Riot Platforms's Options: A Look at What the Big Money Is Thinking

Riot Platforms's Options: A Look at What the Big Money Is Thinking

Deep-pocketed investors have adopted a bearish approach towards Riot Platforms (NASDAQ:RIOT), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in RIOT usually suggests something big is about to happen.

深谋远虑的投资者采取了对riot平台(纳斯达克:RIOT)的看淡态度,这是市场参与者不应忽视的事情。我们在彭博社追踪公开期权记录,今天披露了这一重要举动。这些投资者的身份仍然是未知的,但RIOt的如此重大举动通常暗示着即将发生一些重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 25 extraordinary options activities for Riot Platforms. This level of activity is out of the ordinary.

我们从我们今天的观察得知这一信息,当彭博社的期权扫描仪突出了25个riot平台的非凡期权活动。这种活动水平是非同寻常的。

The general mood among these heavyweight investors is divided, with 40% leaning bullish and 56% bearish. Among these notable options, 2 are puts, totaling $73,060, and 23 are calls, amounting to $1,317,357.

这些知名投资者之间的普遍情绪分化,40%看好,56%看淡。在这些引人注目的期权中,有2个看跌,总计73060美元,23个看涨,总额1317357美元。

Expected Price Movements

预期价格波动

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $5.0 to $13.0 for Riot Platforms over the recent three months.

根据交易活动,看起来这些重要投资者正瞄准riot平台在最近三个月内涨至5.0到13.0美元之间的价格区间。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

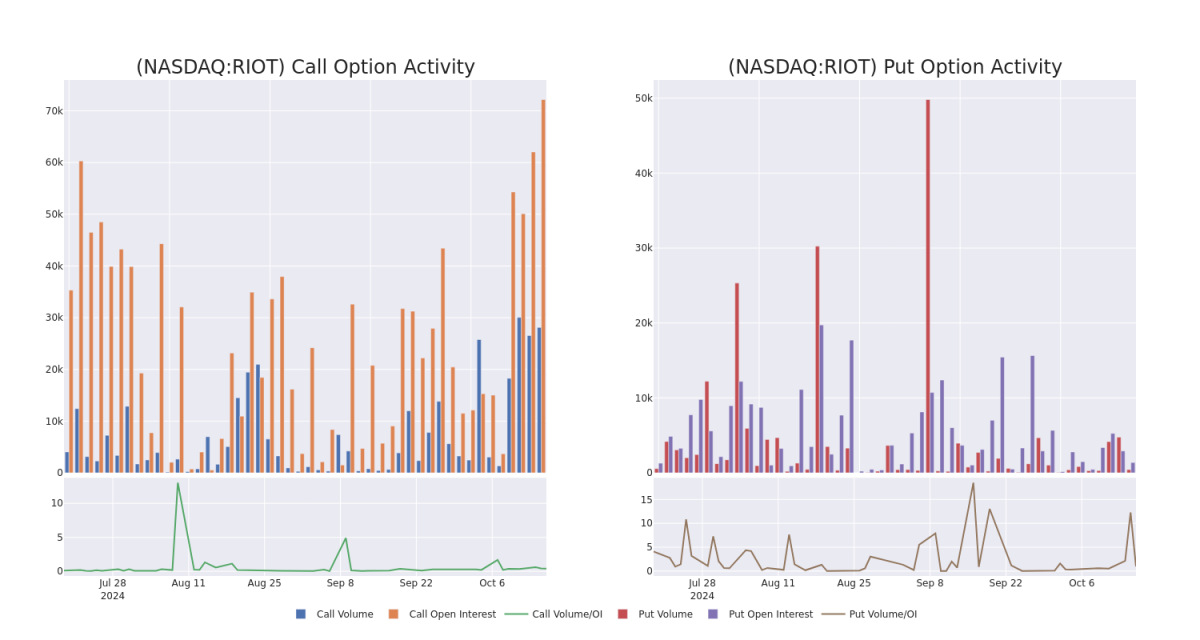

In today's trading context, the average open interest for options of Riot Platforms stands at 5252.86, with a total volume reaching 28,536.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Riot Platforms, situated within the strike price corridor from $5.0 to $13.0, throughout the last 30 days.

