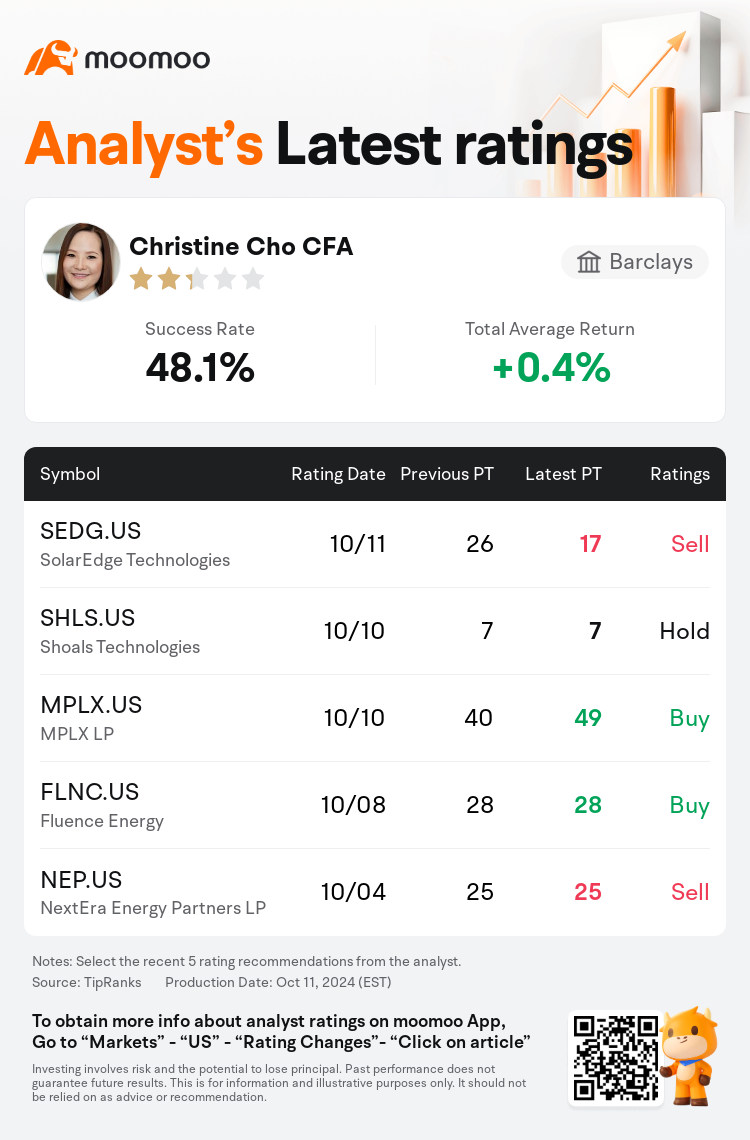

Barclays analyst Christine Cho CFA maintains $SolarEdge Technologies (SEDG.US)$ with a sell rating, and adjusts the target price from $26 to $17.

According to TipRanks data, the analyst has a success rate of 48.1% and a total average return of 0.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $SolarEdge Technologies (SEDG.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $SolarEdge Technologies (SEDG.US)$'s main analysts recently are as follows:

There is a lingering unease regarding SolarEdge's future due to ongoing obstacles and the impending necessity for funds to settle the remaining convertible debt. The company appears to be pressed for time in escalating its U.S. production, which is anticipated to significantly burden its cash reserves. It is challenging to adopt a positive stance on SolarEdge's prospects.

The market is displaying a sense of optimism for a potential uptick in inverter demand by 2025, starting from the first quarter of the year. However, there is a cautious stance being maintained towards these prospects. Despite prevalent concerns regarding the effective utilization of the company's financial resources, analysis suggests that SolarEdge would need to experience a significant and consistent drop in sales, alongside no enhancements in working capital and postponed realization of IRA credits, to face challenges in settling its 2025 convertible obligations or to require further fundraising efforts.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

巴克莱银行分析师Christine Cho CFA维持$SolarEdge Technologies (SEDG.US)$卖出评级,并将目标价从26美元下调至17美元。

根据TipRanks数据显示,该分析师近一年总胜率为48.1%,总平均回报率为0.4%。

此外,综合报道,$SolarEdge Technologies (SEDG.US)$近期主要分析师观点如下:

此外,综合报道,$SolarEdge Technologies (SEDG.US)$近期主要分析师观点如下:

由于持续的障碍以及迫切需要资金来偿还剩余的可转换债务,人们对SolarEdge的未来仍然感到不安。该公司在美国扩大产量似乎时间紧迫,预计这将给其现金储备带来沉重负担。对SolarEdge的前景采取积极的立场是具有挑战性的。

市场对从今年第一季度开始,到2025年,逆变器需求可能增加,表现出乐观的态度。但是,对这些前景持谨慎立场。尽管人们普遍担心该公司财务资源的有效利用,但分析表明,SolarEdge需要经历销售额的大幅持续下降,营运资金不增加和IRA信贷额度的推迟实现,才能在偿还2025年可转换债务方面面临挑战或需要进一步的筹资工作。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$SolarEdge Technologies (SEDG.US)$近期主要分析师观点如下:

此外,综合报道,$SolarEdge Technologies (SEDG.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of