Gold Recovers Amid Mixed US Economic Indicators

Gold Recovers Amid Mixed US Economic Indicators

By RoboForex Analytical Department

由RoboForex分析部门提供

Gold prices recovered, reaching 2,644.00 USD per troy ounce on Friday, as investors navigated mixed signals from recent US economic data. The resilience in September's employment market introduced some hesitations regarding the Federal Reserve's pace of monetary easing, as the robust job data might warrant a less aggressive approach to rate cuts.

黄金价格回升,周五达到每金衡盎司2,644.00美元,投资者在从最近的美国经济数据中获取混合信号时踌躇。9月就业市场的韧性介入对美联储货币宽松步伐产生了一些犹豫,因为强劲的就业数据可能要求对降息采取更为谨慎的态度。

Recent inflation reports further complicated the market. While the overall consumer price index slowed, it was less than anticipated, and core inflation, which excludes volatile food and energy prices, actually increased. These developments have hindered progress in easing price pressures, leading to adjustments in expectations for US monetary policy.

最近的通货膨胀报告进一步加剧了市场的复杂性。尽管总体消费者价格指数放缓,但不及预期,并且除了食品和能源价格波动的核心通胀实际上有所增加。这些发展阻碍了缓解价格压力的进展,导致对美国货币政策预期的调整。

Initially, there was speculation of a significant 50-basis-point rate cut; however, given the current economic landscape, a more conservative rate cut of 25 basis points is now deemed more likely at the Fed's November meeting. This scenario holds an 86% probability, according to market forecasts. For gold, which does not yield coupon income, the prospect of easing by the US Federal Open Market Committee (FOMC) remains a positive catalyst, particularly in a lower interest rate environment where bonds and other interest-bearing assets become less competitive.

最初有关于大规模降息50个基点的推测;然而,鉴于当前的经济形势,更加保守的25个基点的降息在美联储11月会议上现在被认为更有可能。根据市场预测,这种情形的概率为86%。对于黄金来说,不产生票息的展望令美国联邦公开市场委员会(FOMC)降息仍然是一个积极的催化剂,尤其是在债券和其他计息资产在利率环境更加不具竞争力时。

Despite the recent uptick, gold is on track to register its second consecutive weekly decline.