在今天的交易环境中,riot平台期权的平均未平仓量为5252.86,总成交量达到28536.00。附图详细说明了在过去30天内riot平台高价交易的看涨和看跌期权成交量和未平仓量的进展,这些交易位于5.0到13.0美元的行权价走廊内。

Riot Platforms Option Activity Analysis: Last 30 Days

Riot Platforms期权活动分析:过去30天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RIOT | CALL | SWEEP | BEARISH | 01/17/25 | $3.95 | $3.9 | $3.91 | $5.50 | $276.1K | 3.3K | 2.7K |

| RIOT | CALL | SWEEP | BEARISH | 10/18/24 | $0.92 | $0.91 | $0.91 | $8.00 | $148.7K | 11.0K | 3.9K |

| RIOT | CALL | SWEEP | BEARISH | 01/17/25 | $3.95 | $3.9 | $3.91 | $5.50 | $122.8K | 3.3K | 1.5K |

| RIOT | CALL | SWEEP | BEARISH | 01/17/25 | $4.35 | $4.3 | $4.3 | $5.00 | $65.7K | 2.7K | 417 |

| RIOT | CALL | SWEEP | BEARISH | 01/17/25 | $1.04 | $1.02 | $1.02 | $12.00 | $51.0K | 18.0K | 584 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RIOT | 看涨 | SWEEP | 看淡 | 01/17/25 | $3.95 | $3.9 | $3.91 | 5.50美元 | $276.1K | 3.3K | 2.7K |

| RIOT | 看涨 | SWEEP | 看淡 | 10/18/24 | 0.92美元 | 0.91美元 | 0.91美元 | 8.00美元 | $148.7K | 11.0K | 3.9K |

| RIOT | 看涨 | SWEEP | 看淡 | 01/17/25 | $3.95 | $3.9 | $3.91 | 5.50美元 | $122.8K | 3.3K | 1.5K |

| RIOT | 看涨 | SWEEP | 看淡 | 01/17/25 | $4.35 | $4.3 | $4.3 | $5.00。 | $65.7K | 2.7K | 417 |

| RIOT | 看涨 | SWEEP | 看淡 | 01/17/25 | $1.04 | $1.02 | $1.02 | 12.00美元 | $51.0K | 18.0K | 584 |

About Riot Platforms

关于Riot Platforms

Riot Platforms Inc is a vertically integrated Bitcoin mining company focused on building, supporting, and operating blockchain technologies. The company's segments include Bitcoin Mining; Data Center Hosting and Engineering. It generates maximum revenue from the Bitcoin Mining segment which generates revenue from the Bitcoin the company earns through its mining activities.

Riot Platforms Inc是一家垂直整合的比特币挖矿公司,专注于构建、支持和运营区块链技术。该公司的业务包括比特币挖矿、数据中心托管和工程。它从比特币挖矿业务中获得最大收入,通过挖矿活动获得比特币并产生收入。

In light of the recent options history for Riot Platforms, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考虑到Riot Platforms近期的期权历史,现在应该关注公司本身。我们的目标是探索其当前的业绩。

Riot Platforms's Current Market Status

Riot平台的当前市场地位

- Trading volume stands at 16,771,649, with RIOT's price up by 2.96%, positioned at $9.03.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 20 days.

- 交易量为16,771,649,RIOT的股价上涨2.96%,报$9.03。

- RSI指示股票可能已超买。

- 预计20天内公布收益报告。

Professional Analyst Ratings for Riot Platforms

Riot平台的专业分析师评级

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $18.5.

在过去30天里,共有2位专业分析师对这支股票发表了看法,并设定了平均价格目标为18.5美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* In a cautious move, an analyst from Macquarie downgraded its rating to Outperform, setting a price target of $15. * Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $22.

Benzinga Edge的飞凡期权板块可以在事件发生之前发现潜在的市场变化者。查看大户所持仓位中对你喜欢的股票的看法。点击这里进行访问。* 作为一项谨慎举措,来自麦格理的分析师将其评级调降至表现,设定了一个15美元的价格目标。* 反映关切,坎特菲兹杰的分析师将其评级降至超配,设定了一个新的22美元的价格目标。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Riot Platforms with Benzinga Pro for real-time alerts.

交易期权具有更大的风险,但也提供更高利润的潜力。精明的交易者通过持续的教育、策略性的交易调整、利用各种因子以及保持市场动态的敏感度来减轻这些风险。通过Benzinga Pro及时了解Riot平台的最新期权交易,获取实时警报。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $5.0 to $13.0 for Riot Platforms over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $5.0 to $13.0 for Riot Platforms over the recent three months.