NVIDIA Options Trading: A Deep Dive Into Market Sentiment

NVIDIA Options Trading: A Deep Dive Into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bearish stance on NVIDIA.

有很多钱可以花的鲸鱼对NVIDIA采取了明显的看跌立场。

Looking at options history for NVIDIA (NASDAQ:NVDA) we detected 69 trades.

查看NVIDIA(纳斯达克股票代码:NVDA)的期权历史记录,我们发现了69笔交易。

If we consider the specifics of each trade, it is accurate to state that 40% of the investors opened trades with bullish expectations and 44% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,40%的投资者以看涨的预期开启交易,44%的投资者持看跌预期。

From the overall spotted trades, 14 are puts, for a total amount of $638,666 and 55, calls, for a total amount of $6,598,889.

在所有已发现的交易中,有14笔是看跌期权,总额为638,666美元;55笔看涨期权,总额为6,598,889美元。

Expected Price Movements

预期的价格走势

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $104.0 to $280.0 for NVIDIA during the past quarter.

分析这些合约的交易量和未平仓合约,大型企业似乎一直在关注NVIDIA在过去一个季度的价格范围从104.0美元到280.0美元不等。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

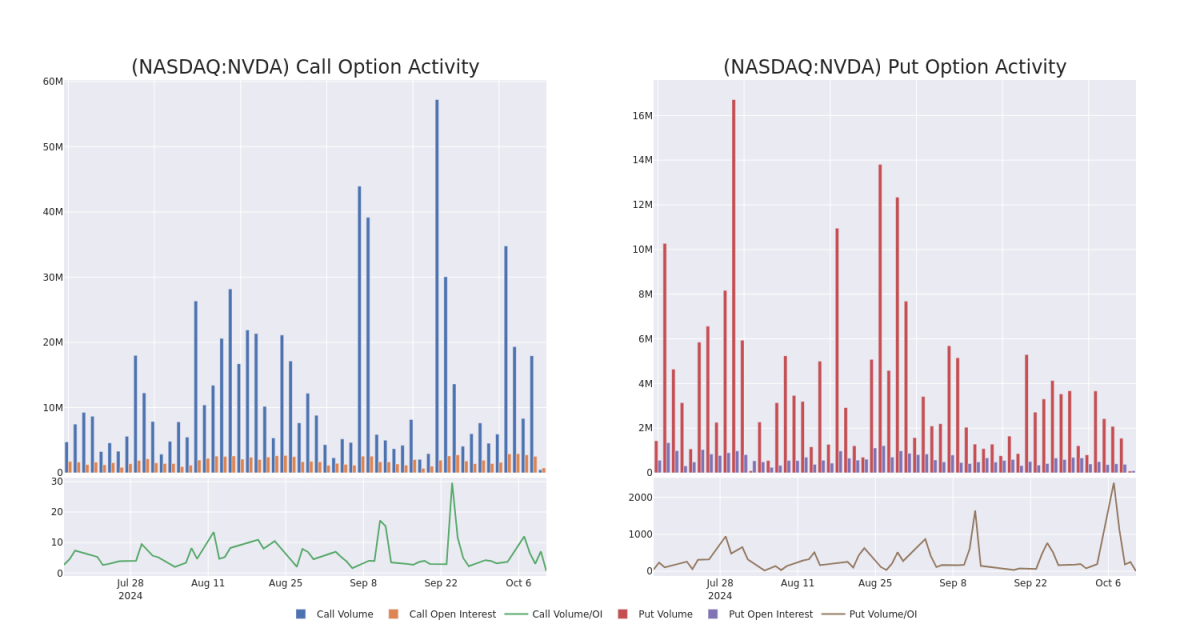

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平仓合约是一种对股票进行尽职调查的有见地的方法。

This data can help you track the liquidity and interest for NVIDIA's options for a given strike price.

这些数据可以帮助您跟踪给定行使价下NVIDIA期权的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of NVIDIA's whale activity within a strike price range from $104.0 to $280.0 in the last 30 days.

