Market Mover | Woodside stock rises 1.05%, nearing a key support level

Market Mover | Woodside stock rises 1.05%, nearing a key support level

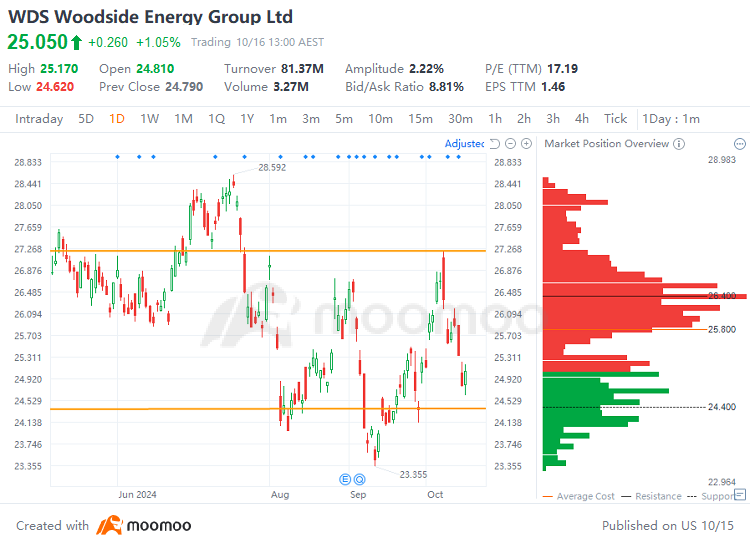

$Woodside Energy Group Ltd (WDS.AU)$ stock rose 1.05% on Wednesday, with trading volume expanding to A$81.37 million. Woodside has fallen 5.32% in the past week, with a cumulative loss of 11.81% year-to-date.

$Woodside Energy Group Ltd (WDS.AU)$ 周三股价上涨1.05%,交易量扩大到A$8137万。伍德赛德上周下跌5.32%,年初以来累计跌幅为11.81%。

Woodside's technical analysis chart:

Woodside的技术面分析图表:

Technical Analysis:

技术面分析:

Support: A$24.4

支撑位:A$24.4

Resistance: A$27.2

压力位:A$27.2

Price range A$24.4 to A$27.2: The trading range indicates a high concentration of sell orders, with the stock price exhibiting a short-term downward trend. There is a significant amount of trapped capital within the trading range, which creates substantial resistance to price increases. The stock price declined near the resistance level of around A$27.2, and it repeatedly touched near the level of A$24.4, forming a certain support. Going forward, we need to observe whether the support at around A$24.4 holds and whether the resistance at around A$27.2 can be effectively breached.

价格区间A$24.4至A$27.2:交易区间显示大量卖单,股价呈现短期下降趋势。交易区间内有大量被套的资本,对价格上涨形成重大阻力。股价接近约A$27.2的阻力水平下跌,反复接近A$24.4水平,形成一定支撑。未来,我们需要观察约A$24.4的支撑位能否保持,约A$27.2的压力位能否被有效突破。

Market News :

市场资讯:

Woodside announced its Q3 2024 results on October 16, 2024, reporting record-breaking production fueled by Sangomar. The company achieved a record quarterly production of 53.1 MMboe (577 Mboe/day), a 20% increase from Q2 2024, primarily due to the ramp-up at Sangomar. This production figure surpassed the consensus estimate of 50.1 MMboe. Additionally, the company reported quarterly revenue of US$3.679 billion, which is a 21% increase from Q2 2024, mainly due to Sangomar cargo sales and higher average LNG prices.

Woodside宣布于2024年10月16日公布了2024年第三季度的业绩,报告称由Sangomar驱动的创纪录产量。公司实现了每日577万桶油当量(53.1 MMboe)的创纪录季度产量,较2024年第二季度增长20%,主要是由于Sangomar的逐步增加。这一产量数字超过了50.1 MMboe的共识估计。此外,该公司报告了季度营业收入为367.9亿美元,较2024年第二季度增长21%,主要是由于Sangomar的货物销售和更高的平均液化天然气价格。

Woodside reviewed its current listing structure and decided to delist from the London Stock Exchange (LSE). Woodside shares represented by depositary interests account for approximately 1% of Woodside’s issued share capital. Trading volumes of Woodside shares on the LSE are low and delisting from the LSE will reduce Woodside’s administration costs.

Woodside审查了其目前的上市结构,并决定从伦敦证券交易所(LSE)退市。由存托凭证代表的Woodside股份占Woodside已发行股本的约1%。Woodside股票在伦敦证券交易所的交易量较低,从伦敦证券交易所退市将减少Woodside的行政成本。

Overall Analysis:

总体分析:

Fundamentally, focus on the company's performance and operational status. Technically, pay attention to whether the support levels hold and if the resistance levels can be effectively breached.

基本上,关注公司的业绩和运营状况。从技术上讲,要注意支撑位能否持稳,以及阻力位是否能被有效突破。

In this scenario, investors should adopt a cautious strategy, setting stop-loss points to manage risk and maintaining ongoing vigilance regarding company developments and market conditions.

在这种情况下,投资者应采取谨慎的策略,设置止损点来管理风险,并对公司发展和市场情况保持持续警惕。

Support: A$24.4

Support: A$24.4