JPMorgan Vs. Wells Fargo: Which Bank Stock Is More Bullish Ahead Of Q3 Earnings?

JPMorgan Vs. Wells Fargo: Which Bank Stock Is More Bullish Ahead Of Q3 Earnings?

Analysts and investors are keenly observing the stock performance of JPMorgan Chase & Co (NYSE:JPM) and Wells Fargo & Co (NYSE:WFC) ahead of their third-quarter earnings reports on Oct. 11.

分析师和投资者正密切关注纽交所摩根大通(NYSE:JPM)和富国银行(NYSE:WFC)在10月11日公布第三季度财报前的股票表现。

Both banks are showcasing strong technical indicators, but which stock charts a more bullish path?

这两家银行展示了强劲的技术面因子,但哪家股票走势更为积极?

JPMorgan Chase: Strong Bullish Signals

摩根大通:强劲的积极信号

JPMorgan is expected to report earnings of $4.01 per share on revenues of $41.66 billion. The stock is currently priced at $213.42, slightly above its analyst consensus target price of $207.17. Consensus analysts rating for JPMorgan stock stands at Overweight.

预计摩根大通的每股收益为4.01美元,营收达416.6亿美元。目前股价为213.42美元,略高于分析师一致预期的207.17美元的目标价。摩根大通股票的一致分析师评级为增持。

Recent ratings from Oppenheimer, Morgan Stanley, and Deutsche Bank have set an average price target of $229.67, suggesting a potential upside of 7.53%.

来自Oppenheimer、摩根士丹利和德意志银行的最新评级给摩根大通设定了平均目标价229.67美元,暗示着上涨潜力为7.53%。

Chart created using Benzinga Pro

使用Benzinga Pro创建的图表

Technical analysis paints a positive picture for JPMorgan stock. The share price is comfortably above its eight, 20 and 50-day simple moving averages (SMAs), indicating strong bullish momentum.

技术面分析描绘了一幅积极的画面,摩根大通股票的价格舒适地位于其八、20和50日简单移动平均线之上,表明有很强的看涨动能。

Additionally, with the stock trading above its 200-day simple moving average (SMA) of $195.79, multiple indicators point towards a bullish signal.

此外,随着股价交易高于195.79美元的200日简单移动平均线(SMA),多个指标指向积极信号。

Wells Fargo: Promising Yet Cautious Outlook

富国银行:前景有望但谨慎。

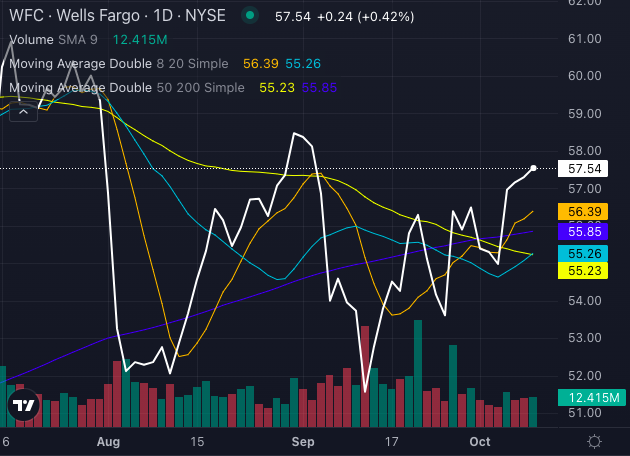

In comparison, Wall Street expects Wells Fargo to deliver earnings of $1.28 per share and revenues of $20.4 billion. The current share price stands at $57.54, lower than the consensus target of $59.80. Consensus analysts rating for Wells Fargo stock stands at a Neutral.

相比之下,华尔街预计富国银行每股盈利1.28美元,营收达到204亿美元。当前股价为57.54美元,低于59.80美元的共识目标价。富国银行股票的共识分析师评级为中立。

However, recent ratings from Wolfe Research, Evercore ISI Group, and Morgan Stanley project an average target of $66.67, hinting at a more substantial upside of 15.86%.

然而,沃尔夫研究、evercore ISI集团和摩根士丹利最近的评级显示,富国银行的平均目标价为66.67美元,暗示着更大的上涨空间,为15.86%。

Chart created using Benzinga Pro

使用Benzinga Pro创建的图表

Wells Fargo stock's technical indicators are also encouraging. The stock price is comfortably above its eight, 20 and 50-day SMAs, with bullish signals confirmed across these indicators.

富国银行股票的技术指标也令人鼓舞。股价稳定高于其八、20和50日移动平均线(SMA),积极信号在这些指标上得到确认。

The current price exceeds its 200-day SMA of $55.85, reinforcing the bullish sentiment in the short term.

当前价格超过了55.85美元的200日简单移动平均线(SMA),加强了短期内的看涨情绪。

Read Also: How To Earn $500 A Month From Wells Fargo Stock Ahead Of Q3 Earnings

阅读也可:如何在第三季度盈利前从富国银行股票中赚取每月500美元

The Verdict

判决

Both JPMorgan and Wells Fargo display bullish characteristics in their stock charts. New York-based JPMorgan appears to have a stronger technical edge with better analyst ratings and a higher current stock price relative to its moving averages.

摩根大通和富国银行的股票图表显示出积极特征。总部位于纽约的摩根大通似乎在技术优势、分析师评级和当前股价与其移动平均线的关系方面更强。

Though consensus price target appears to show more upside with San Francisco-based Wells Fargo.

尽管市场共识目标价显示富国银行总部位于旧金山的股票有更大的上涨空间。

As both companies prepare to release their earnings, investors will be watching closely to see if these bullish trends translate into positive results.

随着两家公司准备发布财报,投资者将密切关注这些积极趋势是否能转化为正面成果。

Indeed, Wells Fargo offers a compelling upside potential. But JPMorgan's current strength in both technical and analyst perspectives may position it as the more bullish financial stock ahead of earnings.

事实上,富国银行提供了令人信服的上行潜力。但摩根大通在技术和分析师观点上的当前实力可能使其成为期望盈利之前更看好的金融股票。

- Marjorie Taylor Greene Boosts Stock Portfolio With AI Exposure, Buys JPMorgan And This Hot Magnificent 7 Stock: Here're Congresswoman's Latest Trades

- 玛乔里·泰勒·格林通过人工智能获得股票组合增值,购买了摩根大通和这家热门的科技七巨头股票:以下是国会女议员最新的交易。

Recent ratings from Oppenheimer, Morgan Stanley, and Deutsche Bank have set an average price target of $229.67, suggesting a potential upside of 7.53%.

Recent ratings from Oppenheimer, Morgan Stanley, and Deutsche Bank have set an average price target of $229.67, suggesting a potential upside of 7.53%.