下面,我们可以分别观察过去30天内NVIDIA所有鲸鱼活动的看涨和看跌期权交易量和未平仓合约的变化,其行使价在104.0美元至280.0美元之间。

NVIDIA 30-Day Option Volume & Interest Snapshot

NVIDIA 30 天期权交易量和利息快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVDA | CALL | SWEEP | BEARISH | 11/15/24 | $9.75 | $9.65 | $9.65 | $132.00 | $1.9M | 32.2K | 4.7K |

| NVDA | CALL | TRADE | BULLISH | 01/17/25 | $10.6 | $10.5 | $10.58 | $145.00 | $211.6K | 41.0K | 1.2K |

| NVDA | CALL | TRADE | NEUTRAL | 06/18/26 | $10.35 | $10.05 | $10.2 | $280.00 | $127.5K | 3.4K | 125 |

| NVDA | PUT | SWEEP | BULLISH | 10/11/24 | $1.07 | $1.04 | $1.07 | $134.00 | $109.0K | 17.3K | 5.3K |

| NVDA | CALL | TRADE | BEARISH | 11/01/24 | $3.7 | $3.65 | $3.65 | $140.00 | $91.2K | 20.5K | 380 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVDA | 打电话 | 扫 | 粗鲁的 | 11/15/24 | 9.75 美元 | 9.65 美元 | 9.65 美元 | 132.00 美元 | 190 万美元 | 32.2K | 4.7K |

| NVDA | 打电话 | 贸易 | 看涨 | 01/17/25 | 10.6 美元 | 10.5 美元 | 10.58 美元 | 145.00 美元 | 211.6 万美元 | 41.0K | 1.2K |

| NVDA | 打电话 | 贸易 | 中立 | 06/18/26 | 10.35 美元 | 10.05 美元 | 10.2 美元 | 280.00 美元 | 12.75 万美元 | 3.4K | 125 |

| NVDA | 放 | 扫 | 看涨 | 10/11/24 | 1.07 | 1.04 | 1.07 | 134.00 美元 | 109.0 万美元 | 17.3K | 5.3K |

| NVDA | 打电话 | 贸易 | 粗鲁的 | 11/01/24 | 3.7 美元 | 3.65 美元 | 3.65 美元 | 140.00 美元 | 91.2 万美元 | 20.5K | 380 |

About NVIDIA

关于英伟达

Nvidia is a leading developer of graphics processing units. Traditionally, GPUs were used to enhance the experience on computing platforms, most notably in gaming applications on PCs. GPU use cases have since emerged as important semiconductors used in artificial intelligence. Nvidia not only offers AI GPUs, but also a software platform, Cuda, used for AI model development and training. Nvidia is also expanding its data center networking solutions, helping to tie GPUs together to handle complex workloads.

Nvidia 是图形处理单元的领先开发商。传统上,GPU 用于增强计算平台上的体验,最值得注意的是 PC 上的游戏应用程序。此后,GPU 用例已成为人工智能中使用的重要半导体。Nvidia不仅提供人工智能GPU,还提供用于人工智能模型开发和训练的软件平台Cuda。Nvidia还在扩展其数据中心网络解决方案,帮助将GPU结合在一起以处理复杂的工作负载。

After a thorough review of the options trading surrounding NVIDIA, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在全面审查了围绕NVIDIA的期权交易之后,我们将对该公司进行更详细的审查。这包括评估其当前的市场状况和表现。

Present Market Standing of NVIDIA

NVIDIA 目前的市场地位

- With a volume of 10,225,259, the price of NVDA is up 0.04% at $134.86.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 39 days.

- NVDA的交易量为10,225,259美元,价格上涨0.04%,至134.86美元。

- RSI指标暗示标的股票可能接近超买。

- 下一份财报预计将在39天后公布。

Turn $1000 into $1270 in just 20 days?

在短短 20 天内将 1000 美元变成 1270 美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年专业期权交易员透露了他的单线图技术,该技术显示何时买入和卖出。复制他的交易,平均每20天获利27%。点击此处访问。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest NVIDIA options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时警报,随时了解最新的NVIDIA期权交易。

From the overall spotted trades, 14 are puts, for a total amount of $638,666 and 55, calls, for a total amount of $6,598,889.

From the overall spotted trades, 14 are puts, for a total amount of $638,666 and 55, calls, for a total amount of $6,598,889.