Smart Money Is Betting Big In MRVL Options

Smart Money Is Betting Big In MRVL Options

Deep-pocketed investors have adopted a bearish approach towards Marvell Tech (NASDAQ:MRVL), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MRVL usually suggests something big is about to happen.

资深投资者对迈威尔科技(纳斯达克:MRVL)采取了看淡的策略,并且这是市场参与者不应忽视的事情。我们在Benzinga对公开期权记录进行跟踪,今天揭示了这一重要举动。这些投资者的身份仍然未知,但在MRVL展开如此重大的举动通常意味着即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for Marvell Tech. This level of activity is out of the ordinary.

我们从今天的观察中获得了这些信息,当Benzinga的期权扫描器突出显示了迈威尔科技的9项非同寻常的期权活动。这种活动水平是非同寻常的。

The general mood among these heavyweight investors is divided, with 44% leaning bullish and 55% bearish. Among these notable options, 2 are puts, totaling $125,130, and 7 are calls, amounting to $527,266.

这些重量级投资者之间的普遍情绪是分歧的,44%看涨,55%看跌。在这些显着的期权中,有2个看跌,总额为125,130美元,有7个看涨,总额为527,266美元。

Expected Price Movements

预期价格波动

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $52.5 and $90.0 for Marvell Tech, spanning the last three months.

通过评估交易量和未平仓合约数,显而易见,主要市场推动者正专注于迈威尔科技在过去三个月内介于52.5美元和90.0美元之间的价格区间。

Volume & Open Interest Trends

成交量和未平仓量趋势

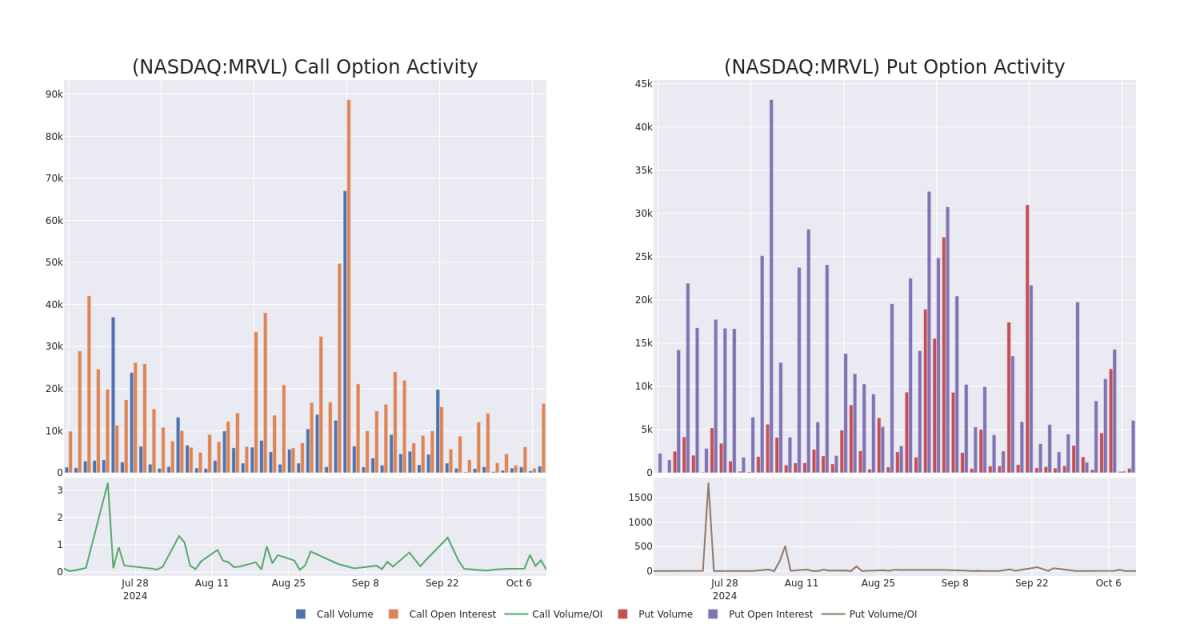

In today's trading context, the average open interest for options of Marvell Tech stands at 2819.5, with a total volume reaching 2,079.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Marvell Tech, situated within the strike price corridor from $52.5 to $90.0, throughout the last 30 days.

在今天的交易背景下,迈威尔科技期权的平均未平仓合约为2819.5,总成交量达到2,079.00。附带图表详细描述了过去30天内迈威尔科技高价交易的看涨和看跌期权成交量和未平仓合约随时间的发展情况,这些交易位于52.5美元至90.0美元之间的行权价走廊内。

Marvell Tech Call and Put Volume: 30-Day Overview

Marvell Tech的看涨和看跌期权成交量:30天概览

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRVL | CALL | SWEEP | BULLISH | 01/17/25 | $2.25 | $2.13 | $2.24 | $90.00 | $198.1K | 5.4K | 888 |

| MRVL | CALL | SWEEP | BULLISH | 01/17/25 | $9.3 | $9.2 | $9.3 | $70.00 | $139.5K | 5.8K | 167 |

| MRVL | PUT | SWEEP | BULLISH | 10/18/24 | $2.6 | $2.55 | $2.55 | $75.00 | $99.1K | 2.4K | 392 |

| MRVL | CALL | SWEEP | BEARISH | 12/20/24 | $3.95 | $3.85 | $3.85 | $80.00 | $66.2K | 4.0K | 189 |

| MRVL | CALL | SWEEP | BEARISH | 12/20/24 | $3.95 | $3.9 | $3.9 | $80.00 | $33.5K | 4.0K | 275 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 迈威尔科技 | 看涨 | SWEEP | 看好 | 01/17/25 | 2.25美元 | $2.13 | $2.24 | $90.00 | 198.1千美元 | 5,400 | 888 |

| 迈威尔科技 | 看涨 | SWEEP | 看好 | 01/17/25 | $9.3 | $9.2 | $9.3 | 70.00美元 | $139.5K | 5.8K | 167 |

| 迈威尔科技 | 看跌 | SWEEP | 看好 | 10/18/24 | $2.6 | $2.55 | $2.55 | $75.00 | $99.1K | 2.4K | 392 |

| 迈威尔科技 | 看涨 | SWEEP | 看淡 | 12/20/24 | $3.95 | $3.85 | $3.85 | $80.00 | $66.2K | 4.0K | $ |

| 迈威尔科技 | 看涨 | SWEEP | 看淡 | 12/20/24 | $3.95 | $3.9 | $3.9 | $80.00 | $33.5千 | 4.0K | 275 |

About Marvell Tech

关于迈威尔科技

Marvell Technology is a fabless chip designer focused on wired networking, where it has the second-highest market share. Marvell serves the data center, carrier, enterprise, automotive, and consumer end markets with processors, optical and copper transceivers, switches, and storage controllers.

迈威尔科技是一家无晶圆厂的芯片设计公司,专门从事有线网络领域的业务,其市场占有率排名第二。迈威尔公司在处理器、光纤和铜传送器、交换机和存储控制器方面为数据中心、运营商、企业、汽车和消费者等各领域提供服务。

Present Market Standing of Marvell Tech

Marvell Tech的市场现状

- Trading volume stands at 3,687,443, with MRVL's price up by 1.96%, positioned at $73.96.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 49 days.

- 交易量为3,687,443,迈威尔科技价格上涨1.96%,定位在73.96美元。

- RSI指标显示该股票目前处于超买和超卖之间的中立状态。

- 预计在49天内公布收益。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的专业期权交易员揭示了他的单线图技巧,可以显示何时买入和卖出。复制他的交易,每20天平均盈利27%。点击这里获取更多信息。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Marvell Tech with Benzinga Pro for real-time alerts.

交易期权涉及更大风险,但也提供更高利润的潜力。精明的交易者通过持续的教育、战略性的交易调整、利用各种因子以及保持对市场动态的关注,来减轻这些风险。通过Benzinga Pro随时获取迈威尔科技的最新期权交易,以获得实时警报。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $52.5 and $90.0 for Marvell Tech, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $52.5 and $90.0 for Marvell Tech, spanning the last three months.