adjusts the target price from $186 to $183.

Barclays analyst Lauren Lieberman maintains with a buy rating, and adjusts the target price from $186 to $183.