This Is What Whales Are Betting On Danaher

This Is What Whales Are Betting On Danaher

Deep-pocketed investors have adopted a bearish approach towards Danaher (NYSE:DHR), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DHR usually suggests something big is about to happen.

资金雄厚的投资者已经采取了对丹纳赫(纽交所:DHR)看淡的策略,这是市场参与者不应忽视的。我们在Benzinga跟踪公开期权记录中发现了这一重要动向。这些投资者的身份仍然未知,但DHR股票出现如此重大的变动通常意味着即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 24 extraordinary options activities for Danaher. This level of activity is out of the ordinary.

我们从观察中获取了这些信息,当Benzinga的期权扫描器为丹纳赫突出显示了24项非同寻常的期权业务时。这种活跃程度是非同寻常的。

The general mood among these heavyweight investors is divided, with 41% leaning bullish and 50% bearish. Among these notable options, 22 are puts, totaling $1,018,942, and 2 are calls, amounting to $107,750.

这些重量级投资者中普遍心情分歧,41%持看好看法,50%持看淡看法。在这些备受关注的期权中,有22份看跌期权,总额达到$1,018,942,还有2份看涨期权,总额为$107,750。

Expected Price Movements

预期价格波动

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $262.5 to $330.0 for Danaher over the last 3 months.

考虑到这些合约的成交量和未平仓合约的情况,看起来鲸鱼们在过去3个月内一直瞄准丹纳赫的价格区间在$262.5至$330.0之间。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

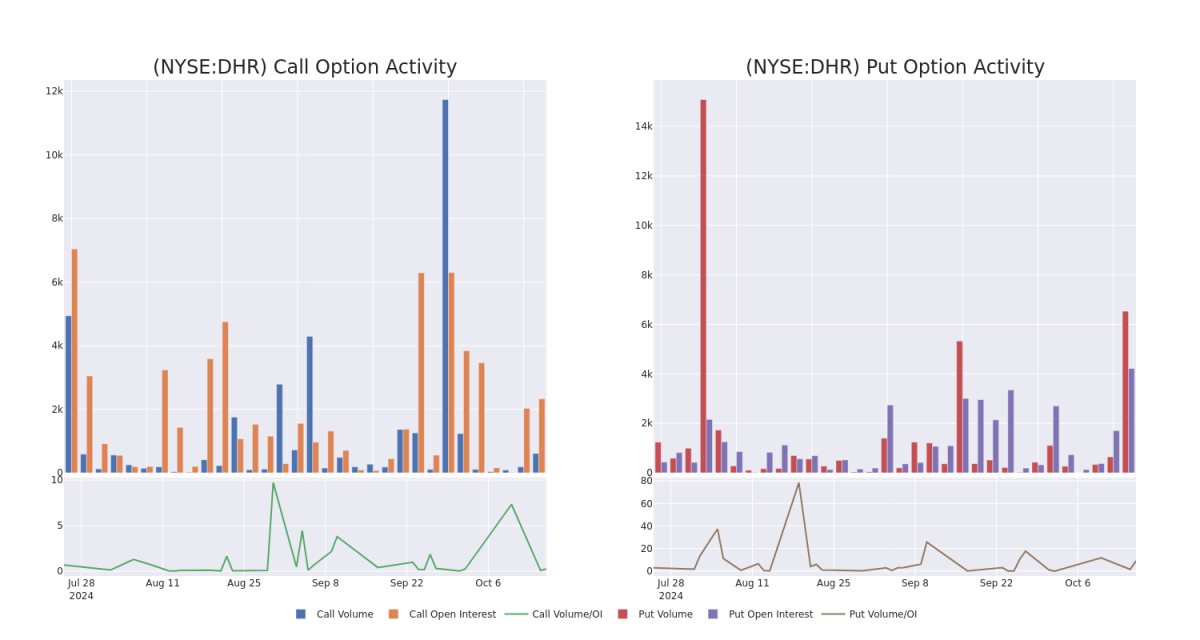

In today's trading context, the average open interest for options of Danaher stands at 817.88, with a total volume reaching 7,139.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Danaher, situated within the strike price corridor from $262.5 to $330.0, throughout the last 30 days.

