COTD: Real Estate Investment Sales Rise 22.7% in Q3, Private Deals Lead

COTD: Real Estate Investment Sales Rise 22.7% in Q3, Private Deals Lead

Private deals accounted for 70.9% of the total investment value in Q3.

私人交易占第三季度总投资价值的70.9%。

Investment sales in Q3 2024 increased for a second consecutive quarter, climbing 22.7% quarter-on-quarter (QoQ), Savills reported.

第三季度投资销售额连续第二个季度增长,报告显示,同比增长22.7%。

On a year-on-year (YoY) basis, investment sales for the first three quarters of 2024 reached $18.85b, representing a 32.6% increase from the $14.21b in the same period last year.

根据同比(YoY)基础,2024年前三个季度的投资销售额达到188.5亿美元,比去年同期的142.1亿美元增长了32.6%。

Private investment sales accounted for 70.9% of the total investment value in Q3, whilst the remaining 29.1% comprised five state sites sold under the Government Land Sales (GLS) Programme, which fell by 25.9% QoQ to $2.3b.

私人投资销售占第三季度总投资价值的70.9%,而剩余的29.1%包括在政府土地销售(GLS)计划下出售的五个国家地点,较上一季度下降了25.9%,达到23亿美元。

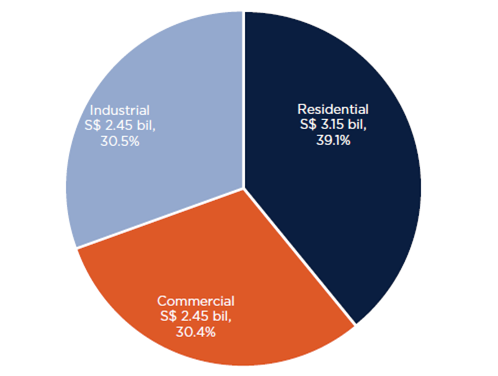

Investment sales in the commercial sector surged by 51.7%, reaching $2.45b, primarily due to the rebound in strata title office sales, with nine transactions each worth over $10 million, totaling $286.3m in Q3.

商业领域投资销售大幅增长51.7%,达到24.5亿美元,主要是由于分层产权办公室销售的反弹,第三季度有九笔交易总值超过1000万美元,总额达到28630万美元。

Notable transactions include The Hour Glass' purchase of two levels of office units in Tong Building for $68.5m.

值得注意的交易包括The Hour Glass以6850万美元购买通大厦两层办公单元。

"Given that the big-ticket items transacted in the third quarter are unlikely to be repeated in Q4, along with the rejection of the Jurong Lake District land bid by the authorities, we maintain our forecast of S$22 to S$23 billion for the full year," Alan Cheong, Executive Director for Research & Consultancy at Savills Singapore said.

“考虑到第三季度交易的重大项目不太可能在第四季度重演,加上裕廊湖区土地买盘被当局拒绝,我们维持对整年的预测为220亿新元至230亿新元,”沙勿略萨维尔斯新加坡研究与咨询执行董事Alan Cheong表示。

"Although interest rates have fallen, there is still a large spread between net yields and total borrowing costs. We may see one or two mega deals conclude in the coming quarters, but it is our opinion that investment sales will generally be driven by the return of ultra-high-net-worth individuals. This will set the narrative for 2025," he added.

尽管利率已经下降,但净收益和总借贷成本之间仍存在较大差距。在接下来的几个季度中,我们可能会看到一两笔巨额交易达成,但我们认为,投资销售通常将受到超高净值个人的影响。这将为2025年奠定基调。

Private investment sales accounted for 70.9% of the total investment value in Q3, whilst the remaining 29.1% comprised five state sites sold under the Government Land Sales (GLS) Programme, which fell by 25.9% QoQ to $2.3b.

Private investment sales accounted for 70.9% of the total investment value in Q3, whilst the remaining 29.1% comprised five state sites sold under the Government Land Sales (GLS) Programme, which fell by 25.9% QoQ to $2.3b.