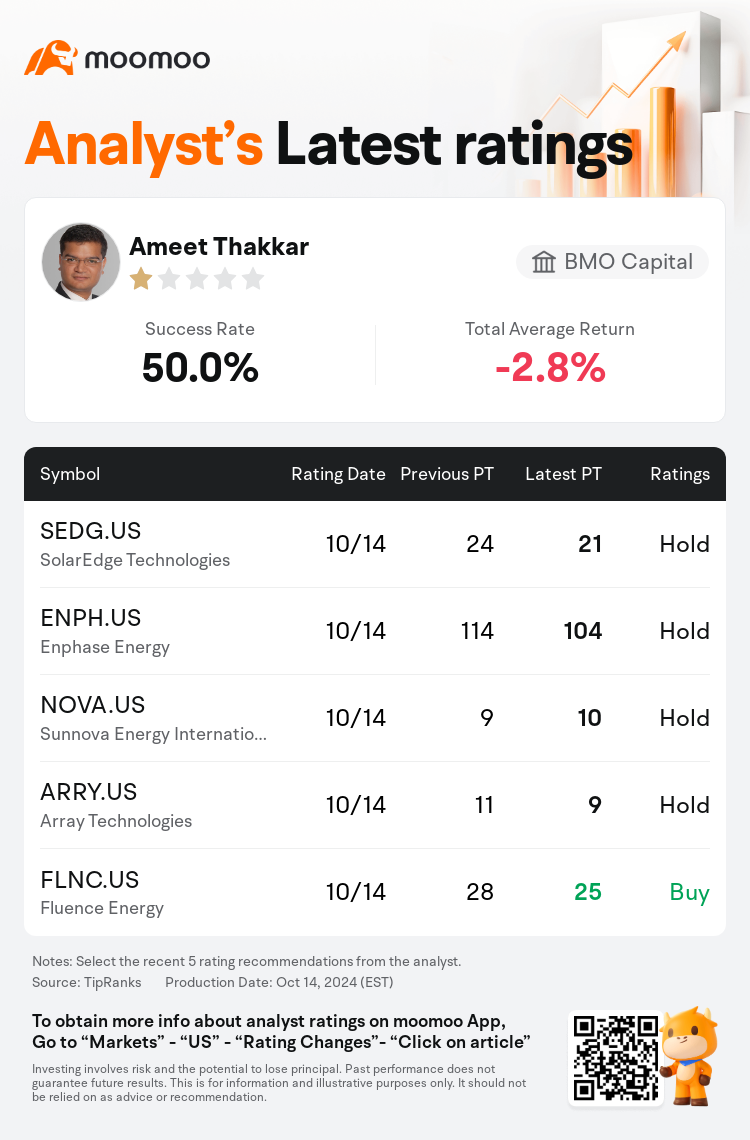

BMO Capital analyst Ameet Thakkar maintains $SolarEdge Technologies (SEDG.US)$ with a hold rating, and adjusts the target price from $24 to $21.

According to TipRanks data, the analyst has a success rate of 50.0% and a total average return of -2.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $SolarEdge Technologies (SEDG.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $SolarEdge Technologies (SEDG.US)$'s main analysts recently are as follows:

Concerns persist regarding SolarEdge's outlook amidst ongoing challenges and the possible requirement for capital to settle the remaining convertible debt. The company appears to have limited flexibility in postponing the expansion of its U.S. manufacturing, which is expected to significantly impact cash reserves. It's challenging to adopt a positive stance on SolarEdge given these factors.

The anticipation of third-quarter results within the Energy Transition & Infrastructure sector is occurring alongside the U.S. elections, prompting a recommendation for investors to exercise caution when considering adding to existing positions or introducing new capital. Instead, the focus should be on 'relative value'. Despite the low likelihood of a complete retraction of the Inflation Reduction Act, policy uncertainty is anticipated in the event of a political shift caused by the upcoming elections. Moreover, both data and industry commentary from the U.S. and Europe suggest a continued stagnation or minimal recovery in residential solar demand, which is crucial for driving the company's primary financial performance.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

BMO资本市场分析师Ameet Thakkar维持$SolarEdge Technologies (SEDG.US)$持有评级,并将目标价从24美元下调至21美元。

根据TipRanks数据显示,该分析师近一年总胜率为50.0%,总平均回报率为-2.8%。

此外,综合报道,$SolarEdge Technologies (SEDG.US)$近期主要分析师观点如下:

此外,综合报道,$SolarEdge Technologies (SEDG.US)$近期主要分析师观点如下:

在持续的挑战以及可能需要资本来偿还剩余的可转换债务的情况下,人们仍然对SolarEdge的前景感到担忧。该公司在推迟扩张美国制造业方面的灵活性似乎有限,预计这将对现金储备产生重大影响。鉴于这些因素,对SolarEdge采取积极立场是困难的。

能源转型和基础设施行业对第三季度业绩的预期与美国大选同时发生,这促使投资者建议投资者在考虑增加现有头寸或引入新资本时要谨慎行事。相反,重点应该放在 “相对价值” 上。尽管完全撤回《通货膨胀削减法》的可能性很小,但如果即将举行的选举导致政治转变,预计政策将出现不确定性。此外,来自美国和欧洲的数据和行业评论都表明,住宅太阳能需求持续停滞或复苏幅度微乎其微,这对于推动公司的主要财务业绩至关重要。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$SolarEdge Technologies (SEDG.US)$近期主要分析师观点如下:

此外,综合报道,$SolarEdge Technologies (SEDG.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of