Market Mover | Bank of Queensland stock jumps 6.22% on FY24 results and a positive outlook

Market Mover | Bank of Queensland stock jumps 6.22% on FY24 results and a positive outlook

$Bank of Queensland Ltd (BOQ.AU)$'s stock surged 6.22%, following the release of its financial results for the year ending 31 August 2024, which exceeded analyst forecasts.

$Bank of Queensland Ltd (BOQ.AU)$股票上涨6.22%,反映出截至2024年8月31日的财年财务业绩超出分析师预期。

FY24 financial results

财年24财务业绩

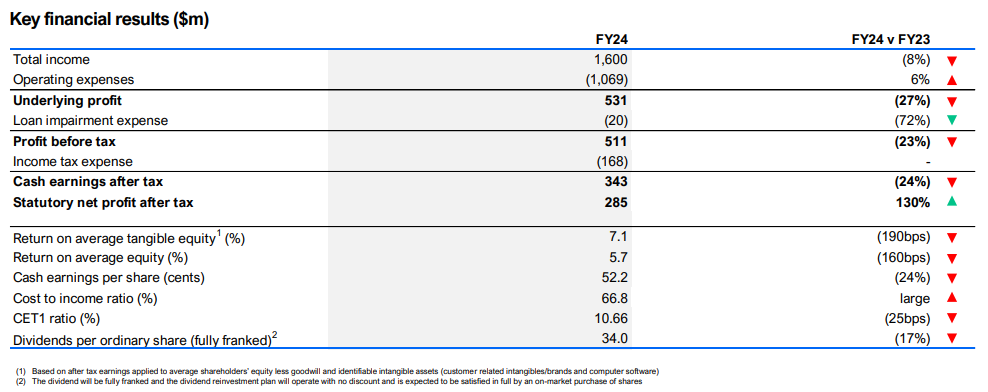

Total income of $1.60 billion, down 8% from FY23

Operating expenses of $1.069 billion, up 6% from FY 2023

Cash earnings after tax of $343 million, down 24% from FY23

Net interest margin decline by 0.13% to 1.56%

Fully franked final dividend of A$17 per share, down from A$0.21 a year earlier.

营业总收入为16亿,比财年23下降8%

营业费用为10.69亿,比2023财年上涨6%

税后现金收益为34300万,比2023财年下降24%

净利息收益率下降0.13%,至1.56%

每股全面认购的最终股息为A$17,低于前一年的A$0.21。

Despite a 20% reduction in the final dividend to A$0.17 from A$0.21, this was higher than Citi's projection of A$0.15 and matched Macquarie's estimate. The bank's full-year net interest margin was 1.56%, surpassing the market's 1.54% expectation.

尽管最终股息减少了20%,从A$0.21降至A$0.17,但这高于花旗银行预测的A$0.15,并与麦格理的估计相匹配。银行全年净利息收益率为1.56%,超过了市场预期的1.54%。

Financial Outlook

财务展望

As for FY25 outlook, management anticipates stable margins and revenue benefits from business bank growth in specialist areas, and branch conversion. However, these will be partially offset by further reductions in mortgage balances. Expense growth is forecast to be broadly flat, with the transformation investment spend coming down materially. Capital is expected to remain within management's target range of 10.25% to 10.75%.

至于FY25展望,管理团队预计边际稳定,营业收入将获得业务银行在专业领域和分行改建方面的好处,然而,这将部分抵消贷款余额的进一步减少。预计费用增长将基本持平,转型投资支出将大幅下降。资本预计将保持在管理目标范围10.25%至10.75%之内。

Also, Bank of Queensland states that it is transforming to a simpler, specialist bank with an enhanced customer experience, and it aims to deliver FY26 ROE target of 8%, with strategy to deliver further uplift in the medium term.

此外,昆士兰银行表示,正在转型为一个更简单、更专业的银行,提升客户体验,并旨在实现FY26的roe目标为8%,并计划在中期实现进一步提升。

Source: ASX, Market Index

来源:ASX,市场指数

Operating expenses of $1.069 billion, up 6% from FY 2023

Operating expenses of $1.069 billion, up 6% from FY 2023