Market Mover | AMP stock rises 13%, maintaining a strong bullish trend

Market Mover | AMP stock rises 13%, maintaining a strong bullish trend

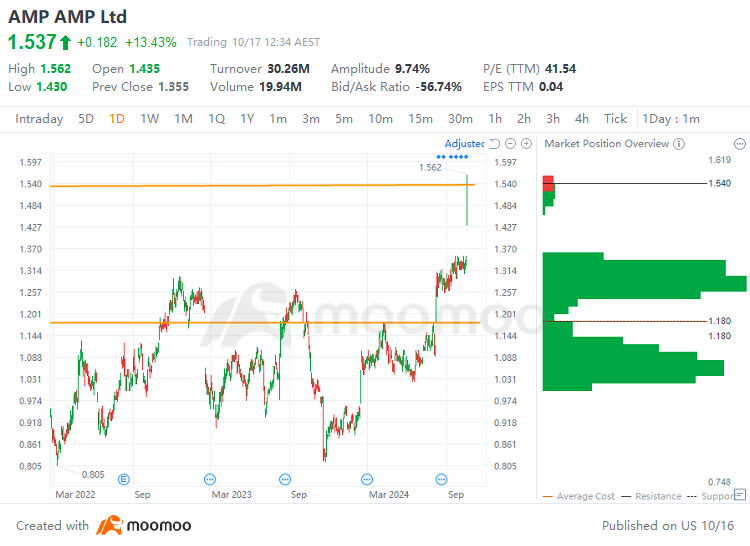

$AMP Ltd (AMP.AU)$ stock rose 13.43% on Thursday, with trading volume expanding to A$30.26 million. AMP has risen 14.7% in the past week, with a cumulative gain of 70.88% year-to-date.

$AMP Ltd (AMP.AU)$ 周四股票上涨13.43%,交易量扩大至A$3026万。AMP过去一周上涨了14.7%,年初至今累计涨幅达70.88%。

AMP's technical analysis chart:

AMP的技术面分析图表:

Technical Analysis:

技术面分析:

Support: A$1.18

压力位:A$1.18

Resistance: A$1.54

支撑位:A$1.54

Price range A$1.18 to A$1.54: The trading range indicates a heavy concentration of buy orders, with the stock price on an upward trend and strong upward momentum. However, there is a risk of profit-taking as some gains have been accumulated. The stock had found support near the A$1.18. Currently, the stock is near the upper resistance level of near the A$1.54. Going forward, it is necessary to observe whether the resistance near A$1.54 can be effectively broken through.

价格区间为A$1.18至A$1.54:交易区间显示买入订单集中,股价呈上涨趋势且具有强劲的向上动能。然而,存在一定盈利回吐的风险,部分收益已经积累。股价在A$1.18附近找到支撑。目前,股价接近A$1.54附近的上方压力位。未来需要观察A$1.54附近的阻力是否能够有效突破。

Market News :

市场资讯:

AMP released its Q3 24 cashflows and business update on October 17, 2024. The report highlighted several positive financial indicators: Platforms net cashflows reached A$750 million, marking a 76% increase from Q3 23. Notably, North inflows from Independent Financial Advisers (IFAs) saw a significant surge, increasing by 47% compared to Q3 23, to reach A$832 million. The Platforms Assets Under Management (AUM) also showed robust growth, climbing to A$78.1 billion, up from A$74.7 billion in Q2 24. In the Superannuation & Investments sector, AUM rose to A$55.8 billion, from A$54.0 billion in Q2 24, with net cash outflows significantly reduced by 46% to A$334 million, compared to net cash outflows of A$619 million in Q3 23, excluding a A$4.3 billion mandate loss. The New Zealand Wealth Management division reported net cashflows of A$40 million, up from A$6 million in Q3 23, with AUM increasing to A$11.6 billion, from A$11.2 billion in Q2 24. Lastly, AMP Bank reported a total loan book of A$23.0 billion, slightly up from A$22.9 billion in Q2 24, and total deposits increased to A$20.9 billion, from A$20.6 billion in Q2 24.

AMP在2024年10月17日发布了其Q3 24的现金流和业务更新。该报告突出了几个积极的财务指标:平台净现金流达到了75000万澳元,比Q3 23增长了76%。值得注意的是,来自独立金融顾问(IFAs)的北部资金流入量大幅增长,较Q3 23增加了47%,达到了83200万澳元。平台管理的资产(AUM)也表现出强劲增长,从Q2 24的747亿澳元上升到了781亿澳元。在养老金和投资板块,AUM从Q2 24的540亿澳元上升到了558亿澳元,净现金流出较去除了43亿澳元委托损失后,大幅减少了46%,相比Q3 23的净现金流出5.19亿澳元。新西兰财富管理部门报告的净现金流量为4千万澳元,比Q3 23的600万澳元增加,管理的资产(AUm)从Q2 24的112亿澳元增至116亿澳元。最后,AMP银行报告的总贷款规模为230亿澳元,略高于Q2 24的229亿澳元,总存款从Q2 24的206亿澳元增加至209亿澳元。

Overall Analysis:

总体分析:

Fundamentally, focus on the company's performance and operational status. Technically, pay attention to whether the support levels hold and if the resistance levels can be effectively breached.

基本上,关注公司的业绩和运营状况。从技术上讲,要注意支撑位能否持稳,以及阻力位是否能被有效突破。

In this scenario, investors should adopt a cautious strategy, setting stop-loss points to manage risk and maintaining ongoing vigilance regarding company developments and market conditions.

在这种情况下,投资者应采取谨慎的策略,设置止损点来管理风险,并对公司发展和市场情况保持持续警惕。

Source: AMP

资料来源:AMP

Support: A$1.18

Support: A$1.18