Top 3 Risk Off Stocks Which Could Rescue Your Portfolio This Quarter

Top 3 Risk Off Stocks Which Could Rescue Your Portfolio This Quarter

The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

必需消费品行业中超卖次数最多的股票为买入被低估的公司提供了机会。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI是一个动量指标,它比较股票在价格上涨的日子里的走强与价格下跌的日子的走强。与股票的价格走势相比,它可以让交易者更好地了解股票在短期内的表现。根据Benzinga Pro的数据,当相对强弱指数低于30时,资产通常被视为超卖。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是该行业主要超卖参与者的最新名单,RSI接近或低于30。

Coty Inc (NYSE:COTY)

科蒂公司(纽约证券交易所代码:COTY)

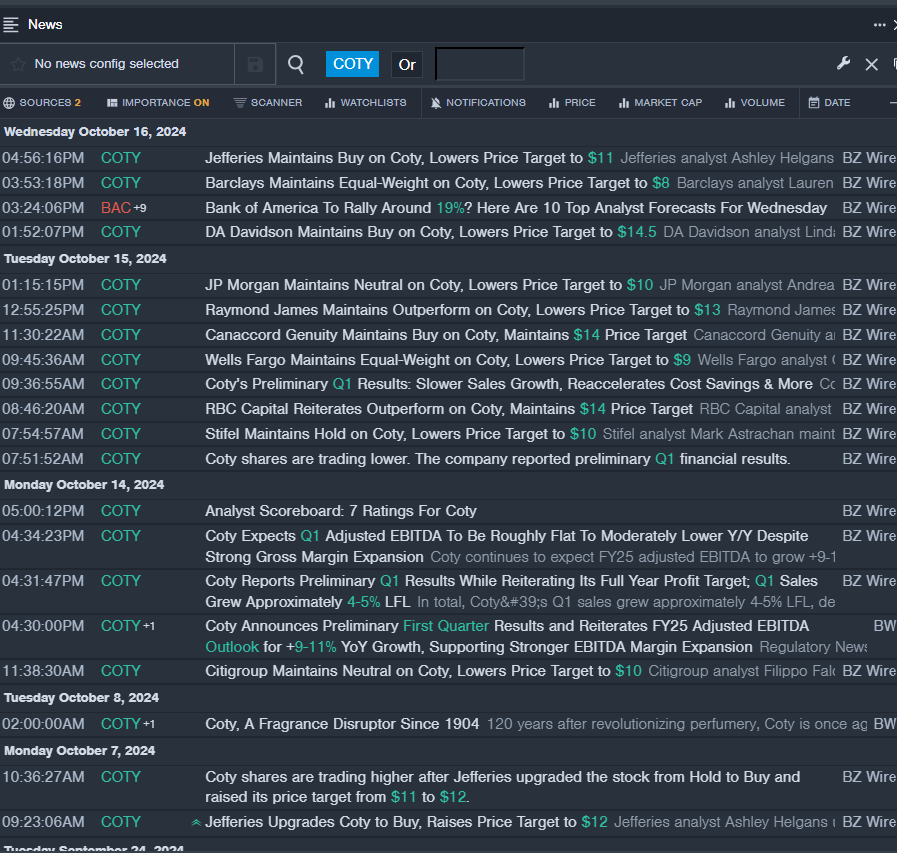

- On Oct. 14, Coty announced preliminary first quarter results and reiterated FY25 adjusted Ebitda outlook for +9-11% year over year growth. The company's stock fell around 11% over the past five days and has a 52-week low of $7.95.

- RSI Value: 29.19

- COTY Price Action: Shares of Coty fell 2.3% to close at $7.99 on Wednesday.

- Benzinga Pro's real-time newsfeed alerted to latest COTY news.

- 10月14日,科蒂公布了第一季度初步业绩,并重申了25财年调整后的息税折旧摊销前利润同比增长9-11%。该公司的股票在过去五天中下跌了约11%,跌至52周低点7.95美元。

- RSI 值:29.19

- COTY价格走势:周三,科蒂股价下跌2.3%,收于7.99美元。

- Benzinga Pro的实时新闻提醒了COTY的最新消息。

22nd Century Group Inc (NASDAQ:XXII)

22世纪集团公司(纳斯达克股票代码:XXII)

- On Sept. 13, 22nd Century Group's chairman and CEO Lawrence Firestone purchased 39,000 shares at an average price of 27 cents per share, disclosed in an SEC filing. The company's stock fell around 43% over the past five days. It has a 52-week low of $0.10.

