Behind the Scenes of Intel's Latest Options Trends

Behind the Scenes of Intel's Latest Options Trends

Investors with a lot of money to spend have taken a bearish stance on Intel (NASDAQ:INTC).

有大量资金可以花的投资者对英特尔(纳斯达克股票代码:INTC)采取了看跌立场。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

今天,当交易出现在我们在本辛加追踪的公开期权历史记录上时,我们注意到了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with INTC, it often means somebody knows something is about to happen.

这些是机构还是富人,我们都不知道。但是,当INTC发生如此大的事情时,通常意味着有人知道某件事即将发生。

So how do we know what these investors just did?

那么我们怎么知道这些投资者刚才做了什么?

Today, Benzinga's options scanner spotted 26 uncommon options trades for Intel.

今天,Benzinga的期权扫描仪发现了英特尔26笔不常见的期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 30% bullish and 50%, bearish.

这些大资金交易者的整体情绪介于30%的看涨和50%的看跌之间。

Out of all of the special options we uncovered, 17 are puts, for a total amount of $853,611, and 9 are calls, for a total amount of $430,971.

在我们发现的所有特殊期权中,有17个是看跌期权,总额为853,611美元,9个是看涨期权,总额为430,971美元。

What's The Price Target?

目标价格是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $19.0 and $30.0 for Intel, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场走势者将注意力集中在英特尔过去三个月的19.0美元至30.0美元之间的价格区间上。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

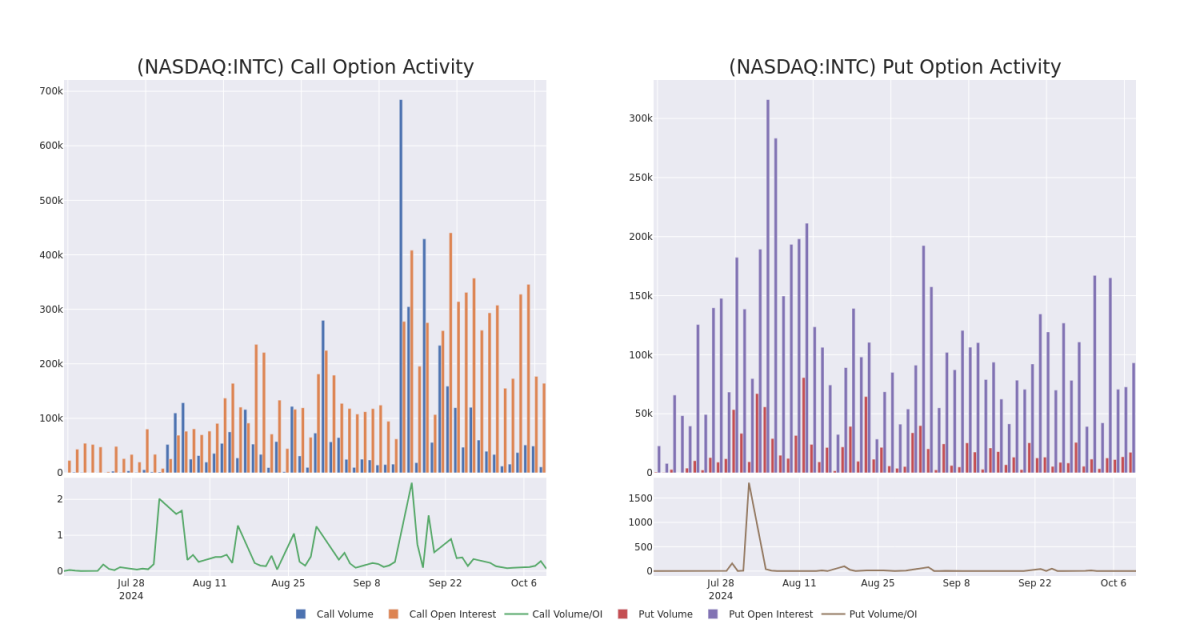

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Intel's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Intel's whale trades within a strike price range from $19.0 to $30.0 in the last 30 days.

