BofA Securities analyst Saurabh Pant maintains $ProFrac Holding (ACDC.US)$ with a hold rating, and adjusts the target price from $8.5 to $7.5.

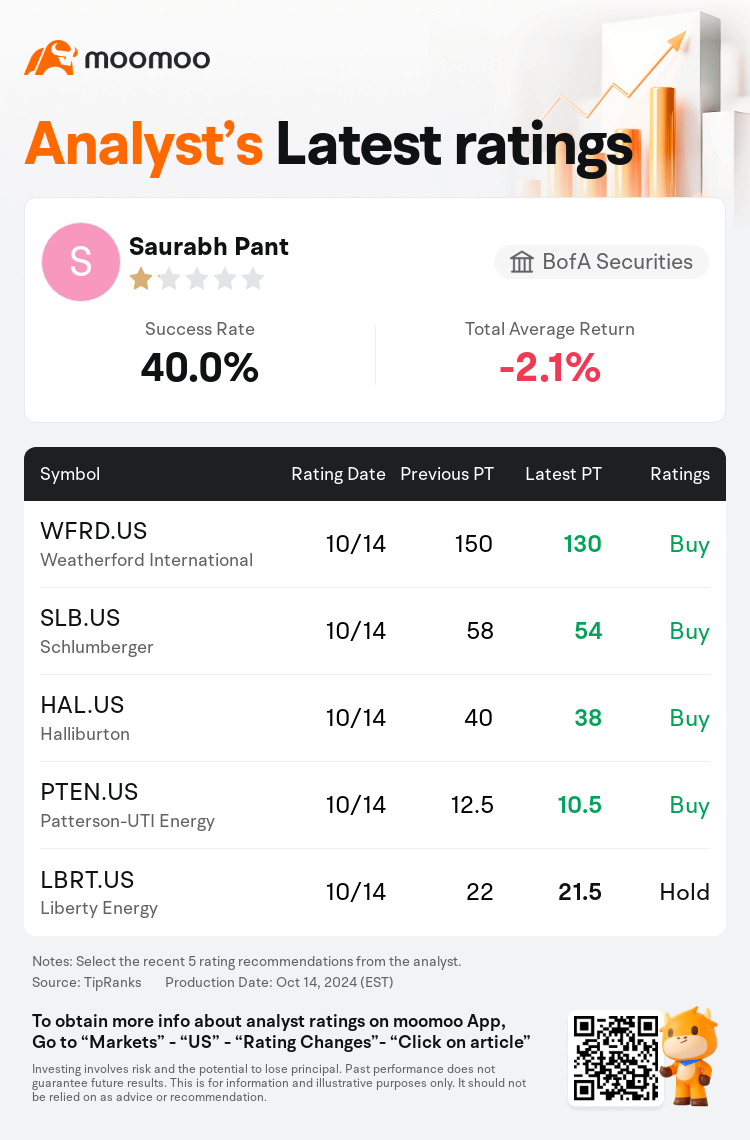

According to TipRanks data, the analyst has a success rate of 40.0% and a total average return of -2.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $ProFrac Holding (ACDC.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $ProFrac Holding (ACDC.US)$'s main analysts recently are as follows:

Weakening global oil demand growth alongside an abundant supply is anticipated to present a challenging environment for oil prices and Oilfield Services stock selection in 2025. The current global oil supply/demand dynamics are compelling a need for U.S. Land oil production to level off promptly.