- RSI Value: 22.29

- XXII Price Action: Shares of 22nd Century Group fell 17.4% to close at $0.11 on Wednesday.

- Benzinga Pro's charting tool helped identify the trend in XXII stock.

- 9月13日,22世纪集团董事长兼首席执行官劳伦斯·费尔斯通在美国证券交易委员会的一份文件中披露,以每股27美分的平均价格购买了39,000股股票。该公司的股票在过去五天中下跌了约43%。它的52周低点为0.10美元。

- RSI 值:22.29

- 第二十二届价格走势:22世纪集团股价周三下跌17.4%,收于0.11美元。

- Benzinga Pro的图表工具帮助确定了XXII股票的走势。

Mangoceuticals (NASDAQ:MGRX)

Mangoceuticals(纳斯达克股票代码:MGRX)

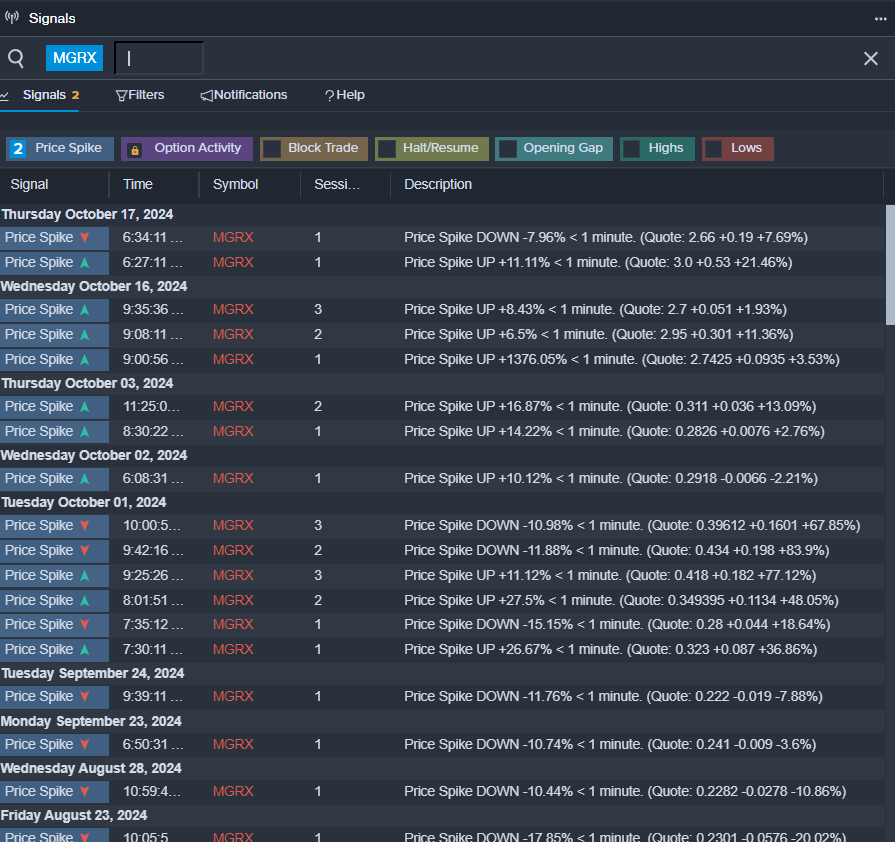

- On Oct 14, Mangoceuticals announced a 1-for-15 reverse stock split.. The company's shares fell around 21% over the past five days and has a 52-week low of $2.14.

- RSI Value: 29.63

- MGRX Price Action: Shares of Mangoceuticals fell 6.8% to close at $2.47 on Wednesday.

- Benzinga Pro's signals feature notified of a potential breakout in MGRX shares.

- 10月14日,Mangoceuticals宣布以1比15的比例进行反向股票拆分。该公司的股价在过去五天中下跌了约21%,跌至52周低点2.14美元。

- RSI 值:29.63

- MGRX价格走势:周三,Mangoceuticals的股价下跌6.8%,收于2.47美元。

- Benzinga Pro的信号功能被告知MGRX股票可能出现突破。

Read More:

阅读更多:

- Wall Street's Most Accurate Analysts Give Their Take On 3 Consumer Stocks Delivering High-Dividend Yields

- 华尔街最准确的分析师对3只提供高股息收益率的消费股发表了看法