P/E Ratio Insights for Intuit

P/E Ratio Insights for Intuit

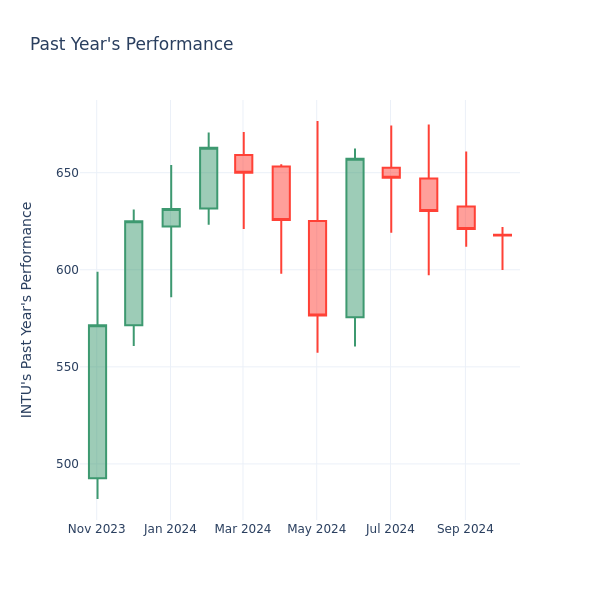

Looking into the current session, Intuit Inc. (NASDAQ:INTU) shares are trading at $617.59, after a 0.65% drop. Over the past month, the stock fell by 4.44%, but over the past year, it actually went up by 15.88%. With questionable short-term performance like this, and great long-term performance, long-term shareholders might want to start looking into the company's price-to-earnings ratio.

查看当前交易日,Intuit Inc.(纳斯达克:INTU)股价为617.59美元,下跌了0.65%。过去一个月,股价下跌了4.44%,但过去一年实际上上涨了15.88%。像这样疑似短期表现不佳,但长期表现却不错的情况下,长期股东可能想开始关注公司的市盈率。

A Look at Intuit P/E Relative to Its Competitors

看一下Intuit的市盈率相对于其竞争对手

The P/E ratio measures the current share price to the company's EPS. It is used by long-term investors to analyze the company's current performance against it's past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

市盈率衡量公司的每股收益与当前股价的比例。长期投资者使用该比率分析公司当前业绩与其过去收益、历史数据和行业或指数的市场数据进行比较,如标普500。更高的市盈率表明投资者预计公司未来表现将更好,股票可能被高估,但不一定如此。它还可以表明,投资者当前愿意支付更高的股票价格,因为他们预计公司在未来季度内表现更好。这使投资者也对未来的分红保持乐观。

Intuit has a lower P/E than the aggregate P/E of 89.69 of the Software industry. Ideally, one might believe that the stock might perform worse than its peers, but it's also probable that the stock is undervalued.

Intuit的市盈率低于软件行业板块的89.69的总平均市盈率。理想情况下,有人可能认为该股票表现可能不如同行,但也有可能是该股被低估了。

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company's stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

总之,市盈率是用来分析公司市场表现的有用指标,但它也有其局限性。虽然较低的市盈率可能表明一家公司被低估,但也可能表明股东并不希望未来增长。此外,市盈率不应该孤立使用,因为其他因素如行业趋势和商业周期也会影响公司的股价。因此,投资者应该将市盈率与其他财务指标和定性分析结合起来,做出明智的投资决策。

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry