Tradepulse Power Inflow Alert: Mercadolibre Inc. Rises Over 30 Points After Signal

Tradepulse Power Inflow Alert: Mercadolibre Inc. Rises Over 30 Points After Signal

STOCK CLIMBS 1.5% AT HIGH POINT

股票上涨1.5%,达到高点

MercadoLibre, Inc. (NASDAQ:MELI) today experienced a Power Inflow, a significant event for those who follow where smart money goes and value order flow analytics in their trading decisions.

MercadoLibre, Inc. (纳斯达克:MELI) 今天经历了一个资金流入,这对于那些追随聪明资金流向和价值订单流分析来做交易决策的人来说是一个重要事件。

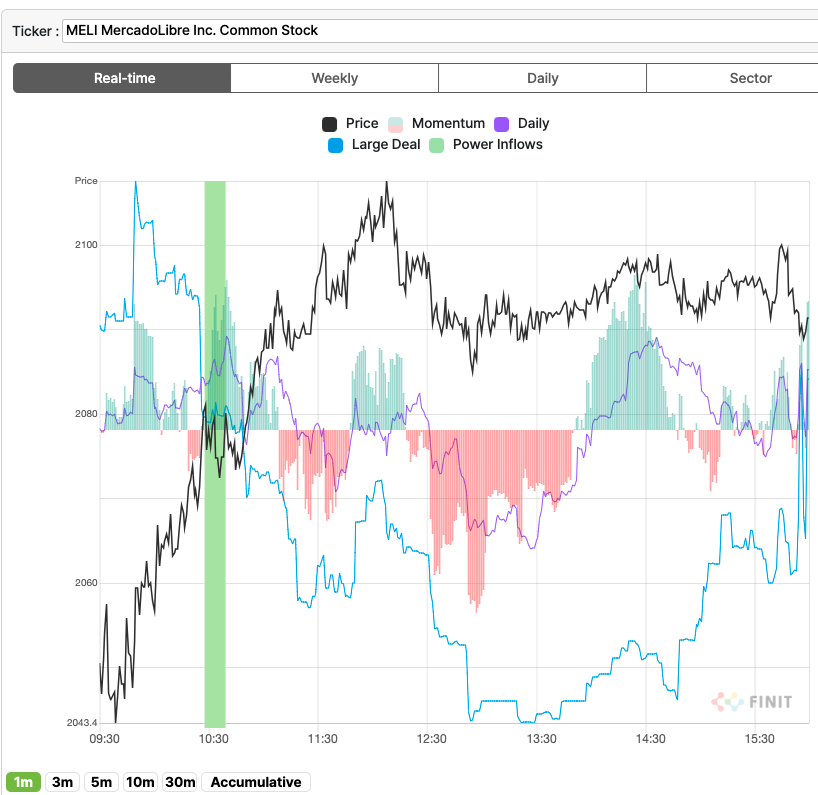

Today, at 10:37 AM on OCTOBER 11th, a significant trading signal occurred for MercadoLibre, Inc. as it demonstrated a Power Inflow at a price of $2074.55. This indicator is crucial for traders who want to know directionally where institutions and so-called "smart money" moves in the market. They see the value of utilizing order flow analytics to guide their trading decisions. The Power Inflow points to a possible uptrend in MercadoLibre's stock, marking a potential entry point for traders looking to capitalize on the expected upward movement. Traders with this signal closely watch for sustained momentum in Mercado Libre's stock price, interpreting this event as a bullish sign.

今天,10点37分,在10月11日,MercadoLibre, Inc. 发生了一个重要的交易信号,表明股价为$2074.55的资金流入。对于想要了解机构和所谓的“智能资金”在市场中的动向的交易者来说,这个指标至关重要。他们看到利用订单流分析指导他们的交易决策的价值。资金流入指向MercadoLibre股票可能的上升趋势,标志着交易者寻求利用预期的上涨运动的潜在入场点。具有这一信号的交易者密切关注Mercado Libre股价的持续动量,将这一事件解释为看涨迹象。

Signal description

信号描述

Order flow analytics, aka transaction or market flow analysis, separate and study both the retail and institutional volume rate of orders (flow). It involves analyzing the flow of buy and sell orders, along with size, timing, and other associated characteristics and patterns, to gain insights and make more informed trading decisions. This particular indicator is interpreted as a bullish signal by active traders.

订单流量分析,又称交易或市场流量分析,研究和分析零售和机构的订单(流量)量率。它涉及分析买入和卖出订单的流向,以及大小、时间和其他相关特征和模式,从而获取见解并做出更明智的交易决策。这一特定指标被积极交易者解读为看涨信号。

The Power Inflow occurs within the first two hours of the market open. Generally, it signals the trend that helps gauge the stock's overall direction, powered by institutional activity in the stock, for the remainder of the day.

资金流入发生在市场开盘的头两个小时内。一般来说,它预示着帮助衡量股票整体方向的趋势,由当天其他机构活动推动。

By incorporating order flow analytics into their trading strategies, market participants can better interpret market conditions, identify trading opportunities, and potentially improve their trading performance. But let's not forget that while watching smart money flow can provide valuable insights, it is crucial to incorporate effective risk management strategies to protect capital and mitigate potential losses. Employing a consistent and effective risk management plan helps traders navigate the uncertainties of the market in a more controlled and calculated manner, increasing the likelihood of long-term success

通过将订单流分析纳入他们的交易策略,市场参与者可以更好地解读市场条件,识别交易机会,并有可能改善其交易绩效。但让我们不要忘记,尽管观察智慧资金流动可以提供宝贵的见解,但将有效的风险管理策略纳入非常重要,以保护资金并降低潜在风险。采用一致且有效的风险管理计划有助于交易者以更加受控和计算的方式应对市场的不确定性,提高长期成功的可能性。

Market News and Data brought to you by Benzinga APIs and include firms, like Finit USA, responsible for parts of the data within this article.

由Benzinga API提供的市场资讯和数据,包括Finit USA等公司负责本文中部分数据。

2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2024年Benzinga.com保留版权所有,Benzinga.com不提供投资建议。

After Market Close UPDATE:

收盘后更新:

The price at the time of the Power Inflow was $2074.55. The returns on the High price ($2105.33) and Close price ($2091.28) after the Power Inflow are respectively 1.5% and 0.8%. The result underlines the importance of a trading plan that includes Profit Targets and Stop Losses that reflect your risk appetite.

在资金流入时,价格为2074.55美元。资金流入后,最高价(2105.33美元)和收盘价(2091.28美元)的回报分别为1.5%和0.8%。该结果强调了包括盈利目标和止损在内的交易计划的重要性,这些计划要反映您的风险偏好。