在今天的交易环境中,丹纳赫期权的平均未平仓合约为817.88,总成交量达到7,139.00。附带的图表描述了过去30天内丹纳赫的高价值交易中,看涨和看跌期权的成交量和未平仓合约的发展,这些交易涉及的行权价区间为$262.5至$330.0。

Danaher Option Volume And Open Interest Over Last 30 Days

过去30天内丹纳赫期权的成交量和未平仓合约

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DHR | PUT | TRADE | BULLISH | 10/18/24 | $1.55 | $1.15 | $1.25 | $262.50 | $87.5K | 234 | 1.0K |

| DHR | PUT | SWEEP | BULLISH | 10/18/24 | $6.2 | $5.7 | $5.7 | $270.00 | $70.1K | 1.7K | 684 |

| DHR | PUT | SWEEP | BEARISH | 10/18/24 | $4.5 | $3.8 | $4.4 | $270.00 | $59.8K | 1.7K | 496 |

| DHR | CALL | TRADE | BULLISH | 10/18/24 | $1.4 | $0.95 | $1.4 | $275.00 | $56.0K | 2.0K | 562 |

| DHR | PUT | SWEEP | BEARISH | 11/15/24 | $16.1 | $15.7 | $16.1 | $280.00 | $53.0K | 429 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 丹纳赫 | 看跌 | 交易 | 看好 | 10/18/24 | $1.55 | $1.15 | $1.25 | $262.50 | $87.5K | 234 | 1.0K |

| 丹纳赫 | 看跌 | SWEEP | 看好 | 10/18/24 | $6.2 | $5.7 | $5.7 | $270.00 | $70.1K | 1.7K | 684 |

| 丹纳赫 | 看跌 | SWEEP | 看淡 | 10/18/24 | $4.5 | $3.8 | $4.4 | $270.00 | $59.8K | 1.7K | 496 |

| 丹纳赫 | 看涨 | 交易 | 看好 | 10/18/24 | $1.4 | 0.95美元 | $1.4 | $275.00 | $56.0K | 2.0K | 562 |

| 丹纳赫 | 看跌 | SWEEP | 看淡 | 11/15/24 | $16.1 | 15.7 | $16.1 | $280.00 | 53.0千美元 | 429 | 0 |

About Danaher

关于丹纳赫

In 1984, Danaher's founders transformed a real estate organization into an industrial-focused manufacturing company. Through a series of mergers, acquisitions, and divestitures, Danaher now focuses primarily on manufacturing scientific instruments and consumables in the life science and diagnostic industries after the late 2023 divesititure of its environmental and applied solutions group, Veralto.

1984年,丹纳赫的创始人将一个房地产组织转变成了一家以制造业为重点的制造公司。通过一系列的并购和剥离,丹纳赫现在主要专注于在生命科学和诊断行业制造科学仪器和消耗品,其环保和应用解决方案集团Veralto在2023年末进行了分拆。

In light of the recent options history for Danaher, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考虑到丹纳赫最近的期权历史,现在集中关注公司本身是合适的。我们旨在探讨其当前的业绩表现。

Present Market Standing of Danaher

丹纳赫当前市场地位

- With a trading volume of 908,531, the price of DHR is down by -2.15%, reaching $266.83.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 6 days from now.

- 丹纳赫的交易量为908,531,其价格下跌了-2.15%,达到266.83美元。

- 目前的RSI值表明该股票目前处于超买和超卖之间的中立状态。

- 下一个收益报告将在6天后发布。

What Analysts Are Saying About Danaher

关于丹纳赫,市场专家们的看法如下

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $296.5.

在过去一个月里,有2位行业分析师分享了对这支股票的见解,提出了平均目标价为296.5美元。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Reflecting concerns, an analyst from Stephens & Co. lowers its rating to Overweight with a new price target of $315.* An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Danaher, which currently sits at a price target of $278.

20年期期权交易专家揭示了他的一行图表技巧,显示何时买入和卖出。复制他的交易,这些交易平均每20天获利27%。点击此处获取。* 反映担忧,来自斯蒂芬斯公司的分析师将评级下调为超重,设定新的价格目标为315美元。* Evercore ISI Group的分析师决定维持对丹纳赫的跑赢评级,目标价为278美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $262.5 to $330.0 for Danaher over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $262.5 to $330.0 for Danaher over the last 3 months.