The firm has revised its activity assumptions for the second half of 2024 and the entirety of 2025 within the U.S., resulting in a more conservative outlook for international growth in 2025, and subsequently adjusted its estimates for oilfield services companies. The expectation is for U.S. activity levels to remain roughly consistent through 2025, with limited immediate impetus for stock movement. The moderated expectations for land activity in the U.S. underpin the less optimistic stance on ProFrac, with the company's higher leverage compared to its peers continuing to be a point of concern for investors and a potential obstacle for the stock's valuation.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美银证券分析师Saurabh Pant维持$ProFrac Holding (ACDC.US)$持有评级,并将目标价从8.5美元下调至7.5美元。

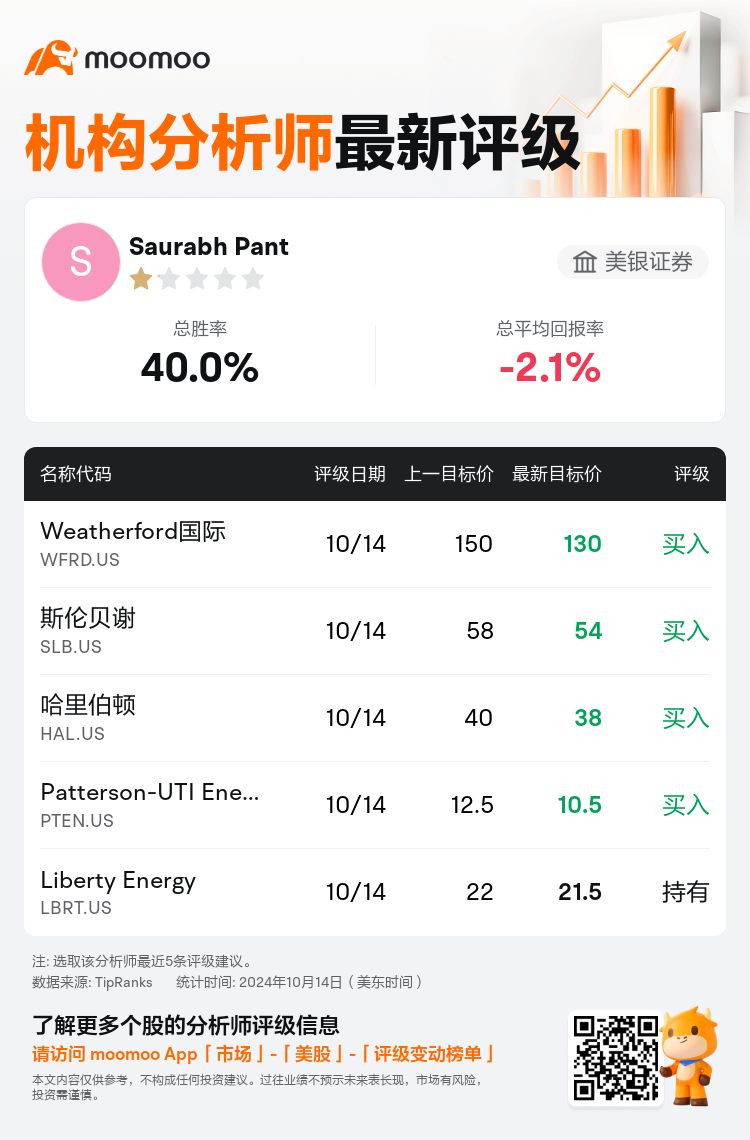

根据TipRanks数据显示,该分析师近一年总胜率为40.0%,总平均回报率为-2.1%。

此外,综合报道,$ProFrac Holding (ACDC.US)$近期主要分析师观点如下:

此外,综合报道,$ProFrac Holding (ACDC.US)$近期主要分析师观点如下:

预计全球石油需求增长疲软,加上供应充足,将在2025年为油价和油田服务股票选择带来挑战性的环境。当前的全球石油供应/需求动态迫使美国陆地石油产量迅速趋于平稳。

该公司修改了2024年下半年和整个2025年美国境内的活动假设,使2025年的国际增长前景更加保守,随后调整了对油田服务公司的估计。预计到2025年,美国的活动水平将大致保持稳定,而股票变动的直接动力有限。对美国土地活动的预期温和支撑了对ProFrac不那么乐观的立场,与同行相比,该公司更高的杠杆率仍然是投资者关注的问题,也是该股估值的潜在障碍。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$ProFrac Holding (ACDC.US)$近期主要分析师观点如下:

此外,综合报道,$ProFrac Holding (ACDC.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of