尽管最近有所上涨,但黄金正朝着登记第二个连续周度下跌的方向前进。

Technical Analysis Of Gold

黄金的技术面分析

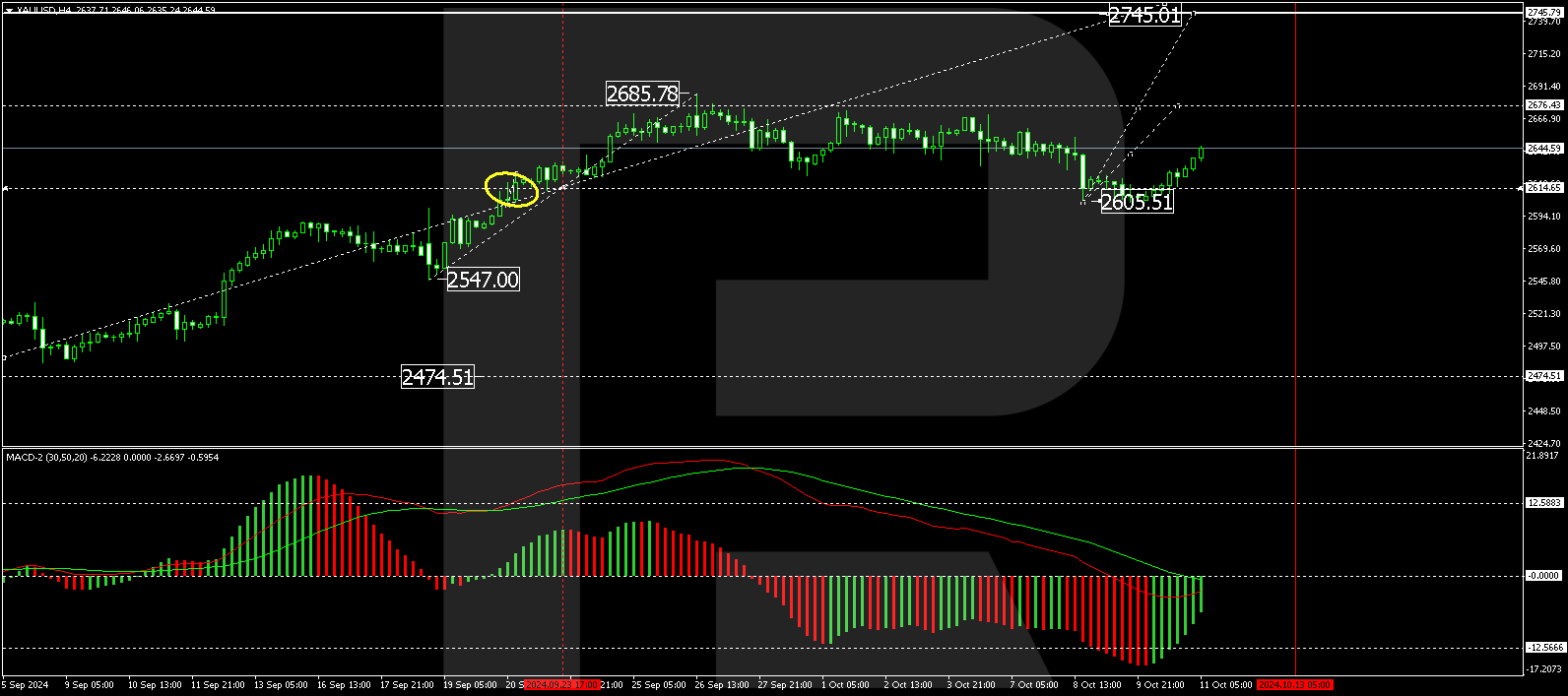

The gold market experienced a correction down to 2,605.00 but has since shown signs of resurgence. The current technical setup suggests a potential continuation towards 2,676.50, which would mark the next target in this upward trend. Following the achievement of this level, a correction back to 2,645.00 may occur. This bullish scenario is supported by the MACD indicator, which, although below zero, is gearing up for a potential rise, indicating strengthening momentum.

黄金市场经历了一次回调至2,605.00,但此后显示出回升迹象。当前的技术设置暗示可能会持续走向2,676.50,这将标志着这一上升趋势中的下一个目标。在达到此水平后,可能会出现回调至2,645.00。这种看好的情景得到了MACD指标的支撑,尽管位于零以下,正在为潜在上涨作准备,表明增强的动量。

On the hourly chart, gold has formed a consolidation range above 2,605.00 and has broken upwards. It nearly reached the target of 2,644.00. Today, we might see the formation of a narrow consolidation range, and if a downward exit occurs, a corrective move to 2,625.00 could be expected. Following this correction, the market may gear up for another rise towards 2,662.00. This forecast is technically backed by the Stochastic oscillator, with its signal line currently above 80 but poised to start a decline, suggesting a short-term pullback before further gains.

在小时图上,黄金形成了一个在2,605.00以上的盘整区间并向上突破。它几乎达到了2,644.00的目标。今天,我们可能会看到一个狭窄的整理区间的形成,如果出现向下的突破,则可能预期一次向2,625.00的修正行情。在这次调整之后,市场可能会为再次上涨至2,662.00做准备。这一预测在技术上得到了随机振荡器的支持,其信号线目前位于80以上,但随时准备开始下降,表明短期回撤之前的进一步涨势。

Disclaimer

免责声明

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

本分析仅代表作者个人观点,不得视为交易建议。RoboForex不承担基于本文所含交易建议和评论所产生的任何交易结果的责任。

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

本文来自非报酬的外部投稿人。它不代表Benzinga的报道,并且没有因为内容或准确性而被编辑。

Initially, there was speculation of a significant 50-basis-point rate cut; however, given the current economic landscape, a more conservative rate cut of 25 basis points is now deemed more likely at the Fed's November meeting. This scenario holds an 86% probability, according to market forecasts. For gold, which does not yield coupon income, the prospect of easing by the US Federal Open Market Committee (FOMC) remains a positive catalyst, particularly in a lower interest rate environment where bonds and other interest-bearing assets become less competitive.

Initially, there was speculation of a significant 50-basis-point rate cut; however, given the current economic landscape, a more conservative rate cut of 25 basis points is now deemed more likely at the Fed's November meeting. This scenario holds an 86% probability, according to market forecasts. For gold, which does not yield coupon income, the prospect of easing by the US Federal Open Market Committee (FOMC) remains a positive catalyst, particularly in a lower interest rate environment where bonds and other interest-bearing assets become less competitive.