交易期权时,查看交易量和未平仓合约是一个强有力的举动。这些数据可以帮助您跟踪给定行使价下英特尔期权的流动性和利息。下面,我们可以分别观察过去30天内英特尔所有鲸鱼交易的看涨期权和未平仓合约的变化,其行使价在19.0美元至30.0美元之间。

Intel Option Volume And Open Interest Over Last 30 Days

过去 30 天的英特尔期权交易量和未平仓合约

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTC | PUT | TRADE | BEARISH | 12/20/24 | $2.22 | $2.19 | $2.21 | $23.00 | $221.0K | 4.5K | 1.0K |

| INTC | PUT | TRADE | BEARISH | 11/15/24 | $1.28 | $1.25 | $1.27 | $22.00 | $95.2K | 7.6K | 762 |

| INTC | PUT | SWEEP | BULLISH | 10/18/24 | $0.79 | $0.76 | $0.77 | $23.50 | $77.0K | 4.8K | 1.1K |

| INTC | CALL | SWEEP | BULLISH | 01/17/25 | $4.75 | $4.7 | $4.75 | $20.00 | $73.6K | 22.7K | 307 |

| INTC | CALL | TRADE | BEARISH | 10/18/24 | $0.84 | $0.81 | $0.82 | $23.00 | $71.4K | 47.7K | 607 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTC | 放 | 贸易 | 粗鲁的 | 12/20/24 | 2.22 美元 | 2.19 美元 | 2.21 美元 | 23.00 美元 | 221.0 万美元 | 4.5K | 1.0K |

| INTC | 放 | 贸易 | 粗鲁的 | 11/15/24 | 1.28 美元 | 1.25 美元 | 1.27 | 22.00 美元 | 95.2 万美元 | 7.6K | 762 |

| INTC | 放 | 扫 | 看涨 | 10/18/24 | 0.79 美元 | 0.76 美元 | 0.77 美元 | 23.50 美元 | 77.0 万美元 | 4.8K | 1.1K |

| INTC | 打电话 | 扫 | 看涨 | 01/17/25 | 4.75 美元 | 4.7 美元 | 4.75 美元 | 20.00 美元 | 73.6 万美元 | 22.7K | 307 |

| INTC | 打电话 | 贸易 | 粗鲁的 | 10/18/24 | 0.84 美元 | 0.81 美元 | 0.82 美元 | 23.00 美元 | 71.4 万美元 | 47.7K | 607 |

About Intel

关于英特尔

Intel is a leading digital chipmaker, focused on the design and manufacturing of microprocessors for the global personal computer and data center markets. Intel pioneered the x86 architecture for microprocessors and was the prime proponent of Moore's law for advances in semiconductor manufacturing. Intel remains the market share leader in central processing units in both the PC and server end markets. Intel has also been expanding into new adjacencies, such as communications infrastructure, automotive, and the Internet of Things. Further, Intel expects to leverage its chip manufacturing capabilities into an outsourced foundry model where it constructs chips for others.

英特尔是领先的数字芯片制造商,专注于为全球个人计算机和数据中心市场设计和制造微处理器。英特尔开创了微处理器的 x86 架构,并且是促进半导体制造进步的摩尔定律的主要支持者。英特尔仍然是个人电脑和服务器端市场中央处理器的市场份额领导者。英特尔还一直在向新的邻接领域扩张,例如通信基础设施、汽车和物联网。此外,英特尔希望利用其芯片制造能力进入外包代工模式,为他人制造芯片。

Following our analysis of the options activities associated with Intel, we pivot to a closer look at the company's own performance.

在分析了与英特尔相关的期权活动之后,我们转而仔细研究公司自身的表现。

Where Is Intel Standing Right Now?

英特尔现在的立场如何?

- Trading volume stands at 22,739,265, with INTC's price down by -0.59%, positioned at $23.32.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 21 days.

- 交易量为22,739,265美元,其中INTC的价格下跌了-0.59%,为23.32美元。

- RSI指标显示该股可能已超买。

- 预计将在21天后公布财报。

Turn $1000 into $1270 in just 20 days?

在短短 20 天内将 1000 美元变成 1270 美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年专业期权交易员透露了他的单线图技术,该技术显示何时买入和卖出。复制他的交易,平均每20天获利27%。点击此处访问。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Intel options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助 Benzinga Pro 的实时警报,随时了解最新的英特尔期权交易。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with INTC, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with INTC, it often means somebody knows something is about to happen.