Ericsson Q3 Earnings: Gains From AT&T Boost, CEO Signals North American Recovery

Ericsson Q3 Earnings: Gains From AT&T Boost, CEO Signals North American Recovery

Ericsson (NASDAQ:ERIC) reported third-quarter fiscal 2024 results.

瑞典爱立信(NASDAQ: ERIC)报告了2024财年第三季度的业绩。

Sales declined 4% year-over-year to 61.8 billion Swedish Krona, driven by strong growth in the North American market. In USD, sales of $5.93 billion beat the analyst consensus estimate of $5.72 billion.

销售额同比下降4%,至618亿瑞典克朗,主要受北美市场强劲增长推动。以美元计算,销售额为59.3亿美元,超过分析师共识预期的57.2亿美元。

Group organic sales declined by 1% Y/Y.

集团有机销售同比下降1%。

Also Read: T-Mobile Partners with NVIDIA, Ericsson, And Nokia to Pioneer AI-Driven Mobile Networks

另请阅读:腾讯与英伟达、爱立信和诺基亚合作,开创人工智能驱动的移动网络。

Ericsson's partnership with AT&T Inc boosted the telecom equipment company's quarterly print. AT&T inked a five-year $14 billion deal with Ericsson to lead the US in commercial-scale open radio access network (Open RAN) deployment.

爱立信与AT&T公司的合作推动了这家电信设备公司季度业绩表现。AT&T公司与爱立信签署了一项为期五年的140亿美元交易,旨在领导美国商业规模的开放式无线电访问网络(Open RAN)部署。

Under the deal, Ericsson will leverage its USA 5G Smart Factory in Lewisville, Texas, to manufacture 5G equipment. AT&T is committed to building a telecom network that leverages ORAN technology.

根据协议,爱立信将利用其位于德克萨斯州刘易斯维尔的美国5G智能工厂,制造5G设备。AT&T致力于构建利用ORAN技术的电信网络。

Adjusted gross margin improved to 46.3% from 39.2% Y/Y, driven primarily by improved gross margin in Networks.

调整后的毛利率从去年同期的39.2%提高到46.3%,主要是由于网络业务的毛利率改善。

Adjusted EBIT margin was 11.9% versus (43.5)% Y/Y due to a non-cash impairment loss relating to the Vonage acquisition. Adjusted EBITA margin improved to 12.6% from 7.3% a year ago.

由于与Vonage收购有关的非现金减值损失,调整后的EBIt毛利率为11.9%,同比改善了43.5%。调整后的EBITA毛利率从一年前的7.3%提高至12.6%。

Ericsson reported an EPS of SEK 1.14 versus SEK (9.21) Y/Y. In USD, EPS of $0.11 beat the analyst consensus estimate of $0.09.

爱立信报告的每股收益为SEk 1.14,同比改善了SEk (9.21)。按美元计算,每股收益为0.11美元,超过分析师对0.09美元的共识预期。

Free cash flow before M&A was SEK 12.94 billion in the quarter, benefiting from the operational improvements.

并购前的自由现金流在本季度达到了129.4亿瑞典克朗,得益于运营改善。

As of September 30, 2024, net cash stood at SEK 25.53 billion.

截至2024年9月30日,净现金达到了255.3亿瑞典克朗。

CEO Börje Ekholm noted signs of the overall market stabilizing, with North America, as an early adopter market, returning to growth. He expects Networks sales to stabilize Y/Y during the fourth quarter, driven by North America. He also flagged further near-term sales pressure in Enterprise due to its focus on profitable segments.

首席执行官Börje Ekholm指出整体市场出现稳定迹象,作为早期采用市场的北美市场开始恢复增长。他预计网络销售在第四季度将同比稳定,受北美市场推动。他还提到由于重点放在盈利领域,企业部门在短期内面临更多销售压力。

The weakness in demand from North American mobile operators in the last two years affected Ericsson and its peers, prompting them to shift focus to developing markets like India, often compromising their profits.

过去两年来,北美移动运营商需求疲软影响了爱立信及其同行,促使它们转向印度等新兴市场,经常牺牲利润。

Outlook: Ericsson expects a fourth-quarter adjusted gross margin of 47%-49% and restructuring charges of SEK 4.0 billion in 2024.

展望:爱立信预计第四季度调整后的毛利率为47%-49%,并计划在2024年进行40亿瑞典克朗的重组费用。

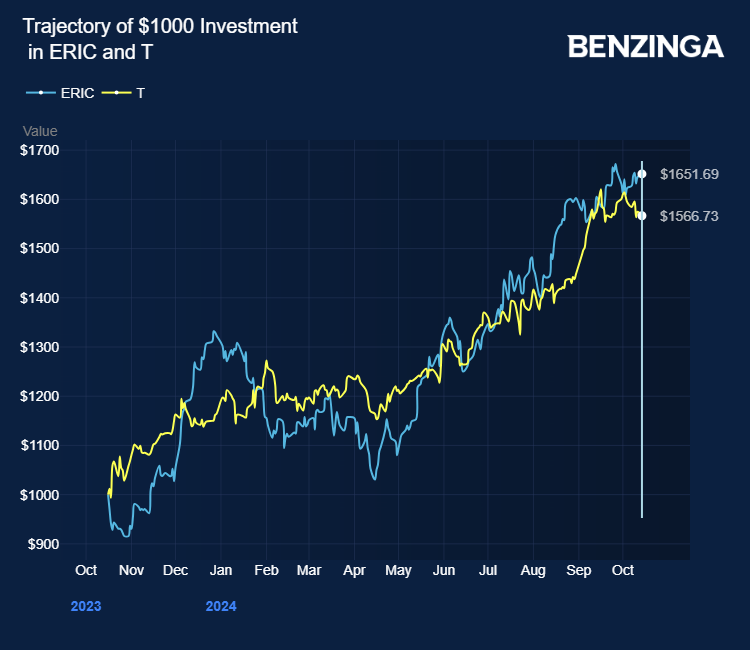

Ericsson stock gained over 58% in the last 12 months. Investors can gain exposure to the stock through First Trust NASDAQ Technology Dividend Index Fund (NASDAQ:TDIV) and iShares US Digital Infrastructure and Real Estate ETF (NYSE:IDGT).

过去12个月,爱立信股价上涨超过58%。投资者可以通过First Trust纳斯达克科技股息指数基金(纳斯达克:TDIV)和iShares美国数字基础设施和房地产ETF(纽交所:IDGT)获得该股票曝光度。

Price Action: ERIC stock traded higher by 9.68% at $8.27 premarket at the last check Tuesday.

价格走势:周二最后一次检查时,爱立信股价盘前上涨9.68%,报8.27美元。

Photo by Mats Wiklund via Shutterstock

通过Shutterstock的Mats Wiklund拍摄的照片

Also Read:

还阅读:

- Nokia And AT&T Partner For Next-Gen Fiber Network: Details

- 诺基亚与AT&t合作建设下一代光纤网络:详情